FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

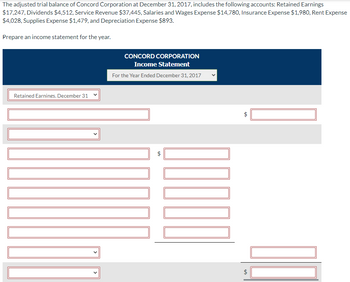

Transcribed Image Text:The adjusted trial balance of Concord Corporation at December 31, 2017, includes the following accounts: Retained Earnings

$17,247, Dividends $4,512, Service Revenue $37,445, Salaries and Wages Expense $14,780, Insurance Expense $1,980, Rent Expense

$4,028, Supplies Expense $1,479, and Depreciation Expense $893.

Prepare an income statement for the year.

Retained Earnings. December 31

CONCORD CORPORATION

Income Statement

For the Year Ended December 31, 2017

LA

tA

$

LA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At January 1, 2020, Crane Company reported retained earnings of $1,938,000. In 2020, Crane discovered that 2019 depreciation expense was understated by $387,600. In 2020, net income was $822,000 and dividends declared were $205,000. The tax rate is 20%. Prepare a 2020 retained earnings statement for Crane Company. CRANE COMPANY Retained Earnings Statementarrow_forwardFollowing are the financial statements and other supplementary information for Summer Corporation for its year-ended December 31, 2022: Sales Cost of goods sold Gross Margin Depreciation Expense Wage Expense Other operating expenses Interest Expense Loss on Sale of Equipment Income Before Tax Income Tax Expense Net Income Current Assets Cash Accounts receivable Inventory Prepaid Expenses Non-Current Assets Equipment Accumulated Depreciation Total Assets Current Liabilities Accounts Payable Income Taxes Payable Wages Payable barnet Davable $1,055,000 (545,000) 510,000 (37,000) (103,000) (55,000) (25,000) (Z.800) 282,200 (112,880) $169,320 2022 $102,560 98,000 85,900 6,700 275,000 (54,000) $514,160 $32,500 5,600 8,800 6,500 Long-Term Liabilities and Shareholders' Equity LT Notes Payable Common Shares Retained Earnings Total Liabilities and Shareholders' Equity 6,500 2021 $145,000 -42,440 110,000 -12,000 43,000 42,900 1,200 5,500 Change 125,000 150,000 (25,000) 29,000 $399,200 114,960…arrow_forwardAssume a company starts operations on 1/1/2013 with an equity investment of $776,750. The companies next 7 years of financial performance are listed below. Assume that the company has no permanent or temporary differences for the first three fiscal years. During fiscal 2016 the company experiences a net operating loss. The marginal corporate tax rates for each year are located on the Income Statement. Calculate taxable income (IRS), taxes payable (IRS)and tax expenses (USGAAP). How should the company accounts for the Net Operating Loss. Provide all Journal Entries & T-Accounts. Create a complete set of financial statements (I/S, SRE, B/S, SCF) for the firm for years 2013 through 2019. INCOME STATEMENT 1/1/13 12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 Cash Sales - $776,750 $776,750 $776,750 $119,500 $836,500 $717,000 $746,875 Credit Sales - - - - - - - - Instalment Sales - - - - - -…arrow_forward

- Refer to the 3.00% senior notes due May 2027. Calculate the interest expense on this note for fiscal year 2022.arrow_forwardByrd Company had the following transactions during 2019 and 2020: 1. Prepare the journal entries for Byrd for both 2019 and 2020. Assume that the net price method is used to account for the credit terms. 2. Show how the preceding items would be reported in the current liabilities section of Byrd’s December 31, 2019, balance sheet. 3. Next Level Assuming Byrd’s current assets were $1,200,000 and its current ratio was 2.4 at the end of 2018, compute the current ratio at the end of 2019 (based solely on the effects of the preceding transactions).arrow_forwardPlease help mearrow_forward

- Required: 1. Calculate the total current assets at December 31, 2021. 2. Calculate the total liabilities and stockholders' equity at December 31, 2021. 3. Calculate the earnings from operations (operating income) for the year ended December 31, 2021. 4. Calculate the net income (or loss) for the year ended December 31, 2021. 5. What was the average income tax rate for the company for 2021? 6. If 48,000 of dividends had been declared and paid during the year, what was the January 1, 2021, balance of retained earnings? Assume that all balance sheet items reflect account balances at December 31, 2021 of ABC Ind, and that all income statement items reflect activities that occurred during the year then ended. Accounts receivable Depreciation expense Land Cost of goods sold Retained earnings Cash Equipment Supplies Accounts payable Service revenue Interest expense Common stock Income tax expense Accumulated depreciation Long-term debt Supplies expense Merchandise inventory Net sales 99,000…arrow_forwardLansing Company’s 2018 income statement and selected balance sheet data (for current assets and current liabilities) at December 31, 2017 and 2018, follow. LANSING COMPANYIncome StatementFor Year Ended December 31, 2018 Sales revenue $ 100,200 Expenses Cost of goods sold 43,000 Depreciation expense 12,500 Salaries expense 19,000 Rent expense 9,100 Insurance expense 3,900 Interest expense 3,700 Utilities expense 2,900 Net income $ 6,100 LANSING COMPANYSelected Balance Sheet Accounts At December 31 2018 2017 Accounts receivable $ 5,700 $ 6,000 Inventory 2,080 1,590 Accounts payable 4,500 4,800 Salaries payable 900 710 Utilities payable 240 170 Prepaid insurance 270 300 Prepaid rent 240 190 Required:Prepare the cash flows from operating activities section only of the company’s 2018 statement of cash flows using the direct method. (Amounts to be…arrow_forwardThe following items were taken from the adjusted trial balance of the Dylex Corporation for the year ended December 31, 2020. Assume an average 25% income tax on all ens. The accounting period ends December 31, and all amounts given are pre-tax. Dylex Corporation had 11,000 common shares outstanding in 2020 and follows IFRS Cost of goods sold Depreciation expense, building Gain on exchange Gain on sale of assets from discontinued operations Insurance expense Interest expense Interest income Loss on sale of trading investment 140,000 23,000 a) Prepare a multi-step income statement in good form. Please make sure your final anewarts) are accurate to 2 decimal places Dylex Corporation For the Year Ended December 31, 200 125,000 100,000 54,000 52,000 X 58,000 135,000 Operating loss of discontinued operation to disposal date 100,000 Salaries expense 160.000 Sales ** 900,000 REQUIRED DISCLOSURES b) Calculate basic eamings per share (EPS) from continuing operations. Please make sure your final…arrow_forward

- Applying the Fundamental Accounting Equation At the beginning of 2019, KJ Corporation had total assets of $554,000, total liabilities of $261,800, common stock of $139,300, and retained earnings of $152,900. During 2019, KJ had net income of $225,200, paid dividends of $74,400, and issued additional common stock for $93,900. KJ's total assets at the end of 2019 were $721,800. Required: Calculate the amount of liabilities that KJ must have at the end of 2019 in order for the balance sheet equation to balance.arrow_forwardThe current ratio is defined as current assets divided by current liabilities. On December 29, 2021 Ohio Company had current assets of $200 and current liabilities of $100. On December 30, Ohio paid salary payable int the amount of $50. Calculate the current ratio on December 31, 2021.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education