FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

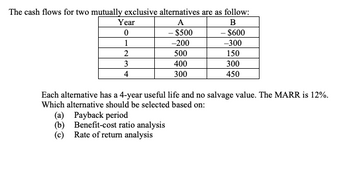

Transcribed Image Text:The cash flows for two mutually exclusive alternatives are as follow:

A

B

- $500

- $600

-200

-300

500

150

400

300

300

450

Year

0

1

2

3

4

Each alternative has a 4-year useful life and no salvage value. The MARR is 12%.

Which alternative should be selected based on:

(a) Payback period

(b) Benefit-cost ratio analysis

(c) Rate of return analysis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cash flows for two alternatives X and Y are shown in the table displayed here. Year: 0 1 2 3 4 5 Alternative X: -$3,000 900 900 900 900 1,300 Alternative Y: -$5,000 1,400 1,400 1,400 1,400 2,100 Write an equation using appropriate compound-interest factors that could be used to solve for the incremental rate of return (ΔIRR) associated with these two alternatives. Do NOT solve this equation for ΔIRR.arrow_forwardYou are given the following information about the cash flows for Projects A and B: Project B $12,643.00 $6,264.00 $5.119.00 $4,284.00 $3,265.00 $2,884.00 Year 0 1 2 3 4 5 Given this information, and assuming a risk-adjusted discount rate of 14.0 percent for both projects, determine the internal rate of return (IRR) for the project with the highest net present value (NPV). 26.0818% 25.6301% 25.1784% Project A -$10,356.00 $2,185.00 $4,294.00 $4,642.00 $6,360.00 $3,125.00 O24.2750%arrow_forwardPayback period. Given the cash flow of two projects-A and B-in the following table, and using the payback period decision model, which project(s) do you accept and which proje period for recapturing the initial cash outflow? For payback period calp What is the payback period for project A? 6 Data Table - X years (Round to one decimal place.) (Click on the following icon D in order to copy its contents into a spreadsheet.) Cash Flow B. Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Cash flow year 5 Cash flow $12,000 $6,000 $6,000 $6,000 $100,000 $20,000 $10,000 $40,000 $6,000 $30,000 SO $6,000 $6,000 year 6. SO Print Donearrow_forward

- Financial assets management decision-making often involves determination of the Present Value (PV) of the flow of money over time. If a monetary PV is given by: PV = Gt/(1+m)t (i) Identify and explain each of the variables: G, m, and t. (ii) Explain how an increase in m would impact the PV of this financial asset. (iii) Find how much would be required to generate a PV of 890, over a 5 years period, at a constant annual interest rate of 4 percent.arrow_forwardA $1,000 investment in project that returns $100/year for 5 years is to be compared with a $700 investment in a project that returns $90/year for 4 years. What would be a good metric(s) for comparing these projects? A. Equivalent uniform annual cash flow, only. B. Internal rate of return (only correct choice of these options) C. Internal rate of return and equivalent uniform annual cash flow D. Benefit to cost ratio and internal rate of return E. Benefit to cost ratio (only correct choice of these options) Give answer fast and only type answerarrow_forwardConsider the cash flows for projects Alpha and Beta as follows: Project Alpha Beta Required: (a) (b) Year 0 cash flow -$250 - $150 Year 1 cash flow 0 Year 2 cash flow 400 200 0 Determine the discount rate that will make the NPV of the two projects equal. (Ignore negative discount rates.) Determine the range of discount rates in which project Alpha is preferred to project Beta.arrow_forward

- Calculate the NPVs of both Project X and Project Y. Show the NPVs for each project. If the Projects are Independent which would you approve? If the Projects are Mutually Exclusive which would you approve?arrow_forwardMasulis Inc. is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: Year 0 Cash flows -$1,225 a. 3.37 years b. 3.63 years c. 1.12 years d. 2.63 years e. 2.37 years 8.75% 1 $575 2 $535 3 $495 4 $455arrow_forwardLiving Colour Company has a project available with the following cash flows: Year Cash Flow 0 - $ 33, 630 1 8, 240 2 9,930 3 14, 190 4 15, 970 5 10,880 If the required return for the project is 8.8 percent, what is the project's NPV? Multiple Choice $11, 883.44 $25,580.00 $ 4,746.96 $12, 873.73 $13, 581.08arrow_forward

- Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$ 243,567 -$ 15,530 1 27,200 55,000 60,000 413,000 234 5,173 8,261 13,237 8,729 Whichever project you choose, if any, you require a 6 percent return on your investment. a. What is the payback period for Project A? Payback periodarrow_forward"Consider the following two mutually-exclusive altematives: Project Alternatives n Project A1 Cash Flows Project A2 Cash Flows 0-514,000 1+$4,000 - $17,000 $21,000 2- 54,000 3-$12,000 If MARR=15% and assuming indefinite required service and repeatability, use the incremental NPV and IRR analyses in parts (a) and (b) of the problem, respectively, to choose the project in part (c). Please note that project alternatives A7 and A2 have different lives, namely three years for A1 and one year for A2. The alternatives should be compared over the same period, so project A2 will have to be repeated twice." axThe Net Present Value of the incremental investment is: YbrThe rternal Rate of Retun of the incremental investment is: (oWe shoulo choose project alternative: Note: Please enrer your onswvers to two decimal places. If using the interest factor method, apply the value of the factor os presented in the table or spreocsheet (with all four decimal places).arrow_forwardUse the table for the question(s) below. Consider the following two projects: Year 0 Project Cash Flow A - 100 40 50 B - 73 30 30 The payback period for project A is closest to: OA. 2.0 years O B. 2.4 years C. 2.2 years O D. 2.5 years Year 1 Cash Flow Year 2 Cash Flow Year 3 Cash Flow 60 30 Year 4 Cash Flow N/A 30 Discount Rate .15 .15arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education