Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?

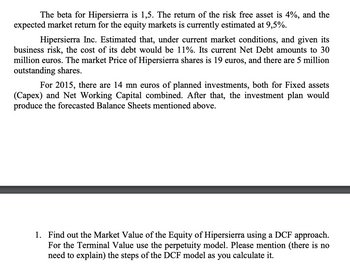

Transcribed Image Text:The beta for Hipersierra is 1,5. The return of the risk free asset is 4%, and the

expected market return for the equity markets is currently estimated at 9,5%.

Hipersierra Inc. Estimated that, under current market conditions, and given its

business risk, the cost of its debt would be 11%. Its current Net Debt amounts to 30

million euros. The market Price of Hipersierra shares is 19 euros, and there are 5 million

outstanding shares.

For 2015, there are 14 mn euros of planned investments, both for Fixed assets

(Capex) and Net Working Capital combined. After that, the investment plan would

produce the forecasted Balance Sheets mentioned above.

1. Find out the Market Value of the Equity of Hipersierra using a DCF approach.

For the Terminal Value use the perpetuity model. Please mention (there is no

need to explain) the steps of the DCF model as you calculate it.

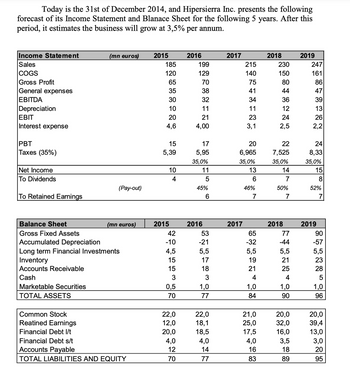

Transcribed Image Text:Today is the 31st of December 2014, and Hipersierra Inc. presents the following

forecast of its Income Statement and Blanace Sheet for the following 5 years. After this

period, it estimates the business will grow at 3,5% per annum.

Income Statement

Sales

COGS

Gross Profit

General expenses

EBITDA

Depreciation

EBIT

Interest expense

PBT

Taxes (35%)

Net Income

To Dividends

To Retained Earnings

Balance Sheet

Gross Fixed Assets

Inventory

Accounts Receivable

Cash

Marketable Securities

TOTAL ASSETS

(mn euros)

Accumulated Depreciation

Long term Financial Investments

Common Stock

Reatined Earnings

Financial Debt I/t

(Pay-out)

(mn euros)

Financial Debt s/t

Accounts Payable

TOTAL LIABILITIES AND EQUITY

2015

185

120

65

35

30

10

20

4,6

15

5,39

10

4

2015

42

-10

4,5

15

15

3

0,5

70

22,0

12,0

20,0

4,0

12

70

2016

199

129

70

38

*

32

11

21

4,00

17

5,95

35,0%

11

5

45%

2016

6

53

-21

5,5

17

18

3

1,0

77

22,0

18,1

18,5

4,0

14

77

2017

215

140

75

41

34

11

23

2017

3,1

20

6,965

35,0%

13

6

46%

7

65

-32

5,5

19

21

4

1,0

84

21,0

25,0

17,5

4,0

16

83

2018

230

150

80

44

36

12

24

2,5

22

7,525

35,0%

14

7

50%

2018

7

77

-44

5,5

21

25

4

1,0

90

20,0

32,0

16,0

3,5

18

89

2019

247

161

86

47

39

13

26

2,2

24

8,33

35,0%

15

8

52%

2019

90

-57

5,5

23

28

5

1,0

96

20,0

39,4

13,0

3,0

20

95

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education