ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

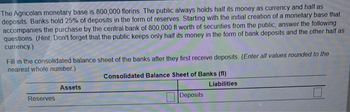

Transcribed Image Text:The Agricolan monetary base is 800,000 florins. The public always holds half its money as currency and half as

deposits. Banks hold 25% of deposits in the form of reserves. Starting with the initial creation of a monetary base that

accompanies the purchase by the central bank of 800,000 fl worth of securities from the public, answer the following

questions (Hint: Don't forget that the public keeps only half its money in the form of bank deposits and the other half as

currency)

Fill in the consolidated balance sheet of the banks after they first receive deposits. (Enter all values rounded to the

nearest whole number.)

Reserves

Assets

Consolidated Balance Sheet of Banks (fl)

Deposits

Liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider again the economy with a total money supply of $2 million and nominal GDP of $6 million. In this economy, the money supply is growing at a rate of 3 percent per year, prices are falling at a rate of 1 percent, and velocity is constant. This economy's real output is growing at a rate of _________ percent. (Enter your answer "as a percent, but without a percentage sign." In other words, if you think output is growing at a rate of 99.99%, enter only 99.99 in the blank. Use a positive sign to indicate an increase and a negative sign to indicate a decrease.)arrow_forwardHey, I need help with the following macro question. Thank you in advance! Imagine that the chair of the Federal Reserve announced that, as of the following day, all currency in circulation in the United States would be worth 10 times its face denomination. For example, a $10 bill would be worth $100; a $100 bill would be worth $1,000; and so forth. Furthermore, the balances in all checking and savings accounts would be multiplied by 10. So, for example, if you had $500 in your checking account, as of the following day your balance would be $5,000. Would you actually be 10 times better off on the day the announcement took effect? Why or why not?arrow_forwardCould you add more information regarding the below statement? "The Federal Reserve System plays a massive role in not only the economy of the united states but alos in the global economy. The US dollar is one of the most popular and well recognized forms of currency all around the world, making it the basis for many financial transactions and trades. This popularity and standardization in regards to the dollar makes it one of if not the most important currency in the world, whose value has implications on nearly every aspect of trade, consumers, and even other countries wellbeing. Because of this, the fed, who has the ability to influence the value of the dollar and the economy, is likely the most important financial institution of the world, because of it's ability to severely impact both positively and negatively the united states economy and the world economy. With the recent inflation, I do think that the fed should take some action to mitigate the risk of any catastrophic…arrow_forward

- Introduction to Macroeconomics Required Reserves and the Money Multiplier When a bank receives a deposit, it must set aside part of it according to the established reserve requirement. The remaining funds are excess reserves and can be lent out, In our economy of multiple banks, it is very likely that the proceeds of the loan will end up on deposit at another bank. When that happens, the process repeats itself: The bank sets aside required reserves and can lend out its excess reserves. The result is the money multiplier process. Use the table that follows to learn more about this process. The table begins with an initial deposit of $1,000 to one bank and assumes a required reserve ratio of 15%. Assume the amount lent by one bank is always deposited in another. 1. Calculate the amount of required reserves, excess reserves, and lending at each step in the process. The first boxes of the table are filled in to get you started. Continue until you have filled in five rows of numbers. 2. Now…arrow_forwardConsider two countries, Canada (Home) and US (Foreign). In 2018, Canada experienced relatively slow output growth (2%), whereas US had relatively robust output growth (4.2%). Suppose the Bank of Canada allowed the money supply to grow by 2% each year, whereas the Federal Reserve (Fed), the US central bank, chose to maintain relatively high money growth of 10% per year. For the following questions, use the simple monetary model (where I is constant).Consider the general monetary model, in which L is no longer assumed constant and money demand is inversely related to the nominal interest rate. In addition to the scenario described in the beginning of the question, the bank deposits in Canada pay 3% interest. Suppose the Fed increases the money growth rate from 10% to 12% and the inflation rate rises proportionately (one for one) with this increase. Using time series diagrams, illustrate how this increase in the money growth rate affects the US money supply, interest rate, prices, real…arrow_forwardScenario 29-1 The Monetary Policy of Jaune is controlled by the country's central bank known as the Bank of Jaune. The local unit of currency is the Jaunian dollar. Aggregate banking statistics show that collectively the banks of Jaune hold $240 million of required reserves, $60 million of excess reserves, have issued $6,000 million of deposits, and hold $480 million of Jaunian Treasury bonds. Jaunians prefer to use only demand deposits and so all money is on deposit at the bank. Refer to Scenario 29-1. Assume that banks desire to continue holding the same ratio of excess reserves to deposits. What is the reserve requirement and the reserve ratio for Jaunian Banks? O 5 percent, 8 percent 4 percent, 8 percent 4 percent, 5 percent 5 percent, 4 percentarrow_forward

- For all questions assume the following starting point: The money supply (M) is composed of currency (C) held by the non-bank private sector (NBPS) and demand deposits (DD) held at banks. Banks are required to hold cash reserves (CR) equal to 10% of their demand deposit liabilities. The remainder of the bank’s DD liabilities is backed by loans (L). Initially, banks have 2000 in cash reserves and the NBPS holds 500 in currency. Currently, banks not hold excess reserves. a. What are the initial values for DD, L, and M? DD= $20,000 L= $18,000 M= $5,000 b. What happens to the values in part a, if the NBPS decides to hold an additional 200 in currency? DD = 20,000, L = 18,000, M = 20,700 c. What would happen to the values in part a if banks decided to hold 2.5% excess reserves? DD = 20,000, L = 17,500, M = 20,500 d. What happens to the values in part a if concerns about the economy's future caused both b and c to happen? DD = 20,000, L = 17,500, M = 20,700 Given the results in…arrow_forwardLet’s assume that the nominal Gross Domestic Product, GDP, of a hypothetical country is $45,000 and that the velocity of money of this country is 5. This implies that the money supply, in this country, is:arrow_forwardAll other things being equal, by how much will nominal GDP expand if the central bank increases the money supply by $110 billion, and the velocity of money is 3.2? (Enter your answer in billions of dollars. That is, if you find an expansion of 1 billion enter 1 for your answer.)arrow_forward

- Y5arrow_forwardUse the Quantity Theory of Money equation to solve the following: If the velocity of circulation is constant, real GDP is growing at 4.5 percent a year, the real interest rate is 2.1 percent a year, and the nominal interest rate is 5.7 percent a year. What is the growth of nominal GDP? Hint: Recall that nominal GDP=PxYarrow_forwardAssume we have an economy in which banks would hold 25% of their deposits as reserves. Initially, deposits are $7,000 and currency is $1,000. Now the central bank purchases $500 of bonds from the public, using new currency. a) Illustrate the first three rounds of deposit creation, assuming that public would like to continue to hold $1,000 of currency. PLEASE incorporate the fact that the central bank purchases $500 of bonds from the public, using new currency. b) What will money supply ultimately be in this case? c) Repeat the analysis in (a), but now assume that the public would like to hold a constant ratio of currency to deposits. Briefly explain why the two results are different.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education