FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

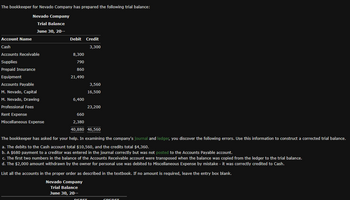

Transcribed Image Text:The bookkeeper for Nevado Company has prepared the following trial balance:

Nevado Company

Trial Balance

June 30, 20--

Account Name

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Accounts Payable

M. Nevado, Capital

M. Nevado, Drawing

Professional Fees

Rent Expense

Miscellaneous Expense

Debit Credit

3,300

8,300

790

860

21,490

6,400

3,560

16,500

23,200

660

2,380

40,880 46,560

The bookkeeper has asked for your help. In examining the company's journal and ledger, you discover the following errors. Use this information to construct a corrected trial balance.

a. The debits to the Cash account total $10,560, and the credits total $4,360.

b. A $680 payment to a creditor was entered in the journal correctly but was not posted to the Accounts Payable account.

c. The first two numbers in the balance of the Accounts Receivable account were transposed when the balance was copied from the ledger to the trial balance.

d. The $2,000 amount withdrawn by the owner for personal use was debited to Miscellaneous Expense by mistake - it was correctly credited to Cash.

DERIT

List all the accounts in the proper order as described in the textbook. If no amount is required, leave the entry box blank.

Nevado Company

Trial Balance

June 30, 20--

CREDIT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- hh. Subject:- Accounting On December 31, the company purchases equipment for $10,000 and pays for the purchase in cash.Complete the necessary journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.arrow_forwardCustomer deposits (prepayments) are recorded - Select one: a. as debits to accounts receivable for the customer b. as negative sales invoices C. as credits to accounts receivable for the customer O d. when the customer makes a partial payment on accountarrow_forwardCreate a schedule of accounts receivable using the accounts receivable subsidiary ledger‘s.arrow_forward

- Jervis sels $4,300 of its accounts receivable to Northem Bank in order to obtain necessary cash. Northem Bank charges 2 tactoing fee Wmat entry should Jervis make to record the transaction? Multiple Choice Debir Accounts Receivable $4,300; credit Factoring Fee Expense $86; credit Cash $4214 Debit Accounts Receivable $4,214; debit Factoring Fee Expense $86; credit Cash $4,300. Debit Cash $4,300; credit Factoring Fee Expense $86; credit Accounts Receivable $4,300arrow_forwardSales-Related Transactions, Including the Use of Credit Cards Journalize the entries for the following transactions:arrow_forward1. Using EXCEL => Set up "T – Accounts" for each account listed in the Campln Inc. Post-Closing Trial Balance. "T-Account" example for several accounts. Assets Cash Accounts Receivable Inventory Beg $ 750,000 Beg $ 450,000 Beg $ 1,200,000 The following Post-Closing Trial Balance is available in EXCEL. Campln Inc. Post Closing Trial Balance 12/31/2020 Debit Credit Cash 750,000 Accounts Receivable 450,000 Allowance for Doubtful Accounts $ 10,000 Prepaid Insurance 100,000 Inventory 1,200,000 Equipment 4,500,000 Accumulated Depreciation - Equipment 1,350,000 Building 850,000 Accumulated Depreciation - Building $4 250,000 Land 1,100,000 Accounts Payable Salaries Payable 375,000 50,000 1,400,000 2,250,000 6,000 Mortgage Payable $ Long-Term Debt Common Stock - Par $0.01 APIC $ 2,994,000 Retained Earnings $ 265,000 8,950,000 8,950,000 $4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education