FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

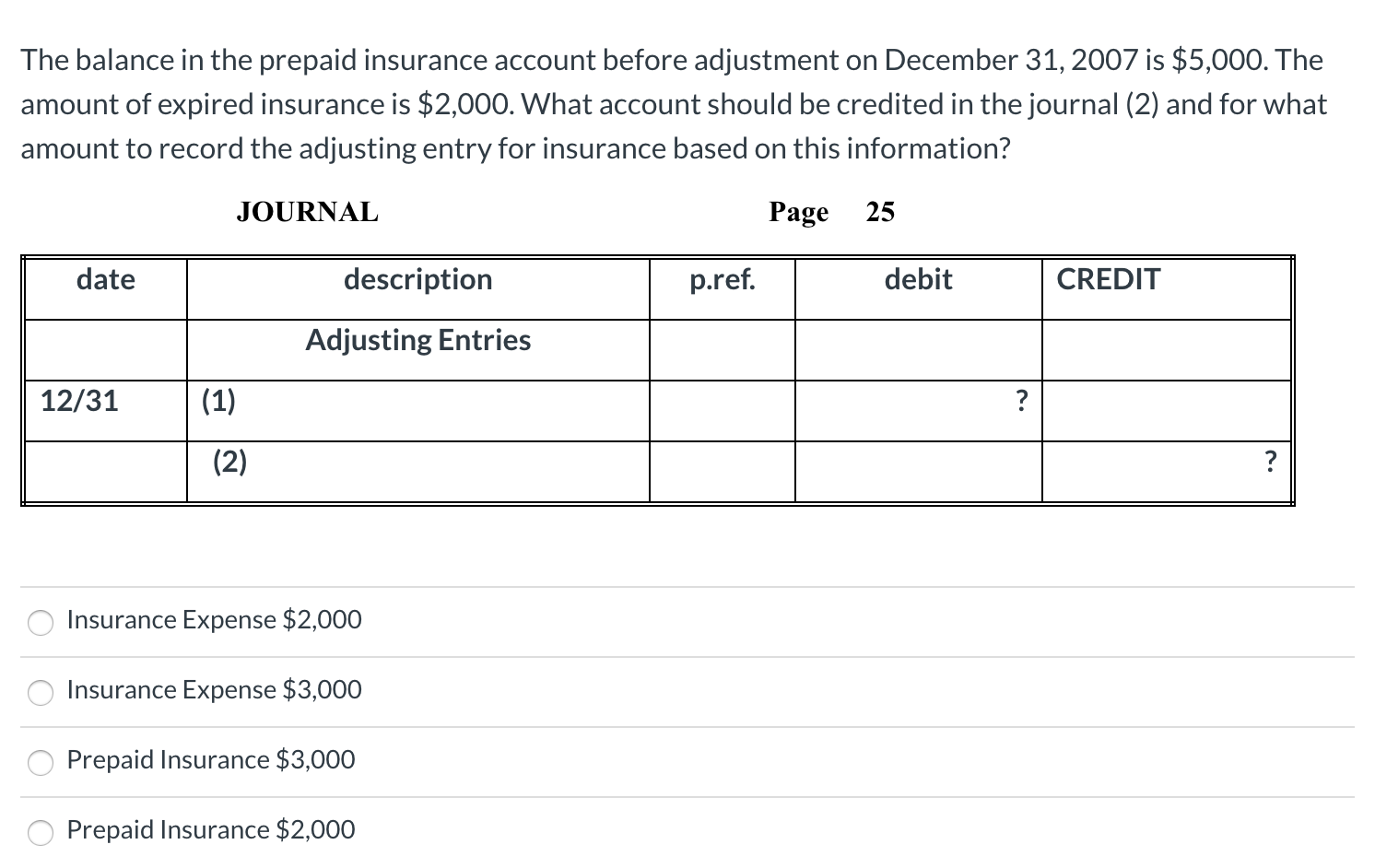

Transcribed Image Text:The balance in the prepaid insurance account before adjustment on December 31, 2007 is $5,000. The

amount of expired insurance is $2,000. What account should be credited in the journal (2) and for what

amount to record the adjusting entry for insurance based on this information?

JOURNAL

25

Page

debit

date

description

p.ref.

CREDIT

Adjusting Entries

(1)

12/31

(2)

Insurance Expense $2,000

Insurance Expense $3,000

Prepaid Insurance $3,000

Prepaid Insurance $2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- adjusted trail balance is available as well as the required information, please record the closure entry of revenue accounts, as well as record the closure entry of expenssses acounts. Thank you.arrow_forwardkk. Subject :- Accountingarrow_forwardPhysicians’ Hospital has the following balances on December 31, 2024, before any adjustment: Accounts Receivable = $50,000; Allowance for Uncollectible Accounts = $1,000 (credit). On December 31, 2024, Physicians’ estimates uncollectible accounts to be 20% of accounts receivable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2024.2. Determine the amount at which bad debt expense is reported in the income statement and the allowance for uncollectible accounts is reported in the balance sheet.3. Calculate net accounts receivable reported in the balance sheet.arrow_forward

- A one-year insurance policy was purchased on June 1 for $1,920. Journalize the adjusting entry required on December 31. If an amount box does not require an entry, leave it blank. Dec. 31 - Select - - Select - - Select - - Select -arrow_forwardzmo Company purchased a 1-year insurance policy on October 1 for $4,560. Journalize the adjusting entry on December 31. If an amount box does not require an entry, leave it blank. December 31 Insurance Expense Prepaid Insurance X X X 8 Xarrow_forwardView Policies Current Attempt in Progress On July 1, 2022, Blossom Co. pays $12.000 to Nash's Insurance Co. for a 4-year insurance contract. Both companies have fiscal years ending December 31. For Blossom Co. journalize and post the entry on July 1 and the annual adjusting entry on December 31. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem) Debit Credit Date Account Titles and Explanation 100arrow_forward

- Do a journal entry based on this transections, round interest amounts to the nearest dollar,arrow_forwardThe balance in the prepaid insurance account before adjustment on December 31, 2007 is $5,000. The amount of expired insurance is $2,000. What account should be credited in the journal (2) and for what amount to record the adjusting entry for insurance based on this information? JOURNAL Page 25 date description p.ref. debit CREDIT Adjusting Entries 12/31 (1) ? (2) ? Group of answer choices Prepaid Insurance $3,000 Prepaid Insurance $2,000 Insurance Expense $2,000 Insurance Expense $3,000arrow_forwardJournalize the adjusting entries and post to the general ledger - Adjusting entries: 1. Expired insurance for the period $500 2.Accrued salary expense ( earned but not paid ) owed to Sophia LeBron,$5600. (Credit Salaries Payable. Payroll taxes are not considered in this entry. 3.Provision for uncollectible accounts estimated at 3.0% of March creadit sales,$927arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education