FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

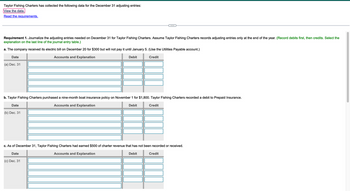

Transcribed Image Text:Taylor Fishing Charters has collected the following data for the December 31 adjusting entries:

View the data.

Read the requirements.

Requirement 1. Journalize the adjusting entries needed on December 31 for Taylor Fishing Charters. Assume Taylor Fishing Charters records adjusting entries only at the end of the year. (Record debits first, then credits. Select the

explanation on the last line of the journal entry table.)

a. The company received its electric bill on December 20 for $300 but will not pay it until January 5. (Use the Utilities Payable account.)

Accounts and Explanation

Credit

Date

(a) Dec. 31

b. Taylor Fishing Charters purchased a nine-month boat insurance policy on November 1 for $1,800. Taylor Fishing Charters recorded a debit to Prepaid Insurance.

Accounts and Explanation

Debit

Date

Debit

(b) Dec. 31

Credit

c. As of December 31, Taylor Fishing Charters had earned $500 of charter revenue that has not been recorded or received.

Date

Accounts and Explanation

Debit

(c) Dec. 31

Credit

Transcribed Image Text:Taylor

Fishing Charters has collected the following data for the December 31 adjusting entries:

View the data.

Read the requirements.

Re

ex

a.

(a

b.

(b

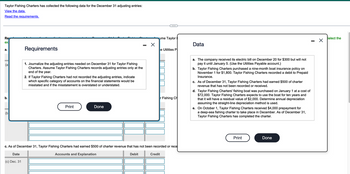

Requirements

V

1. Journalize the adjusting entries needed on December 31 for Taylor Fishing

Charters. Assume Taylor Fishing Charters records adjusting entries only at the

end of the year.

2. If Taylor Fishing Charters had not recorded the adjusting entries, indicate

which specific category of accounts on the financial statements would be

misstated and if the misstatement is overstated or understated.

Print

Done

I

Debit

X

ume Taylor

e Utilities P

c. As of December 31, Taylor Fishing Charters had earned $500 of charter revenue that has not been recorded or rece

Date

Accounts and Explanation

(c) Dec. 31

Credit

r Fishing Ch

Data

a. The company received its electric bill on December 20 for $300 but will not

pay it until January 5. (Use the Utilities Payable account.)

b. Taylor Fishing Charters purchased a nine-month boat insurance policy on

November 1 for $1,800. Taylor Fishing Charters recorded a debit to Prepaid

Insurance.

c. As of December 31, Taylor Fishing Charters had earned $500 of charter

revenue that has not been recorded or received.

d. Taylor Fishing Charters' fishing boat was purchased on January 1 at a cost of

$72,000. Taylor Fishing Charters expects to use the boat for ten years and

that it will have a residual value of $2,000. Determine annual depreciation

assuming the straight-line depreciation method is used.

e. On October 1, Taylor Fishing Charters received $4,000 prepayment for

a deep-sea fishing charter to take place in December. As of December 31,

Taylor Fishing Charters has completed the charter.

Print

Done

-

X

Select the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, 2022, Sheridan Company pays $18,500 to Wildhorse Co. for a 2-year insurance contract. Both companies have fiscal years ending December 31. (a1) Journalize the entry on July 1 and the adjusting entry on December 31 for Wildhorse Co.. Wildhorse uses the accounts Unearned Service Revenue and Service Revenue. (Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Creditarrow_forwardI. The senior accountant for Koo Graphics discovered that the company'e accounting clerk had a different method of recording the purchase cf automobile insurance. Specifically, when one-year policies were purchased on July 1, the clerk debited Insurance Expense $7200 and credited Bank $7200, A. Has the clerk done anything seriously wrong? Explain. B. Use the T-accounts in your Workbook to calculate the year-end adjustment for insurance for December 31. Journalize the adjusting entry.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Please help with a and barrow_forwardThe Yellow Company made year-end adjusting entries affecting each of the following accounts: Office Salaries Payable (credited); Depreciation Expense (debited); Unearned Rental Revenue (debited); and Prepaid Insurance (credited). Which account is likely to appear in Yellow's reversing entries? a. Office salaries payable b. Depreciation expense c. Unearned rental revenue d. Prepaid insurancearrow_forward1. What is the net overstatement/(understatement) of KnK for the year ended December31, 2022? 2. What adjusting entry is necessary to correct KnK’s financial statements for the yearended Dec 31, 2022 ?arrow_forward

- The Yellow Canoe Company made year-end adjusting entries affecting each of the following accounts: InterestRevenue (credited); Depreciation Expense (debited); Unearned Rental Revenue (debited); and Prepaid Insurance(credited). Which account is likely to appear in Yellow Canoe’s reversing entries?a. Depreciation Expenseb. Interest Revenuec. Prepaid Insuranced. None of these answer choices is correct.arrow_forwardThe information necessary for preparing the 2021 year-end adjusting entries for Gamecock Advertising Agency appears below. Gamecock’s fiscal year-end is December 31. 1. On July 1, 2021, Gamecock receives $6,000 from a customer for advertising services to be given evenly over the next 10 months. Gamecock credits Deferred Revenue. 2. At the beginning of the year, Gamecock’s depreciable equipment has a cost of $28,000, a four-year life, and no salvage value. The equipment is depreciated evenly (straight-line depreciation method) over the four years. 3. On May 1, 2021, the company pays $4,800 for a two-year fire and liability insurance policy and debits Prepaid Insurance. 4. On September 1, 2021, the company borrows $20,000 from a local bank and signs a note. Principal and interest at 12% will be paid on August 31, 2022. 5. At year-end there is a $2,700 debit balance in the Supplies (asset) account. Only $1,000 of supplies remains on hand.Required: Record the necessary adjusting entries on…arrow_forwardAmong other things, the trial balance of Ashanti, Inc., at December 31, 2023 includesPrepaid Insurance of $7,500. Examination of the company’s records shows that an adjustment should be made to the Prepaid Insurance account for the following reason: of the $7,500 of Prepaid Insurance in the trial balance, $2,500 is for insurance coverage during the months after December 31, 2023. Which of the following is the correct adjusting entry? Debit Prepaid Insurance $7,500; credit Insurance Expense $7,500. Debit Prepaid Insurance $2,500; credit Insurance Expense $2,500. Debit Prepaid Insurance $5,000; credit Insurance Expense $5,000. Debit Insurance Expense $5,000; credit Prepaid Insurance $5,000. Debit Insurance Expense $2,500; credit Prepaid Insurance $2,500. Debit Insurance Expense $7,500; credit Prepaid Insurance $7,500.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education