FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

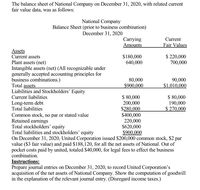

Transcribed Image Text:The balance sheet of National Company on December 31, 2020, with related current

fair value data, was as follows:

National Company

Balance Sheet (prior to business combination)

December 31, 2020

Carrying

Amounts

Current

Fair Values

Assets

Current assets

$180,000

640,000

$ 220,000

700,000

Plant assets (net)

Intangible assets (net) (All recognizable under

generally accepted accounting principles for

business combinations.)

Total assets

Liabilities and Stockholders' Equity

Current liabilities

80,000

$900,000

90,000

$1,010,000

$ 80,000

190,000

$ 270,000

$ 80,000

200,000

$280,000

$400,000

220,000

$620,000

$900,000

Long-term debt

Total liabilities

Common stock, no par or stated value

Retained earnings

Total stockholders’ equity

Total liabilities and stockholders’ equity

On December 31, 2020, United Corporation issued $200,000 common stock, $2 par

value ($3 fair value) and paid $188,120, for all the net assets of National. Out of

pocket costs paid by united, totaled $40,000, for legal fees to effect the business

combination.

Instructions:

Prepare journal entries on December 31, 2020, to record United Corporation's

acquisition of the net assets of National Company. Show the computation of goodwill

in the explanation of the relevant journal entry. (Disregard income taxes.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- .arrow_forwardFinanced by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Liabilities Accrued expense Barakah Company Balance Sheet as at 31st December 2019 100,000 245,500 30,000 Additional Information: i) ii) 600,000 155,500 75,000 830,500 25,000 375,500 1,231,000 Fixed Assets (net after depreciation) $ Land & Buildings Equipment Vehicles Fixtures & Fittings Current Assets Inventory Accounts Receivable Prepayments Cash at Bank Cash in Hand Work-in-Progress is one-sixth of the total Inventory. Prepayments are related to the rental of buildings. Bad debt is 5% for the year. Non-Muslim ownership is at 20%. 350,500 200,500 150,000 50,000 751,000 Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method. 125,000 215,000 10,000 110,000 20,000 1,231,000arrow_forwardSubject: acountingarrow_forward

- Comparative data from the statement of financial position of Munchies Ltd. are shown below. Current assets Property, plant, and equipment Goodwill Total assets Current assets Property, plant, and equipment Total assets 2021 $1,519,000 2021 3,114.000 $4.730,000 % %6 97,000 2020 $1,164.000 2,827,000 107,000 $4,098,000 Using horizontal analysis, calculate the percentage of the base-year amount, using 2019 as the base year. (Round answers to 1 decimal place, e.g. 52.7%) 2020 2019 % $1,227,000 2.871,000 -0- $4,098,000 2019arrow_forwardBridgeport Corporation’s balance sheet at the end of 2019 included the following items. Current assets (Cash $ 82,000) $ 236,480 Current liabilities $ 151,480 Land 32,960 Bonds payable 101,480 Buildings 121,480 Common stock 182,960 Equipment 92,960 Retained earnings 46,960 Accum. depr.-buildings ( 31,480 ) Total $ 482,880 Accum. depr.-equipment ( 11,000 ) Patents 41,480 Total $ 482,880 The following information is available for 2020. 1. Net income was $ 54,810. 2. Equipment (cost $ 21,480 and accumulated depreciation $ 9,480) was sold for $ 11,480. 3. Depreciation expense was $ 5,480 on the building and $ 10,480 on equipment. 4. Patent amortization was $ 2,500. 5. Current assets other than cash increased by $ 29,000. Current liabilities increased by $ 14,480. 6. An addition to the building was completed at a cost of $ 28,480. 7. A long-term investment in…arrow_forwardUse the following financial statements for Manufacturing Inc. to compute the 1) DSO 2) TIE 3) ROE Manufacturing Inc. Balance Sheets, Income Statements and Additional Information for Year Ending December 31 (Millions of Dollars, Except for Per Share Data) Balance Sheet 2019 Assets Cash and equivalents $4,156.00 Accounts receivable $12,980.00 Inventories $8,920.00 Total current assets $26,056.00 Net property, plant & equipment (PP&E) $13,405.00 Total assets $39,461.00 Liabilities and Equity Accounts payable $7,410.00 Notes payable $5,460.00 Accruals $4,290.00 Total current liabilities $17,160.00 Long-term bonds $7,800.00 Total liabilities $24,960.00 Common stock $6,921.00 Retained earnings $7,580.00 Total common equity $14,501.00 Total liabilities and equity $39,461.00 Income Statement…arrow_forward

- Sonic Corporation recorded current assets of $345,200 and current liabilities of $318,650 for year 2020. Compute for Sonic's working capital for the year. Select one: a. $663,850 b. $26,550 O C. 92% d. 1.08arrow_forwardFollowing are selected balance sheet accounts of Sheffield Bros. Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from 2019 to 2020. Also presented is selected income statement information for the year ended December 31, 2020, and additional information. Selected balance sheet accounts Assets Accounts receivable Property, plant, and equipment Accumulated depreciation-plant assets Liabilities and stockholders' equity. Bonds payable Dividends payable Common stock, $1 par Additional paid-in capital Retained earnings Depreciation Gain on sale of equipment Net income Additional information: 1. 2. 3. (a) (b) (c) (d) 2020 $34,000 Proceeds from the sale of equipment. Cash dividends paid. 278,500 (176,300 ) (168,400) 2020 Redemption of bonds payable. $49,000 8,000 22,100 9,100 104,600 Selected income statement information for the year ended December 31, 2020: Sales revenue $154,400 38,100 2019 14,700 $24,100 30,900 249,400 2019 $45,900 5,100 18,900 3,000…arrow_forwardThe balance sheet for Stuart Corporation follows: Current assets Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings Total liabilities and stockholders' equity Working capital Current ratio Debt-to-assets ratio Debt-to-equity ratio $ 238,000 770,000 $1,008,000 Required Compute the following. (Round "Ratios" to 1 decimal place.) % 144,000 441,000 585,000 423,000 $1,008,000arrow_forward

- Splish Brothers Limited had the following statement of financial position for the current year, 2023: Current assets Investments Property, plant, and equipment Intangible assets Other assets SPLISH BROTHERS LIMITED Statement of Financial Position December 31, 2023 1. 2. $125,020 80,840 199,280 30,080 35,720 $470,940 Current liabilities Long-term liabilities Shareholders' equity $91,180 159,800 219,960 The following additional information is available and provides information regarding errors in classification which need to be corrected: to $470,940 Current Assets include the following: bank account with an overdraft balance of $14,100; inventory with a FIFO cost of $81,780 and a net realizable value of $79,900; accounts receivable of $62,040 less allowance for expected credit losses of $2,820. Investments include the following: a mortgage receivable from parent company $56,400, due in 2028; FV-NI investments held for trading with a cost of $9,400 and a fair value of $11,280; FV-OCI…arrow_forwardInc’s financial statements are as follows: TURCO Inc. Balance sheet For the Period ended 2019 and 2020 ($000) ASSETS 2019 2020 Cash $ 200 $ 150 Accounts receivable 450 425 Inventory 550 625 CURRENT ASSETS $ 1,200 $ 1,200 Plant & equipment $2,200 $2,600 Less Accumulated Depreciation (1,000) (1,200) Net Plant & equipment $1,200 $1,400 Total Assets $2,400 $2,600 LIABILITIES & Owner’s Equity Accounts payable $ 200 $150 Notes Payable current (15%) 0 150 CURRENT LIABILITIES $ 200 $300 Bonds $ 600 $600 Owner’s Equity Common stock $900 $900 Retained earnings 700 800 Total Owner’s Equity $ 1,600 $1,700 Total liabilities & Equity $2,400 $2,600 TURCO Inc. Income Statements (000’s) 2019 2020 Sales $1,200 $1,450 COGS 700…arrow_forwardIf Net Working Capital Current Assets - Current Liabilities, what is Kelley Corp's net working capital for the year ending December 31, 2023, given the following account balances? Accounts Receivable: $40 Equipment: $20 Accumulated Depreciation: $10 Patent: $50 Inventory: $15 Accounts payable: $30 Goodwill: $65 Long-term note payable: $70 =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education