Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

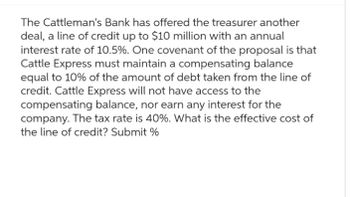

Transcribed Image Text:The Cattleman's Bank has offered the treasurer another

deal, a line of credit up to $10 million with an annual

interest rate of 10.5%. One covenant of the proposal is that

Cattle Express must maintain a compensating balance

equal to 10% of the amount of debt taken from the line of

credit. Cattle Express will not have access to the

compensating balance, nor earn any interest for the

company. The tax rate is 40%. What is the effective cost of

the line of credit? Submit %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Melvin Indecision has difficulty deciding whether to put his savings in Mystic Bank or Four Rivers Bank. Mystic offers 10% interest compounded semiannually. Four Rivers offers 8% interest compounded quarterly. Melvin has $10,000 to invest. He expects to withdraw the money at the end of 4 years.Calculate interest for each bank and identify which bank gives Melvin the better deal? (Use the Table provided.) (Do not round intermediate calculations. Round your answers to the nearest dollar amount.)arrow_forwardCoronado Corporation has elected to use the fair value option for one of its notes payable. The note was issued at an effective rate of 12% and has a carrying value of $13,000. At year - end, Coronado's borrowing rate (credit risk) has declined; the fair value of the note payable is now $14,600. (a) Determine the unrealized holding gain or loss on the note. (Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Unrealized holding gain or loss $enter the unrealized holding gain or loss in dollars eTextbook and Media List of Accounts Attempts: 0 of 6 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardFoxtrot Corporation is purchasing a new Ford Transit delivery van for $24,600. Its lender requires a maximum loan to value ratio of 80% on the purchase price of the vehicle. The term of the loan is 5 years. The interest rate is 5% APR. The loan is a closed end credit loan. There is no trade-in. Sales tax is 7%. Documentation fee is $275. a. What is the total cost of the delivery van including purchase price, sales tax, and documentation fee; and how much is classified as an asset on the balance sheet and how much is classified as an expense on the income statement? b. How much cash must Foxtrot Corporation have to make the down payment? c. How much of the first monthly payment will be interest and how much of the last monthly payment will be interest?arrow_forward

- Summit Record Company is negotiating with two banks for a $122,000 loan. Fidelity Bank requires a compensating balance of 20 percent, discounts the loan, and wants to be paid back in four quarterly payments. Southwest Bank requires a compensating balance of 10 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. The stated rate for both banks is 9 percent. Compensating balances will be subtracted from the $122,000 in determining the available funds in part a. a-1. Calculate the effective interest rate for Fidelity Bank and Southwest Bank. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Fidelity Bank Southwest Bank a-2. Which loan should Summit accept? Southwest Bank O Fidelity Bank Effective Rate of Interest b. Recompute the effective cost of interest, assuming that Summit ordinarily maintains $24,400 at each bank in deposits that will serve as compensating balances. (Do not round intermediate…arrow_forwardNonearrow_forwardAlpesh bhaliyaarrow_forward

- On December 31, 2020, Sarasota Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Sarasota Co. agreed to accept a $337,600 zero-interest-bearing note due December 31, 2022, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 11%. Sarasota is much more creditworthy and has various lines of credit at 5%. Click here to view factor table. (a) Your answer is partially correct. Prepare the journal entry to record the transaction of December 31, 2020, for the Sarasota Co. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Dec. 31, 2020 Account Titles and Explanation Notes Receivable Service Revenue Discount on Notes Receivable Debit…arrow_forwardMax Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forwardCompany A is currently cash-constrained, and must make a decision about whether to delay paying one of its suppliers, or taking out a loan. They owe the supplier $23345, and they can borrow the money from Bank A, which has offered to lend the firm $23345 for 2 month(s) at an APR (compounded) of 15%. The bank will require a (no-interest) compensating balance of 7% of the face value of the loan and will charge a $216 loan origination fee, which means Hand-to-Mouth must borrow even more than the $23345. Compute the EAR of the loan. Give typing answer with explanation and conclusionarrow_forward

- Shawn Bixby borrowed $29,000 on a 120-day, 8% note. After 55 days, Shawn paid $3,200 on the note. On day 95, Shawn paid an additional $5,200. Use ordinary interest. a. Determine the total interest use the U.S. Rule. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Total interest b. Determine the ending balance due use the U.S. Rule. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Ending balance duearrow_forwardThe Patel Company has several financial issues to solve. As the company’s Financial Analyst you have been asked to answer the following 2 questions: Their bank will lend them $100,000 for 90 days at a cost of $1,200 interest. What is the company’s effective annual rate? A major supplier has granted credit terms of 1/10 N120. Assuming the company can borrow any amount of money at the rate you have calculated above (in part 1), should the company take the discount? (Your answer must be supported with a calculation of the cost of not taking the discount – using either simple or effective annual rate)arrow_forwardA building contractor gives a $15,000 promissory note to a plumber who has loaned him $15,000. The note is due in 9 months with interest at 8%. Three months after the note is signed, the plumber sells it to a bank. If the bank gets a 9% return on its investment, how much will the plumber receive? Will it be enough to pay a bill for $ 15,285? How much will the plumber receive?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education