FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Why would question 3 considered incorrect?

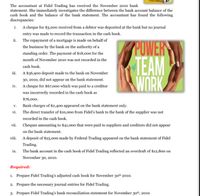

Transcribed Image Text:The accountant at Fidel Trading has received the November 2010 bank

statement. She immediately investigates the difference between the bank account balance of the

cash book and the balance of the bank statement. The accountant has found the following

discrepancies:

i. A cheque for $3,000 received from a debtor was deposited at the bank but no journal

entry was made to record the transaction in the cash book.

ii. The repayment of a mortgage is made on behalf of

POWER

TEAM

WORK

the business by the bank on the authority of a

standing order. The payment of $18,00o for the

month of November 2010 was not recorded in the

cash book.

iii. A$36,900 deposit made to the bank on November

30, 2010, did not appear on the bank statement.

iv. A cheque for $67,000 which was paid to a creditor

was incorrectly recorded in the cash book as

$76,000.

Bank charges of $2,400 appeared on the bank statement only.

V.

vi. The direct transfer of $10,000 from Fidel's bank to the bank of the supplier was not

recorded in the cash book.

vii. Cheques amounting to $41,000 that were paid to suppliers and creditors did not appear

on the bank statement.

viii. A deposit of $25,000 made by Federal Trading appeared on the bank statement of Fidel

Trading.

ix. The bank account in the cash book of Fidel Trading reflected an overdraft of $12,800 on

November 30, 2010.

Required:

1. Prepare Fidel Trading's adjusted cash book for November 30th 2010.

2. Prepare the necessary journal entries for Fidel Trading.

3. Prepare Fidel Trading's bank reconciliation statement for November 30th, 2010

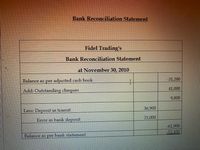

Transcribed Image Text:Bank Reconciliation Statement

Fidel Trading's

Bank Reconciliation Statement

at November 30, 2010

Balance as per adjusted cash book

-31,200

41,000

Add: Outstanding cheques

9,800

Less: Deposit in transit

36,900

25,000

Error in bank deposit

-61,900

-52.100

Balance as per bank statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is underpricing? Why is it used? What evidence do we have to support the belief that underpricing is a regular problem?arrow_forwardWhat is Descartes's account of error? How do we make one and how can we avoid making one?arrow_forwardDescribe the term Legitimized disagreement and skepticism?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education