ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Can you give a better explanation for this problem

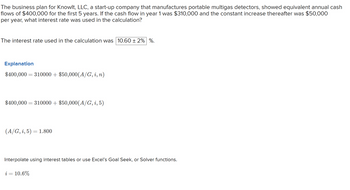

Transcribed Image Text:The business plan for Knowlt, LLC, a start-up company that manufactures portable multigas detectors, showed equivalent annual cash

flows of $400,000 for the first 5 years. If the cash flow in year 1 was $310,000 and the constant increase thereafter was $50,000

per year, what interest rate was used in the calculation?

The interest rate used in the calculation was 10.60 ± 2% %.

Explanation

$400,000 = 310000 + $50,000(A/G, i, n)

$400,000 = 310000+ $50,000(A/G, i, 5)

(A/G, i, 5) = 1.800

Interpolate using interest tables or use Excel's Goal Seek, or Solver functions.

i = 10.6%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- i need the answer quicklyarrow_forwardA company showed equivalent annual cash flows of $400,000 for the first 7 years. If the cash flow in year 1 was $320,000 and the constant increase thereafter was $50,000 per year, what interest rate was used in the calculation? 59.73% 38.49% 22.58% 48.12% Click the answer you think is right.arrow_forwardTroy Long wishes to deposit a single sum of money into a savings account so that five equal annual withdrawals of $2000 can be made before depleting the funds. If the first withdrawal is made in year 1 after the deposit and if the bank provides an interest rate of 5% per year, how much money should be deposited now? What if Troy decides to withdraw all that he has deposited in the bank now, 5 years later, how much money should he expect to get with an interest rate of 5%? I 2.arrow_forward

- Leon and Heidi decided to invest $32500 annually for only the first nine years of their marriage. The first payment was made at age 20. If the annual interest rate is 8%, how much accumulated interest and principal will they have at age 65?arrow_forwardIt is estimated that a copper mine will produce 10,000 tons of ore during the coming year. Production is expected to increase by 5% per year thereafter in each of the following six years. Profit per ton will be $14 for years one to seven. a. Draw a cash flow diagram for this copper mine operation from the company's viewpoint. b. If the company can earn 10% per year on its capital, what is the equivalent of the coppermines cashflow in year seven?arrow_forward1. Many small companies use accounts receivable as collateral to borrow money for continuing operations and meeting payrolls. If a company borrows $300,000 now at an interest rate of 1% per month, but the rate changes to 1.25% per month after 4 months, how much will the company owe at the end of 1 year?arrow_forward

- How much should Engr. Cruz deposit now, if after 10 years, this will amount to Php 100,000. Interest rate is 12% compounded semiannually?arrow_forwardCompute the number of years (t) if future value (FV) = $13514, present value (FV) = $1186, and interest rate (r) = 11.8%,.arrow_forwardThe business plan for KnowIt, LLC, a start-up company that manufactures portable multigas detectors, showed equivalent annual cash flows of $400,000 for the first 5 years. If the cash flow in year 1 was $306,000 and the constant increase thereafter was $50,000 per year, what interest rate was used in the calculation? The interest rate used in the calculation wasarrow_forward

- draw the cash flow diagram pleasearrow_forwardFor an investment of$800 every 6 months at 6.2%/a compounded semi-annually for 20 years, what is the value of the last investment at the end of 20 years?.arrow_forwardSolve all A 40-year-old Ministry of Finance officer is planning to save money for retirement. He intends to deposit 5% of his salary. 1. In the present year, he deposited 600,000 baht from his salary, and after this he intends to deposit another 50,000 baht a year every year from year 1 to year 10. At the end of 10 years, how much will he have in the account with the interest rate of 6% per year? 2. If he changes his mind to start saving at the age of 45, how much will he have to deposit with the same amount per year in order to get the equal equivalent amount as the amount received from the first form of deposit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education