FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

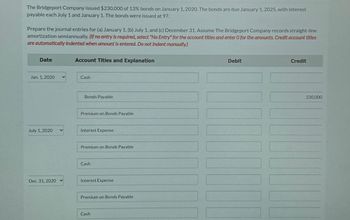

Transcribed Image Text:The Bridgeport Company issued $230,000 of 13% bonds on January 1, 2020. The bonds are due January 1, 2025, with interest

payable each July 1 and January 1. The bonds were issued at 97.

Prepare the journal entries for (a) January 1, (b) July 1, and (c) December 31. Assume The Bridgeport Company records straight-line

amortization semiannually. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles

are automatically indented when amount is entered. Do not Indent manually.)

Date

Jan. 1, 2020

July 1, 2020

Dec. 31, 2020 ✓

Account Titles and Explanation

Cash

Bonds Payable

Premium on Bonds Payable

Interest Expense

Premium on Bonds Payable

Cash

Interest Expense

Premium on Bonds Payable

Cash

Debit

100

Credit

230,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sheffield Corp. issues $6000000 face value of bonds at 96 on January 1, 2019. The bonds are dated January 1, 2019, pay interest semiannually at 8% on June 30 and December 31, and mature in 10 years. Straight-line amortization is used for discounts and premiums. On September 1, 2022, $3600000 of the bonds are called at 102 plus accrued interest. What gain or loss would be recognized on the called bonds on September 1, 2022? OO $216000 loss. $360000 loss. $271500 loss. $163200 loss.arrow_forwardPatricia Johnson Company issued $420,000 of 10%, 20-year bonds on January 1, 2025, at 102. Interest is payable semiannually on July 1 and January 1. Johnson Company uses the straight-line method of amortization for bond premium or discount. Prepare the journal entries to record the following. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) a. b. с The issuance of the bonds. The payment of interest and the related amortization on July 1, 2025. The accrual of interest and the related amortization on December 31, 2025. Date Account Titles and Explanation Debit 1000 Creditarrow_forwardOn January 1, 20x1, SENECTITUDE OLD AGE Co. issued its 12%, 3-year, P2,000,000 convertible bonds at 110. Each P1,000 bond is convertible into 8 shares with par value per share of P100. Principal is due on December 31, 20x3 but interests are due annually at each year-end. When the bonds were issued, they were selling at a yield to maturity market rate of 10% without the conversion option. On December 31, 20x2, half of the bonds were converted into equity. Conversion costs incurred amounted to P20,000. Requirements: a. Provide the pertinent entries. b. Net increase in equity as a result of the conversion. c. Net increase in "share premium" general account as a result of the conversion.arrow_forward

- Oriole Company issued $636,000 of 10%, 20-year bonds on January 1, 2020, at 103. Interest is payable semiannually on July 1 and January 1. Oriole Company uses the straight-line method of amortization for bond premium or discount. Prepare the journal entries to record the following. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (a) The issuance of the bonds. (b) The payment of interest and the related amortization on July 1, 2020. (c) The accrual of interest and the related amortization on December 31, 2020. Date Account Titles and Explanation 1/1/20 7/1/20 12/31/20 Debit Creditarrow_forwardNates corporation issued $1,500,000 of 11% of bonds at 97 on Jan 2,2019. Interest is paid semiannually on June 30 and December 31. The bonds had a 10-year life from the date of issue, and the company uses the straight-line method of amortization. On April 30, 2021, Balboa recalls the bonds at the call price of 105 plus accrued interest. Journal entries for 2021 would include:arrow_forwardMadison Corporation is authorized to issue $570,000 of 5-year bonds dated June 30, 2019, with a stated rate of interest of 11%. Interest on the bonds is payable semiannually, and the bonds are sold on June 30, 2019. Required: Determine the proceeds that the company will receive if it sells the following: (Click here to access the tables to use with this exercise and round your answers to two decimal places, if necessary.) 1. The bonds to yield 12% $fill in the blank 1 2. The bonds to yield 10% $fill in the blank 2arrow_forward

- On May 1, 2021, Bramble Corp. purchased $1,580,000 of 12% bonds, interest payable on January 1 and July 1, for $1,406,500 plus accrued interest. The bonds mature on January 1, 2027. Amortization is recorded when interest is received by the straight-line method. (Assume bonds are available for sale.) (a) Prepare the journal entry for May 1, 2021.arrow_forwardOn January 1, 2025, Concord Corporation issued $500,000 of 7% bonds, due in 10 years. The bonds were issued for $537.196, and pay interest each July 1 and January 1. The effective-interest rate is 6%. Prepare the company's journal entries for (a) the January 1 issuance. (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Concord uses the effective interest method. (Round answers to 0 decimal places, eg, 38,548. If no entry is required, select "No Entry for the account titles and enter O for the amounts Credit account titles are automatically indented when the amount is entered. Do not indent manually List all debit entries before credit entries) No. (4) Date Account Titles and Explanation Debit Credarrow_forwardYour answer is partially correct. On January 1, 2020, Oriole Enterprises issued 8%, 20-year bonds with a face amount of $5,350,000 at 102. Interest is payable annually on January 1. Prepare the entries to record the issuance of the bonds and the first annual interest accrual and amortization assuming that the company uses straight-line amortization. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Jan. 1 Dec. 31 Account Titles and Explanation Cash Bonds Payable Premium on Bonds Payable Interest Expense Premium on Bonds Payable Interest Payable Debit 5457000 385200 42800 Credit 5350000 107000 428000arrow_forward

- Bramble Company issued $504,000 of 11%, 20-year bonds on January 1, 2020, at 101. Interest is payable semiannually on July 1 and January 1. Bramble Company uses the straight-line method of amortization for bond premium or discount. Prepare the journal entries to record the following. (If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (a) The issuance of the bonds. (b) The payment of interest and the related amortization on July 1, 2020. (c) The accrual of interest and the related amortization on December 31, 2020. Date Account Titles and Explanation Debit Credit 1/1/20 7/1/20 12/31/20arrow_forwardCrane Company issued $516,000 of 10%, 20-year bonds on January 1, 2020, at 102. Interest is payable semiannually on July 1 and January 1. Crane Company uses the straight-line method of amortization for bond premium or discount. Prepare the journal entries to record the following. (if no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (a) The issuance of the bonds. (b) The payment of interest and the related amortization on July 1, 2020. (c) The accrual of interest and the related amortization on December 31, 2020. Date Account Titles and Explanation Debit Credit 1/1/20 Cash Bonds Payable 516,000 Premium on Bonds Payable 7/1/20 Interest Expense Premium on Bonds Payable Cash 12/31/20 Interest Expense Premium on Bonds Payable Interest Payablearrow_forwardThe Pearl Company issued $240,000 of 10% bonds on January 1, 2025. The bonds are due January 1, 2030, with interest payable each July 1 and January 1. The bonds are issued at face value. Prepare Pearl's journal entries for (a) the January issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. (a) (b) (c) Date Account Titles and Explanation Debit Credarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education