Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

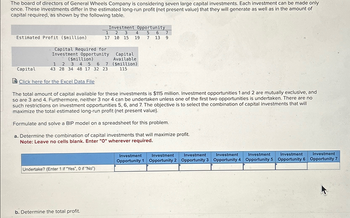

Transcribed Image Text:The board of directors of General Wheels Company is considering seven large capital investments. Each investment can be made only

once. These investments differ in the estimated long-run profit (net present value) that they will generate as well as in the amount of

capital required, as shown by the following table.

Investment Opportunity

1

17

2 3 4

10 15 19 7 13 9

5 6 7

Estimated Profit ($million)

Capital Required for

Investment Opportunity

($million)

1 2 3 4 5 6 7

Capital

43 28 34 48 17 32 23

Capital

Available

($million)

115

Click here for the Excel Data File

The total amount of capital available for these investments is $115 million. Investment opportunities 1 and 2 are mutually exclusive, and

so are 3 and 4. Furthermore, neither 3 nor 4 can be undertaken unless one of the first two opportunities is undertaken. There are no

such restrictions on investment opportunities 5, 6, and 7. The objective is to select the combination of capital investments that will

maximize the total estimated long-run profit (net present value).

Formulate and solve a BIP model on a spreadsheet for this problem.

a. Determine the combination of capital investments that will maximize profit.

Note: Leave no cells blank. Enter "O" wherever required.

Undertake? (Enter 1 if "Yes", 0 if "No")

b. Determine the total profit.

Investment

Investment

Investment

Investment

Investment

Investment

Investment

Opportunity 1 Opportunity 2 Opportunity 3 Opportunity 4 Opportunity 5 Opportunity 6 Opportunity 7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 15 images

Knowledge Booster

Similar questions

- Pls help ASAP on botharrow_forward1arrow_forwardKathy receives her real estate license. Within a month of receiving her license, she gets a new job offer she can't refuse. She decides to continue to hold her license but not practice, do any real estate work, or collect any referrals at this time. She is willing to renew her license, do her continuing education, and pay the renewal fee for her license. What should Kathy do? ○ Opt not, renew her license or complete the educational requirements ○ Seek a voluntary inactive license. Seek an involuntary inactive license. Seek a broker who will not be upset if she does not work too hard.arrow_forward

- 19 of Vision Company purchased treasury stock with a cost of $16,000 during 2017. During the year, the company paid dividends of $20,000 and issued bonds payable for proceeds of $860,000. Cash flows from financing activities for 2017 total Select one: a. $840,000 net cash inflow b. $856,000 net cash inflow c. $860,000 net cash outflow d. $824,000 net cash inflowarrow_forwardDeforrest Marine Motors manufactures engines for the speedboat racing circuit. As part of their annual planning cycle, they forecasted demand for the next four quarters. The number of available days of production and the anticipated demand are given below. Employees Production Rate Production Cost Backorder Cost Overtime Cost Overtime Limit Demand Q1 2,400 6,019,000 They also estimated many of the costs required to conduct operations planning. Some of these key figures are listed below. 30 70 units/employee/quarter Q2 2,200 $1,000/unit $200/unit/quarter $1,500/unit <= 25% of Reg. Production Q3 1,700 Q4 1,800 Hire Cost Fire Cost Subcontracting Cost Subcontracting Limit Inventory Cost Initial Inventory $1,200/employee $800/employee $1,800/unit 400 units maximum $100/unit/quarter 280 units Deforrest Marine Motors wishes to maintain the current number of employees for the entire year to follow a level strategy balanced with inventory and backorders as needed. What is the total cost of this…arrow_forwardUse the following for the next 2 questions: A company forecasts that it will ship 120,000 boxes of product in June. The product has a monthly turnover of 3. The company plans to use its facility to ship 80,000 boxes and the balance of the 40,000 boxes will ship from a rented facility. Space may be rented for a charge of $7 per box per month with an in-and-out handling charge of $0.45 per box shipped. 1. What is the rented (fixed) storage cost for June? - $280,000 - $180,000 - $42,500 - $250,000 - $93,333 - $153,333 - $173,333 2. What is the rented variable cost for June? - $33,333 - $43,333 - $6,000 - $38,000 - $18,000 - $28,000 - $23,333arrow_forward

- Based on Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments for each of the following situations? Note: Round time value factor and final answers to 2 decimal places. What relationship exists between the length of the loan and the monthly payment? How does the mortgage rate affect the monthly payment? Monthly Mortgage Payment a. $123,000, 15-year loan at 6.00 percent. b. $165,000, 30-year loan at 7.50 percent. c. $68,000, 20-year loan at 7.50 percent. d-1. Longer mortgage terms mean a monthly payment. d-2. For increase in mortgage rate monthly payment is required.arrow_forwardSubject: acountingarrow_forwarddu/courses/423127/quizzes/3325 take/questions/60963079 Table on the right shows the net cashflow (NCF) and cumulative cashflow for two projects X and Y. Answer the following questions. 1- Based on Descarte's rule of signs, what is the max. number of real ROR (i*) for project X? (put numerical number) 2- Looking at cumulative CF of project X, can we tell that it has only one positive i* value? (put "yes" Project X Project Y Year NCF Cumulative CE NCF Cumulative CF or "no") 180 -100 20,000 20,000 1 50 -130 16,000 36,000 3- Based on Descarte's rule of signs, what is the 36,000 2 50 80 50 30 25,000 25,000 max. number of real ROR (i*) for project Y? (put 4 50 20 30,000 5,000 numerical number) 4- Looking at cumulative CF of project Y, can we tell that it has only one positive i* value? (put "yes" or "no")arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.