Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 27 basis points (0.27percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.19 percent and a minimum of 1.72 percent. Calculate the rate of interest for weeks 2 through 10.

Date LIBOR

Week 1 1.93%

Week 2 1.64%

Week 3 1.46%

Week 4 1.36%

Week 5 1.59%

Week 6 1.65%

Week 7 1.75%

Week 8 1.92%

Week 9 1.87%

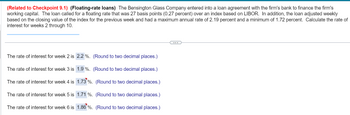

Transcribed Image Text:(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's

working capital. The loan called for a floating rate that was 27 basis points (0.27 percent) over an index based on LIBOR. In addition, the loan adjusted weekly

based on the closing value of the index for the previous week and had a maximum annual rate of 2.19 percent and a minimum of 1.72 percent. Calculate the rate of

interest for weeks 2 through 10.

The rate of interest for week 2 is

The rate of interest for week 3 is

The rate of interest for week 4 is

The rate of interest for week 5 is

The rate of interest for week 6 is

2.2 %. (Round to two decimal places.)

1.9 %. (Round to two decimal places.)

1.73 %. (Round to two decimal places.)

1.71 %. (Round to two decimal places.)

1.86 %. (Round to two decimal places.)

Expert Solution

arrow_forward

Given,

Floating Rate is LIBOR+0.27%

Maximum Annual Rate is 2.19%

Minimum Annual Rate is 1.72%

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 26 basis points (0.26 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.18 percent and a minimum of 1.76 percent. Calculate the rate of interest for weeks 2 through 10. Date Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 LIBOR 1.93% 1.62% 1.52% 1.38% 1.64% 1.66% 1.71% 1.88%arrow_forward(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 26 basis points (0.26 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.17 percent and a minimum of 1.74 percent. Calculate the rate of interest for weeks 2 through 10. Date LIBOR Week 1 1.94% Week 2 1.62% Week 3 1.51% Week 4 1.38% Week 5 1.56% Week 6 1.66% Week 7 1.73% Week 8 1.92% Week 9 1.94%arrow_forwardCanliss Mining Company borrowed money from a local bank. The note the company signed requires five annual installment payments of $10,000 beginning immediately. The interest rate on the note is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) What amount did Canliss borrow? (Round your final answers to nearest whole dollar amount.) Table/Calculator Function = Payment = n = i = Present Value =arrow_forward

- Hewlett Plastics Inc. received a loan of $51,000.00 at 3.50% compounded quarterly to purchase machinery for its factory. Calculate the time period of the loan if the total amount of interest paid was $17,582.10.arrow_forward(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 26 basis points (0.26 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.23 percent and a minimum of 1.72 percent. Calculate the rate of interest for weeks 2 through 10. Date Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Wook 7 Week 8 LIBOR 1.92% 1.66% 1.51% 1.35% 1.64% 1.59% 1.69% 1.92% The rate of interest for week 2 is%. (Round to two decimal places.) COLLEarrow_forward(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 26 basis points (0.26 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.22 percent and a minimum of 1.74 percent. Calculate the rate of interest for weeks 2 through 10. Date LIBOR Week 1 1.94% Week 2 1.67% Week 3 1.54% Week 4 1.32% Week 5 1.64% Week 6 1.64% Week 7 1.69% Week 8 1.92% Week 9 1.85% The rate of interest for week 2 is___________ %.(Round to two decimal places.)arrow_forward

- Robin borrowed $3000.00 from HSBC Bank Canada. The line of credit agreement provided for repayment of the loan in three equal monthly payments plus interest at 6.25% per annum calculated on the unpaid balance. Determine the total interest cost.arrow_forwardThe Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 28 basis points (0.28 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.21 percent and a minimum of 1.72 percent. Calculate the rate of interest for weeks 2 through 10. Date LIBOR Week 1 1.95% Week 2 1.61% Week 3 1.47% Week 4 1.39% Week 5 1.62% Week 6 1.65% Week 7 1.67% Week 8 1.86% Week 9 1.95% (Click on the icon in order to copy its contents into a spreadsheet.) Question content area bottom Part 1 The rate of interest for week 2 is enter your response here%. (arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education