FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

please answer parts 5 and 6 from this practice problem

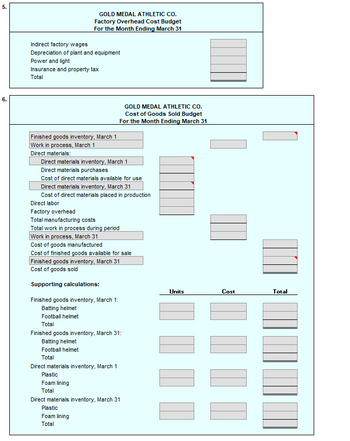

Transcribed Image Text:5.

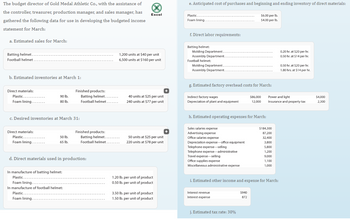

6.

GOLD MEDAL ATHLETIC CO.

Factory Overhead Cost Budget

For the Month Ending March 31

Indirect factory wages

Depreciation of plant and equipment

Power and light

Insurance and property tax

Total

Finished goods inventory, March 1

Work in process, March 1

Direct materials:

GOLD MEDAL ATHLETIC CO.

Cost of Goods Sold Budget

For the Month Ending March 31

Direct materials inventory, March 1

Direct materials purchases

Cost of direct materials available for use

Direct materials inventory, March 31

Cost of direct materials placed in production

Direct labor

Factory overhead

Total manufacturing costs

Total work in process during period

Work in process, March 31

Cost of goods manufactured

Cost of finished goods available for sale

Finished goods inventory, March 31

Cost of goods sold

Supporting calculations:

Finished goods inventory, March 1:

Batting helmet

Football helmet

Total

Finished goods inventory, March 31:

Batting helmet

Football helmet

Total

Direct materials inventory, March 1

Plastic

Foam lining

Total

Direct materials inventory, March 31

Plastic

Foam lining

Total

Units

||||

Cost

||||

Total

Transcribed Image Text:The budget director of Gold Medal Athletic Co., with the assistance of

the controller, treasurer, production manager, and sales manager, has Excel

gathered the following data for use in developing the budgeted income

statement for March:

a. Estimated sales for March:

Batting helmet

Football helmet

b. Estimated inventories at March 1:

Direct materials:

Plastic......

Foam lining....

90 lb.

80 lb.

Direct materials:

Plastic.....

Foam lining...

c. Desired inventories at March 31:

50 lb.

65 lb.

Finished products:

Batting helmet........

Football helmet...

In manufacture of batting helmet:

Plastic....

Foam lining....

In manufacture of football helmet:

Plastic.

Foam lining.

d. Direct materials used in production:

1,200 units at $40 per unit

6,500 units at $160 per unit

Finished products:

Batting helmet.........

Football helmet........

40 units at $25 per unit

240 units at $77 per unit

50 units at $25 per unit

220 units at $78 per unit

1.20 lb. per unit of product

0.50 lb. per unit of product

3.50 lb. per unit of product

1.50 lb. per unit of product

e. Anticipated cost of purchases and beginning and ending inventory of direct materials:

$6.00 per lb.

$4.00 per lb.

Plastic....

Foam lining.

f. Direct labor requirements:

Batting helmet:

Molding Department.

Assembly Department.

Football helmet:

Molding Department.

Assembly Department.

g. Estimated factory overhead costs for March:

Indirect factory wages

Depreciation of plant and equipment

h. Estimated operating expenses for March:

Sales salaries expense

Advertising expense

Office salaries expense

Depreciation expense-office equipment

Telephone expense-selling

Telephone expense-administrative

Travel expense-selling

Office supplies expense

Miscellaneous administrative expense

Interest revenue

Interest expense

$86,000

12,000

j. Estimated tax rate: 30%

i. Estimated other income and expense for March:

$940

872

$184,300

87,200

32,400

3,800

5.800

1,200

9,000

1,100

1,000

0.20 hr. at $20 per hr.

0.50 hr. at $14 per hr.

Power and light

Insurance and property tax

0.50 hr. at $20 per hr.

1.80 hrs. at $14 per hr.

$4,000

2,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education