FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

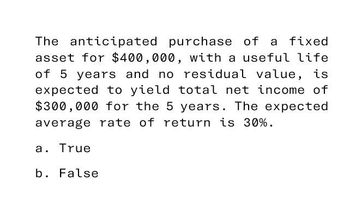

Transcribed Image Text:The anticipated purchase of

purchase of a fixed

asset for $400,000, with a useful life

of 5 years and no residual value, is

expected to yield total net income of

$300,000 for the 5 years. The expected

average rate of return is 30%.

a. True

b. False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Solve it earlyarrow_forward1. A firm is considering two alternatives that have no salvage value. A Initial Cost $10,700 $5,500 Uniform Annual 2,100 1,800 Benefits Useful Life, in 8 4 years At the end of 4 years, another B may be purchased with the same cost, benefit and so forth. 1. Graph the EUAC or EUAW for the alternatives. Construct a choice table for interest rates from 0% to 100%. 2. If the MARR is 10%, which alternative should be selected?arrow_forwardPlease help me with show all calculation thankuarrow_forward

- The expected average rate of return for a proposed investment of $589,600 in a fixed asset with a useful life of four years, straight-line depreciation, no residual value, and an expected total net income of $237,920 for the four years is (round to two decimal points) Oa. 0.40% Оь. 10.09% Oc. 20.18% С. Od. 0.81%arrow_forwardCompare the following alternatives based on the equivalent uniform annual value analysis, using a 15% annual interest rate with continuous capitalization. Alternative A Alternative B Initial Cost $18000 $25000 Annual Cost $4000 $3600 Salvage Value $3000 $2500 Life (years) 3 4arrow_forwardKk201. An asset produces $150 in two years, and $250 in four years, and the current price has been calculated toreflect a rate of return of 9% annually. Using the definition that convexity = second derivative of pricedivided by price, find the convexity of this asset evaluated at the annual yield rate of 9%.arrow_forward

- Complete the following using the present value formula or financial calculator. Note: Do not round intermediate calculations. Round your final answer to the nearest cent. Amount desired at end of period $ 20,000 20 years Length of time Rate Compounded 8% Annually Period used Periodic rate % PV of amount desired at end of periodarrow_forwardConsider an asset that you purchase for $183.836. Its nominal resale value after 3 years of ownership is $16,948. At that time you plan to sell it and invest the proceeds elsewhere. What is the net present cost to you of holding this asset if the nominal discount raM is 6%?arrow_forwardLarkspur company is considering buying equipment for $360,000 with useful life of 5 year and. Financial accountingarrow_forward

- Help me fastarrow_forwardEvaluate the following alternatives through the VPN, VAUE and IRR of the best option. To evaluate the alternatives, consider 6.35% inflation, 2.5% liability rate (risk premium) and x% profit assigned according to the agenda (data to calculate the TMAR). Option A It consists of an investment of Q250,000, to obtain income during the 10 years of useful life for Q100,000 / year, increasing 15% each year the income is interrupted in the last 2 years. The operating costs are of Q15,000 per year Option B Q250,000 must be invested. The investment lasts 4 years and has operating expenses of Q100,000 / year, increasing Q15,000 each year. There is a single salvage value of Q600,000 at the end of the useful life. Option C Q300,000 is invested for advertising expenses, in addition, Q100,000 / year must be given for five years of investment. Income is reported of Q200,000 per year with a salvage value of Q500,000 at the end of the investment.arrow_forwardThe expected average rate of return for a proposed investment of $639,000 in a fixed asset, with a useful life of 4 years, straight-line depreciation, no residual value, and an expected total net income of $335,000 for the 4 years, is (round to two decimal points). Oa. 13.11% Ob. 52.43% 'c. 26.21% Od. 13.90%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education