FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

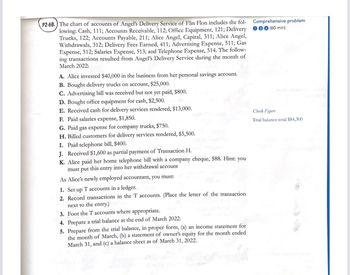

Transcribed Image Text:P2-6B.) The chart of accounts of Angel's Delivery Service of Flin Flon includes the fol-

lowing: Cash, 111; Accounts Receivable, 112; Office Equipment, 121; Delivery

Trucks, 122; Accounts Payable, 211; Alice Angel, Capital, 311; Alice Angel,

Withdrawals, 312; Delivery Fees Earned, 411; Advertising Expense, 511; Gas

Expense, 512; Salaries Expense, 513; and Telephone Expense, 514. The follow-

ing transactions resulted from Angel's Delivery Service during the month of

March 2022:

A. Alice invested $40,000 in the business from her personal savings account.

B. Bought delivery trucks on account, $25,000.

C. Advertising bill was received but not yet paid, $800.

D. Bought office equipment for cash, $2,500.

E. Received cash for delivery services rendered, $13,000.

F. Paid salaries expense, $1,850.

G. Paid gas expense for company trucks, $750.

H. Billed customers for delivery services rendered, $5,500.

I. Paid telephone bill, $400.

J. Received $1,600 as partial payment of Transaction H.

K. Alice paid her home telephone bill with a company cheque, $88. Hint: you

must put this entry into her withdrawal account

As Alice's newly employed accountant, you must:

1. Set up T accounts in a ledger.

2. Record transactions in the T accounts. (Place the letter of the transaction

next to the entry.)

3. Foot the T accounts where appropriate.

4. Prepare a trial balance at the end of March 2022.

5. Prepare from the trial balance, in proper form, (a) an income statement for

the month of March, (b) a statement of owner's equity for the month ended

March 31, and (c) a balance sheet as of March 31, 2022.

Comprehensive problem

000 (60 min)

Check Figure

Trial balance total $84,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 19) Intercom, Inc. paid one of its creditors $678 on their balance due. The journal entry would require a: A) credit to Cash and a debit to Accounts Receivable. B) debit to Cash and a credit to Accounts Receivable. C) debit to Cash and a credit to Accounts Payable. Di debit to Accounts Payable and credit to Cash.arrow_forwardTriple Company's accountant made an entry that included the following items: debit postage expense $12.52, debit office supplies expense $27.43, debit cash over/short $2.29. If the original amount in petty cash is $322, how much was the credit to cash for the reimbursement? Multiple Choice $203. $322. $42.24. $39.95. $29.72.arrow_forwardAshvinbhaiarrow_forward

- Sales-Related Transactions, Including the Use of Credit Cards Journalize the entries for the following transactions:arrow_forwardes Vail Company recorded the following transactions during November. Date General Journal Debit Credit November 5 Accounts Receivable-Ski Shop 5,775 Sales 5,775 November 10 Accounts Receivable-Welcome Incorporated Sales 1,706 1,706 November 13 Accounts Receivable-Zia Company Sales 1,000 1,000 November 21 Sales Returns and Allowances 258 November 30 Accounts Receivable-Zia Company Accounts Receivable-Ski Shop 258 3,557 Sales 3,557 1. Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. 2. Prepare a schedule of accounts receivable. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. General Ledger Accounts Receivable Accounts Receivable Subsidiary Ledger Ski Shop Ending Balance 0 0 Sales Ending Balance 0 0 Zia Company Ending Balance 0 0arrow_forwardQuantum Solutions Company, a computer consulting firm, has decided to write off the $33,550 balance of an account owed by a customer, Alliance Inc. Required: On March 1, journalize the entry to record the write-off, assuming that (a) the direct write-off method is used and (b) the allowance method is used. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Quantum Solutions Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Alliance Inc. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215…arrow_forward

- I am not exactly sure what this question is asking me to do. The attached image is the information that is given to me. Below are the questions that I need to solve. The answer to question A is 3,650. That was given to me in the problem.Unknown Amounts Requireda. Total cash received $3,650b. Total cash collected from credit customersc. Notes payable repaid during the periodd. Good and services received from suppliers on accounte. Net income, assuming that no dividends were paidarrow_forwardan invoice for kitchen appliances is dated December 23 and is paid on January 14 of the following year. credit terms are 2/15,n/45 EOM. The total amount, $497.48 includes a charge for freight and insurance of $62.43. A. What amount should be paid? B.How much is credited to the buyer's account? C. Is any money still owed after the payment?arrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 116,000 Allowance for doubtful accounts 12,700 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $258,000. Sold merchandise to Abbey Corp; invoice amount, $42,000. Sold merchandise to Brown Company; invoice amount, $53,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $56,000. Collected $119,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $48,400. Cavendish paid its account in full after the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education