Terri Allessandro has an opportunity to make any of the following investments: . The purchase price, the lump-sum future value, and the year of receipt are given below for each investment. Terri can earn a rate of return of 13% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is satisfactory, and make an investment recommendation to Terri. The present value, PV, at 13% required return of the income from Investment A is S (Round to the nearest cent.) Data table Investment Purchase Price Future Value Year of Receipt $8.674 $429 $2.282 $57 $21,000 $2,000 $10,000 15 11 $14.000 54 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet)

Terri Allessandro has an opportunity to make any of the following investments: . The purchase price, the lump-sum future value, and the year of receipt are given below for each investment. Terri can earn a rate of return of 13% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is satisfactory, and make an investment recommendation to Terri. The present value, PV, at 13% required return of the income from Investment A is S (Round to the nearest cent.) Data table Investment Purchase Price Future Value Year of Receipt $8.674 $429 $2.282 $57 $21,000 $2,000 $10,000 15 11 $14.000 54 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet)

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 9PB: Joliet Company is considering two alternative investments. The company requires an 18% return from...

Related questions

Question

Transcribed Image Text:Terri Allessandro has an opportunity to make any of the following investments: E. The purchase price, the lump-sum future value, and the year of receipt are given below for

each investment. Terri can earn a rate of return of 13% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is

satisfactory, and make an investment recommendation to Terri.

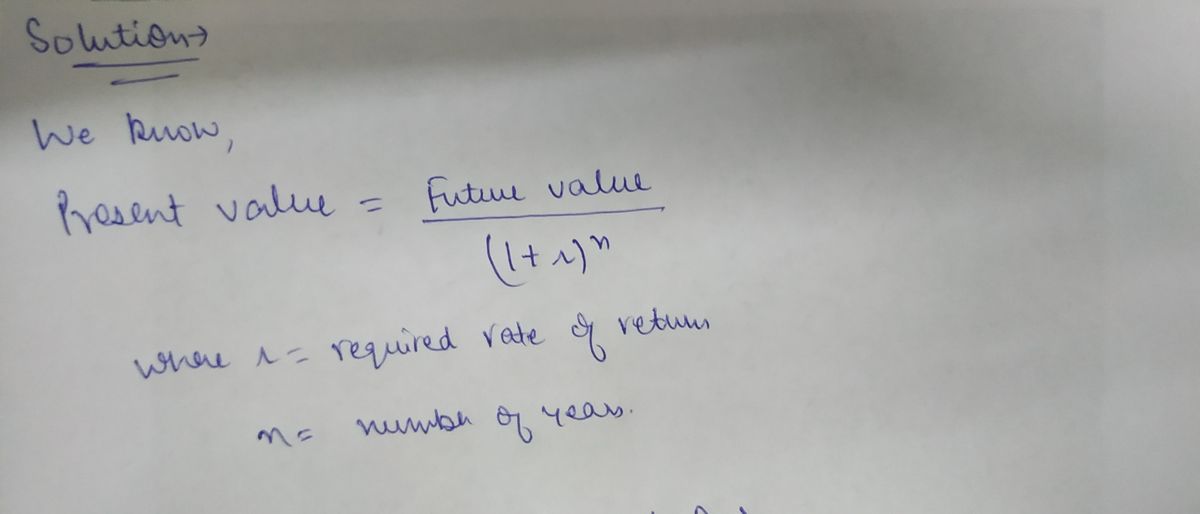

The present value, PV, at 13% required return of the income from Investment A is S . (Round to the nearest cent.)

- X

Data table

Purchase Price

Future Value

Year of Receipt

Investment

$8.674

$21,000

$2.000

15

$429

$2.282

$57

11

$10,000

54

$14,000

(Click on the icon located on the top-right corner of the data table below in order to

copy its contents into a spreadsheet)

Clear all

Check answer

Heln me

BCDS

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College