FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

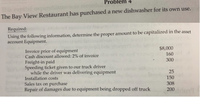

Transcribed Image Text:### Problem 4

The Bay View Restaurant has purchased a new dishwasher for its own use.

#### Required:

Using the following information, determine the proper amount to be capitalized in the asset account Equipment.

- **Invoice price of equipment**: $8,000

- **Cash discount allowed: 2% of invoice**: $160

- **Freight-in paid**: $300

- **Speeding ticket given to our truck driver while the driver was delivering equipment**: $25

- **Installation costs**: $150

- **Sales tax on purchase**: $308

- **Repair of damages due to equipment being dropped off truck**: $200

### Explanation:

To determine the amount to be capitalized, you should consider all necessary expenditures to acquire the asset and prepare it for its intended use. This typically includes the invoice price, minus any discounts, plus freight-in, installation, and sales taxes. Incidental costs like speeding tickets or repairs from mishandling are usually expensed as incurred and not capitalized.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ace Lumber Co. purchased a truck and had the following outlays. How much is the cost of the truck? purchase price $ 40,000 sales tax 3,200 preparation and delivery 900 insurance during delivery 325 insurance after delivery 1,200 cost of the truck ? ________________________________arrow_forwardPlease only answer the amount fields. Thanksarrow_forwardYour Question: Hua Fat Technology Ltd Case Hua Fat Technology Ltd (Hua Fat) is a global telecommunication equipment manufacturer. The company was granted a piece of land by the government to develop its 5G business. On 1st January 2018, the company started to construct a property at the site. The property was used as a testing laboratory (the laboratory) to serve the company’s customers. The construction costs relating to the laboratory were: $000 Cost of construction materials before trade discount of 10% 50,000 Salary of construction workers for six months to 30 June 2018 4,800 Overheads related to the construction 3,600 Payment to external consultants related to the construction 2,000 Expected dismantling and restoration costs (note 3) 400 Notes: Hua Fat…arrow_forward

- Having issue with this problem. Thank youarrow_forwardI need help on how to do this practice problem and how to start it. On March 1, 2022, Newt’s All Things Weasels purchased an automatic weasel groomer, the Weaselmatic, for $62,000 cash. Newt estimated that the machine would have a useful life of 5 years and a resale or residual value of $2,000. Instructions: Make two T accounts (Machine and Accumulated Depreciation – Machine) at the top. Create the journal entry for the acquisition of the machine. Post to the T accounts Create the journal entry to record depreciation expense on 12/31/22 and 12/31/23. Post both to the T accounts. NOTE: Show your calculations for depreciation expense. What is the book value of the Weaselmatic at 12/31/23? Show your calculation. If Newt sold the Weaselmatic on January 1, 2024 for $42,500, how much gain or loss would he record?arrow_forwardK- Belvidere Furniture purchased land, paying $95,000 cash and signing a $280,000 note payable. In addition, Belvidere paid delinquent property tax of $5,000, title insurance costing $1,500, and $8,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $400,000. It also paid $51,000 for a fence around the property, $13,000 for a sign near the entrance, and $3,000 for special lighting of the grounds. Read the requirements. Requirement 1. Determine the cost of the land, land improvements, and building. The cost of the land is $ 389,500 The total cost of the land improvements is Requirements 1. Determine the cost of the land, land improvements, and building. 2. Which of these assets will Belvidere depreciate? Print Done - Xarrow_forward

- The following relates to the town of Coupland (Dollar amounts in thousands): Equipment used in a vehicle repair service that provides service to other departments on a cost-reimbursement basis; the equipment has a 5-year life with no salvage value $1,400 Property taxes levied and collected $6,300 Hotel taxes (restricted to promotion of tourism) collected $1,200 Proceeds of bonds to build a parking garage that must be repaid from user charges $4,000 Using the information above to answer the following questions: Revenue to be recognized In internal service fund? A.) 0 B.) $1,400 C.) $140 D.) None of abovearrow_forwardHow do I do thisarrow_forwardplease show work how its solved thanks.arrow_forward

- Please no written by hand solutions Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $13,200. They expect to use the Suburban for five years and then sell the vehicle for $5,100. The following expenditures related to the vehicle were also made on July 1, 2022: The company pays $2,100 to GEICO for a one-year insurance policy. The company spends an extra $4,200 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. An additional $2,300 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2022, the company pays $1,000 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. General Journal, Income…arrow_forwardAssume that a town sells a truck that it had originally purchased for $65,000 for a cash sale price of $30,000. Required: Prepare the journal entry to record the sale.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education