FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. How many

2. How many ordinary shares are issued at December 31,2019?

3. How many ordinary shares are outstanding at December 31,2019?

4. How much is the total shareholder's equity at December 31,2019?

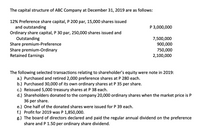

Transcribed Image Text:The capital structure of ABC Company at December 31, 2019 are as follows:

12% Preference share capital, P 200 par, 15,000 shares issued

and outstanding

Ordinary share capital, P 30 par, 250,000 shares issued and

Outstanding

Share premium-Preference

Share premium-Ordinary

Retained Earnings

P 3,000,000

7,500,000

900,000

750,000

2,100,000

The following selected transactions relating to shareholder's equity were note in 2019:

a.) Purchased and retired 2,000 preference shares at P 280 each.

b.) Purchased 30,000 of its own ordinary shares at P 35 per share.

c.) Reissued 5,000 treasury shares at P 38 each.

d.) Shareholders donated to the company 20,000 ordinary shares when the market price is P

36 per share.

e.) One half of the donated shares were issued for P 39 each.

f.) Profit for 2019 was P 1,850,000.

g.) The board of directors declared and paid the regular annual dividend on the preference

share and P 1.50 per ordinary share dividend.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- With the answers to questions 2 provided below please answer question 3 Answer the following questions: a) At the end of 2021 how many shares of stock would you have in FUSTA Company Limited b) What will be the total value of your shares in FUSTA Company Limited at the end of 2021? Number of Shares We Have in 2018 = 100 shares Dividend to Receive in 2018 = Number of Shares You Have x Dividend Per Share Dividend to Receive in 2018 = 100 shares x $2.75 = $275 Number of Shares That Can Be Purchased =Total Dividend Received / Market Price Of Share(aka SharePrice) Number of Shares That Can Be Purchased = $275 / $50.75 = 5.4187 shares Number of Shares You Have 2019 = 100 + 5.4187 = 105.4187 shares Dividend to Receive in 2019 = Number of Shares You Have x Dividend Per Share Dividend to Receive in 2019 = 105.4187 x $3.00 = $316.26 Number of Shares That Can Be Purchased = $316.26 / $55.15 = 5.7345 shares Number of Shares You Have 2020 = 105.4187 +…arrow_forwardWalker Ltd. had the following share transactions in 2021: Event Shares Opening balance, common shares, January 1, 2021 120,000 Common shares issued, March 1, 2021 60,000 Preferred shares issued, May 1, 2021 25,000 Common shares repurchased, June 1, 2021 30,000 What was the weighted average number of common shares outstanding in 2021? Question 7 options: 112,500 169,166 152,500 150,000arrow_forwardIf Friday, October 4, 2019, is the record date for ABC Corporation, when must an investor have purchased the stock in order to be entitled to receive a declared dividend? Select one: O a. Thursday, October 3rd Ob. Wednesday, October 2nd c. Tuesday, October 1starrow_forward

- Question-based on, "Stockholders equity section". I have tried it but got it incorrect.arrow_forwardOn January 5, 2021, Singer Company sells 15,000 shares of $1 par value stock for $20 per share. They repurchase 1,000 of those shares at $21 per share on November 15, 2021. Then on December 30, 2021 they re-issue 500 shares at $23 per share. What is the effect on Stockholders' Equity of the repurchase of shares on November 15, 2021?arrow_forwardHow do I do this?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education