FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

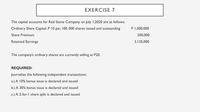

Transcribed Image Text:EXERCISE 7

The capital accounts for Red Stone Company on July 1,2020 are as follows:

Ordinary Share Capital, P 10 par, 100, 000 shares issued and outstanding

P 1,000,000

Share Premium

500,000

Retained Earnings

3,135,000

The company's ordinary shares are currently selling at P20.

REQUIRED:

Journalize the following independent transactions:

a.) A 10% bonus issue is declared and issued

b.) A 30% bonus issue is declared and issued

c.) A 2-for-l share split is declared and issued

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- White Corporation provided you with the following summary of total assets and liabilities at January 1, 2021 and at December 31, 2021.Assets, January 1, 2021 - P9,000,000Assets, December 31, 2021 - P12,000,000Liabilities, January 1, 2021 - P3,200,000Liabilities, December 31, 2021 - P4,500,000During 2021, the company issued 10,000 shares of its P100 par ordinary share at P150 per share and declared dividends of P280,000. There were no other changes affecting the equity accounts. How much is White Corporation’s profit for the year 2021?arrow_forwardAccounting Swifty Corp. has the following portfolio of securities acquired for trading purposes and accounted for using the FV-NI model at September 30, 2020, the end of the company’s third quarter: Investment Cost Fair Value 53,000 common shares of Yuen Inc. $355,100 $212,000 4,300 preferred shares of Monty Ltd. 163,400 172,000 1,900 common shares of Oakwood Inc. 171,000 170,050 On October 8, 2020, the Yuen shares were sold for $6.70 per share. On November 16, 2020, 3,000 common shares of Patriot Corp. were purchased at $44.90 per share. Swifty pays a 1% commission on purchases and sales of all securities. At the end of the fourth quarter, on December 31, 2020, the fair values of the shares held were as follows: Monty $103,700; Patriot $119,500; and Oakwood $192,850. Swifty prepares financial statements every quarter. (a) Prepare the journal entries to record the sale, purchase, and adjusting entries related to the portfolio for the fourth quarter of 2020.…arrow_forwardsubject ; accountarrow_forward

- Blossom SA reported the following balances at December 31, 2019: share capital-ordinary €530,000, share premium-ordinary €115,000, and retained earnings €310,000. During 2020, the following transactions affected equity. 1. Issued preference shares with a par value of €140,000 for €247,000. 2. Purchased treasury shares (ordinary) for €45,000. Earned net income of €174,000. Declared and paid cash dividends of €52,000 3. 4. Prepare the equity section of Blossom SA's December 31, 2020, statement of financial position.arrow_forwardThe following data were taken from the statement of financial position accounts of Cha-Cha Corporation on Dec 31, 2019. Current Assets $ 270,000 Investments $ 312,000 Share Capital - Ordinary (par Value $10) $ 300,000 Share Premium - Ordinary $ 75,000 Retained Earnings $ 420,000 Prepare the required Journal Entries for the following unrelated items! 1. A 5% share dividend is declared and distributed at a time when the market price of the shares is $39 per share. 2. The par value of the ordinary shares is reduced to $2 with a 5-for-1 share split. 3. A dividend is declared January 10, 2020 and paid January 28, 2020, in bonds held as an investment. The bonds have a book value of $ 0f $45,000 and a fair value $ 62,500.arrow_forwardOn November 1, 2020, Skysong, Inc’s stockholders’ equity section is as follows: Common stock, $10 par value $750,000 Paid-in capital in excess of par value—common stock 180,000 Retained earnings 270,000 Total stockholders’ equity $1,200,000 On November 1, Skysong declares and distributes a 15% stock dividend when the fair value of the stock is $18 per share.Indicate the balances in the stockholders’ equity accounts after the stock dividend has been distributed. Common stock $enter a dollar amount Paid-in capital in excess of par value—Common Stock enter a dollar amount Retained earnings enter a dollar amount Total stockholders’ equity $enter a total amount for this sectionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education