FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Compute the following:

6. Assuming that there is a cumulative and participating

will affect the book value per share computation? Explain briefly.

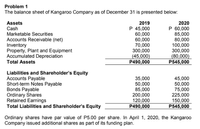

Transcribed Image Text:Problem 1

The balance sheet of Kangaroo Company as of December 31 is presented below:

Assets

2019

2020

P 45,000

60,000

60,000

70,000

300,000

(45,000)

P490,000

P 60,000

85,000

80,000

100,000

300,000

(80,000)

P545,000

Cash

Marketable Securities

Accounts Receivable (net)

Inventory

Property, Plant and Equipment

Accumulated Depreciation

Total Assets

Liabilities and Shareholder's Equity

Accounts Payable

Short-term Notes Payable

Bonds Payable

Ordinary Shares

Retained Earnings

Total Liabilities and Shareholder's Equity

35,000

50,000

85,000

200,000

120,000

P490,000

45,000

50,000

75,000

225,000

150,000

P545,000

Ordinary shares have par value of P5.00 per share. In April 1, 2020, the Kangaroo

Company issued additional shares as part of its funding plan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is purchasing power parity? How might afirm use this concept in its operations?arrow_forward2. What is cost-volume-profit analysis and what are the important assumptions of this analysis?arrow_forwardUsing the following information detailed below, calculate the percentage of equity contribution.arrow_forward

- The relationship: S = C – P + PV(X) shows how a synthetic share can be constructed. What is this relationship called?arrow_forwardExplain the irrelevance and relevance dividend theoriesarrow_forward(b) Why might the usefulness of EPS (earning per share) be limited? Give reasons to support your answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education