ECON MACRO

5th Edition

ISBN: 9781337000529

Author: William A. McEachern

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't use

Answer in step by step with explanation.

Transcribed Image Text:TEA (Millions of pounds)

48

42

38

30

24

18

12

6

PPF

Maldonia

(?)

TEA (Millions of pounds)

48

42

38

PPF

30

24

18

12

6

18, 9

A

Sylvania

0

0

0

6

12 18

24

30

38

42

48

0

8

12

18

24

30

38

42

48

GRAIN (Millions of pounds)

GRAIN (Millions of pounds)

(?)

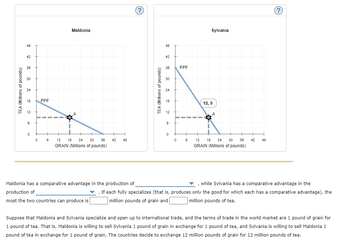

Maldonia has a comparative advantage in the production of

production of

most the two countries can produce is

, while Sylvania has a comparative advantage in the

. If each fully specializes (that is, produces only the good for which each has a comparative advantage), the

million pounds of grain and

million pounds of tea.

Suppose that Maldonia and Sylvania specialize and open up to international trade, and the terms of trade in the world market are 1 pound of grain for

1 pound of tea. That is, Maldonia is willing to sell Sylvania 1 pound of grain in exchange for 1 pound of tea, and Sylvania is willing to sell Maldonia 1

pound of tea in exchange for 1 pound of grain. The countries decide to exchange 12 million pounds of grain for 12 million pounds of tea.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me with this carefully. Thank you.arrow_forwardPrice (dollars per ton) 1,000 800 600 400 200 0 1 2 3 4 5 D 6 Steel (millions of tons per year) The figure shows the market for steel in the United States. If the world price for a ton of steel is $200 per ton, how much steel does the United States import? Suppose the United States imposes a tariff of $400 per ton of steel. With this tariff, how much steel does the United States import? If it is possible to calculate the amount of the deadweight loss from the $400 per ton tariff, what is the amount? If it is not possible, explain why it is not possible to calculate it. Next suppose the United States imposes a tariff of only $200 per ton of steel. With this tariff, how much steel does the United States import? How much revenue does the government collect from this tariff? Finally, suppose that instead of a tariff the United States imposes a quota of 2 million tons of steel per year. Illustrate how the market changes with this quota. With the quota, what is the price of steel in the…arrow_forwardPRICE (Dollars per ton) 865 Domestic Demand 830 795 760 725 690 655 620 585 550 515 7 0 40 80 Domestic Supply PW 120 160 200 240 280 320 360 400 QUANTITY (Tons of oranges) If Honduras is open to international trade in oranges without any restrictions, it will import A tariff set at this level would raise $ Suppose the Honduran government wants to reduce imports to exactly 160 tons of oranges to help domestic producers. A tariff of $ will achieve this. tons of oranges. in revenue for the Honduran government. per tonarrow_forward

- From the following table indicate which commodities the US should export to England. Explain! US UKWheat (Bushels/Labor Hour) 9.0 4.8Cloth (Yards/Labor Hour) 4.5 2.4arrow_forwardSuppose the Italian government imposes a tariff on imported lumber products. The effect this tariff has on the Italian lumber market is to ______ domestic prices, ______ consumer surplus, and ______ producer surplus.arrow_forward6arrow_forward

- China Production Possibilities Product A B C D E F Apparel 20,000 16,000 12,000 8,000 4,000 0 Chemicals(tons) 0 8 16 24 32 40 U.S. Production Possibilities Product R S T U V W Apparel 60,000 48,000 36,000 24,0000 12,000 0 Chemicals(tons) 0 12 24 36 48 60arrow_forwardPRICE (Dollars per ton) 980 Domestic Demand 930 880 830 780 730 680 630 580 530 480 0 50 Domestic Supply Pw 100 150 200 250 300 350 400 450 500 QUANTITY (Tons of oranges) If Zambia is open to international trade in oranges without any restrictions, it will import A tariff set at this level would raise $ ? Suppose the Zambian government wants to reduce imports to exactly 200 tons of oranges to help domestic producers. A tariff of $ will achieve this. tons of oranges. in revenue for the Zambian government. per tonarrow_forwardPRICE (Dollars perton) 1225 1180 1135 1090 1045 1000 955 910 865 820 775 Domestic Demand + 0 30 Domestic Supply 60 90 120 150 180 210 QUANTITY (Tons of limes) 240 C++ P W 270 300 If Zambia is open to international trade in limes without any restrictions, it will import tons of limes.arrow_forward

- Unions in developed nations often oppose imports from low-wage countries and advocate trade barriers to protect jobs from what they often characterize as “unfair” import competition. Is such competition “unfair”? Do you think that this argument is in the best interests of (a) the people they represent, and/or (b) the country as a whole? PLEASE HELP WITH DISCUSSION NEEDS TO BE 150 WORDSarrow_forwardNonearrow_forwardPlease show solution. Thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Principles of Microeconomics

Economics

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:Cengage Learning