FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:TB MC Qu. 08-173 Martin Company purchases a machine...

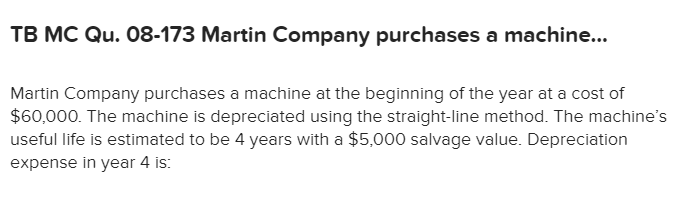

Martin Company purchases a machine at the beginning of the year at a cost of

$60,000. The machine is depreciated using the straight-line method. The machine's

useful life is estimated to be 4 years with a $5,000 salvage value. Depreciation

expense in year 4 is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Delta Machine Company purchased a computerized assembly machine for $108,000 on January 1 Year 1 Delta Machine Company estimated that the machine would have a life of four years and a $11,000 salvage value: Delta Machine Company uses the straight-line method to compute depreciation expense. At the beginning of Year 3 Delta discovered that the machine was quickly becoming. obsolete and would have little value at the end of its useful life Consequently, Delta Machine Company revised the estimated salvage to only $3,000. It did not change the estimated useful life of the machine Compute the depreciation expense for each of the four years Years Year 12 Year 2 Year 3 Year 4 Depreciation Expensearrow_forwardOn January 1, Year 1, Missouri Company purchased a truck that cost $29,000. The truck had an expected useful life of 10 years and a $3,000 salvage value. Missouri uses the double-declining-balance method. What is the amount of depreciation expense recognized in Year 2? Multiple Choice O $4,640 $4,160 $2,900 O $5,800arrow_forward6. Joliet Company is considering two alternative investments. The company requires an 18% return from its investments. Category Initial Investment Net cash flows anticipated: Year 1 Year 2 Year 3 Year 4 Year 5 Project X 108,000 36,000 39,000 32,000 34,000 25,000 Compute the IRR for both Projects and recommend one of them. Project Y $98,000 25,000 45,000 42,000 28,000 17,000arrow_forward

- DEPLORABLE BAD Co. acquired a machine on October 5, 20x1 for a total cost of ₱160,000. The machine was estimated to have a useful life of 4 years and a salvage value of ₱10,000. DEPLORABLE BAD Co. uses the sum-of-the-years' digits method and prorates full-year depreciation to the nearest month. DEPLORABLE BAD Co. sold the machine on December 27, 20x2 for ₱40,000. How much is the gain (loss) on the sale?arrow_forwardNonearrow_forwardA machine was purchased for $72,000, has a 10-year useful life, and a $4,000 salvage value. What is its depreciation expense in year 2 using the sum of the years' digits method (rounded to the nearest dollar)? Select one: O a. 12,364 O b. 11,782 c. 13,091 d. 11,127 Oarrow_forward

- Dogarrow_forwardByrd Inc., a calendar year-end company, purchased a machine on 1/1/X1 with the following attributes: Cost $ 50,000 Salvage Value $ 2,000 Useful life 4 years Assuming that Byrd uses the straight-line depreciation method, answer each of the following questions: (do not include decimals or cents) Question #1: How much depreciation expense should be recorded in 20X2 (the second year of the asset's life)? Answer: $ Question #2: What should be the balance in the "Accumulated Depřeciation" account at the end of 20X2, after all year-end journal entries? Answer: $ Question #3: What should be the book value of the machine at the end of 20X2, after all year-end journal entries? Answer: $arrow_forwardKnife Edge Company purchased tool sharpening equipment on July 1, 20Y5, for $16,200. The equipment was expected to have a useful life of three years and a residual value of $900. Instructions: a. Determine the amount of depreciation expense for the years ended December 31, 20Y5, 20Y6, 20Y7 and 20Y8 by the straight-line method. Depreciation Expense 20Y5 $fill in the blank 1 20Y6 $fill in the blank 2 20Y7 $fill in the blank 3 20Y8 $fill in the blank 4 b. Determine the amount of depreciation expense for the years ended December 31, 20Y5, 20Y6, 20Y7 and 20Y8 by the double-declining-balance method. Round the double-declining-balance depreciation rate to six decimal places and round your final answers to the nearest whole dollar. Depreciation Expense 20Y5 $fill in the blank 5 20Y6 $fill in the blank 6 20Y7 $fill in the blank 7 20Y8 $fill in the blank 8arrow_forward

- The following table reports (in millions) earnings, dividends, capital expenditures, and R&D for Intel for the period 1990–95: Capital YearNet IncomeDividendsExpendituresR&D1990$650$0$680$5171991819094861819921,067431,22878019932,295881,93397019942,2881002,4411,11119953,5661333,5501,296What are the dividend payout rates for Intel during these years? Is this payout policy consistent with the factors expected to drive dividend policy, as discussed in the chapter? What factors do you expect would lead Intel’s management to increase its dividend payout? How do you expect the stock market to react to such a decision?arrow_forwardN purchased a truck cost $46,000. N expected to drive the truck 100,000 miles over its 5 years useful life, and the truck had an estimated salvage value of $8,000. If the truck is driven 26,000 miles in the current accounting period, what would be the amount of depreciation expense for the year? A. $11,960 B. $9,880 C. $9,200 D. $7,600arrow_forwardPeavey Enterprises purchased a depreciable asset for $25,000 on April 1, Year 1. The asset will be depreciated using the straight-line method over its four-year useful life. Assuming the asset's salvage value is $2,600, what will be the amount of accumulated depreciation on this asset on December 31 Year 3? Multiple Choice О $5,600 $22,400 $18,667 $15,400 О $4,667arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education