FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

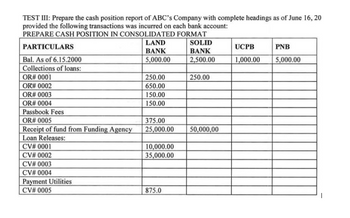

Transcribed Image Text:TEST III: Prepare the cash position report of ABC's Company with complete headings as of June 16, 20

provided the following transactions was incurred on each bank account:

PREPARE CASH POSITION IN CONSOLIDATED FORMAT

PARTICULARS

Bal. As of 6.15.2000

Collections of loans:

OR# 0001

OR# 0002

OR# 0003

OR# 0004

Passbook Fees

OR# 0005

Receipt of fund from Funding Agency

Loan Releases:

CV# 0001

CV# 0002

CV# 0003

CV# 0004

Payment Utilities

CV# 0005

LAND

BANK

5,000.00

250.00

650.00

150.00

150.00

375.00

25,000.00

10,000.00

35,000.00

875.0

SOLID

BANK

2,500.00

250.00

50,000,00

UCPB

1,000.00

PNB

5,000.00

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bank Reconciliation The following data were gathered to use in reconciling the bank account of Azalea Company: Balance per bank $ 17,300 Balance per company records 9,455 Bank service charges 35 Deposit in transit 3,700 Note collected by bank with $100 interest 5,350 Outstanding checks 6,230 a. What is the adjusted balance on the bank reconciliation? b. Journalize any necessary entries for Azalea Company based on the bank reconciliation. f an amount box does not require an entry, leave it blank. Cash Accounts Receivable Miscellaneous Expense Casharrow_forwardExam 3 (Chapters 5-6) 28 Book The following information is available for Birch Company at December 31 Cash in registers Investment naturing in 9 years Accounts receivable Cash in bank account Accounts payable Cash in petty cash fundi Inventory of postage stamps U.S. Treasury bill maturing in 15 days Based on this information, Birch Company should report Cash and Cash Equivalents on December 31 of Multiple Choice O $40.606 $43.091 $38,061 $39,066 $54,261 $ 2,910 $ 16,200 $ 1,775 $ 23,631 $ 770 $ 320 $ 30 $ 11,200arrow_forwardRr.6.1arrow_forward

- Answer full question.arrow_forwardRequlred Informetion [The following information applies to the questions displayed below.] The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Checks Deposits Balance $ 48,000 40, 380 67,830 53,930 ৪9, 938 88,970 88,470 88,520 88,370 Date Other Dec. 1 $ 7,620 558 $28, 000 13,900 11 17 23 36, e00 26 960 30 NSF* $300 50 19, 200 19, e00 31 Interest earned 31 Service charge 150 NSF check from J. Left, a customer. Cash (A) Dec. 1 Balance 48, e00 Deposits Dec. 11 23 Checks written during December: 7,620 28, 800 36, ee0 19,e00 13,e00 550 30 13,900 960 31 150 19,200 4,500 Dec. 31 Balance 97,120 There were no deposits in transit or outstanding checks at November 30. Requlred: 1. Identify and list the deposits in transit at the end of December. (Select all that apply.) $28,000 $36,000 $19,000 $13,000 2. [dentify and list the outstanding checks at the end of December (Select all that apply.) $7,620 $550 $13,900 $880 $150 $19,200 $4,500 OOUIarrow_forwardSubject - account Please help me. Thankyouarrow_forward

- aj.2arrow_forwardA -1 Prepared by Reviewed by William, Inc. Bank Confirmation - General Account December 31, 2022 Balance per Bank at December 31, 2022 $20,200.22 * Deposit in Transit - per A-1-2 2,000.00 # Outstanding Checks - per A-1-3 (5,200.00) Other - Note Collected by Bank (10,000.00) ^ Bank Service Charge (9.50) Balance per Books at December 31, 2022 $8,990.72 * f f Column footed. ^ Amount agrees to amount recorded as a deposit on the bank statement and description agrees with receipt enclosed with 12/31/22 bank statement. This note is the Kristopher note receivable that was recorded as a receipt by the client in the cash receipts journal on January 3, 2023. The receivable was appropriately credited and properly reflected in the January cash receipts journal. No adjustment needed as bank and books simply record this in different periods. #Agreed to December 31,…arrow_forwardBank reconcilationarrow_forward

- Do not provide answer in image formatarrow_forwardPrepare adjusting journal entries to reconcile the book and bank balancesarrow_forwardBank reconcjliation Instructions Chart of Accounts First Question Journal Instructions The following data were gathered to use in reconciling the bank account of Reddan Company: Balance per bank $17,350 Balance pir company records 10,035 Bank service charges 35 Deposit in transit 3,350 Note collected by bank with $190 interest 4,600 Outstanding checks 6,100 Instructions a. What is the adjusted balance on the bank reconciliation? b. Journalize any necessary entries for Reddan Company based on the bank reconciliation. Refer to the Chart of Accounts for exact wordina of Check My Workarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education