Taxes are costs, and, therefore, changes in tax rates can affect consumer prices, project lives, and the value of existing firms. Evaluate the change in

Assumptions: Tax

-

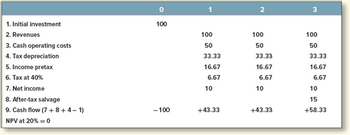

Please verify that the information above yields NPV = 0.

-

If you decide to terminate the project in Year 2, what would be the NPV of the project?

-

Suppose that the government now changes tax depreciation to allow a 100% write-off in Year 1. How does this affect your answers to parts a and b above?

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 8 images

- XYZ Manufacturing is considering the purchase of a new punch press. This press will cost $63,112. This asset will be depreciated using an MACRS (GDS) recovery period of seven years. The book value (BV) at the end of the second year?arrow_forwardH8. A piece of equipment has a capital investment of $1,140,000 and an annual operating expense of $115,500. The life of the equipment is 10 years, the effective income tax rate is 40%, and the after-tax MARR is 9% per year. The equipment qualifies for seven-year MACRS (GDS) properties. Perform after-tax PW analysis.arrow_forwardPlease helparrow_forward

- A company bought a generating set (or Genset) years ago at P5M and is now fully depreciated. It plans to fix it at a cost of P2,731,809 so that it would still have 6-year life remaining and be annually operated at a cost of P1,511,338 and be sold by the end of its life at P400,000. Simultaneously, it will buy a medium-sized Genset at a cost of P2.5M to be operated at P0.25M annually, and a salvage value of P0.35M at the end of 7 years. Leasing is the 2nd option having an annual payment of P1.4M and the initial payment of P0.1M, lasting for 4 years. What is the Annual Equivalent Cost of the 1st Option when interest is 22% cpd.-annually?arrow_forwardGoodson Healthcare purchased a new sonogram imaging unit for $300,000 and a truck body and chassis for an additional $100,000 to make the unit mobile. The unit-truck system will be depreciated as one asset. The functional life is 8 years, and the salvage is estimated to be 15% of the purchase price of the imaging unit regardless of the number of years of service. Use classical Straight Line depreciation to determine the salvage value, annual depreciation, and book value after 5 years of service. The salvage value is determined to be $ . The annual depreciation is determined to be $ . The book value after 5 years of service is determined to be $ .arrow_forwardA firm can purchase a centrifugal separator (5-year MACRS property) for $22,000. The estimated salvage value is $4,000 after a useful life of six years. Operating and maintenance (O&M) costs for the first year are expected to be $2,200. These O&M costs are projected to increase by $1,000 per year each year thereafter. The income tax rate is 24% and the MARR is 11% after taxes. What must the uniform annual benefits be for the purchase of the centrifugal separator to be economical on an after-tax basis?arrow_forward

- A corporation in 2018 expects a gross income of $430,000, total operating expenses of $330,000, and capital investments of $14,000. In addition the corporation is able to declare $53,000 of depreciation charges for the year. The federal income tax rate is 21%. What is the expected taxable income and total federal income taxes owed for the year 2018?arrow_forwardMaterial-handling equipment used in the manufacture of grain products (MACRS-GDS 10-year property) is purchased and installed for $180,000. It is placed in service in the middle of the tax year. If it is removed just before the end of the tax year approximately 4.5 years from the date placed in service, determine the depreciation deduction during each of the tax years involved using MACRS-GDS allowances. ———————- Repeat the previous problem if the material-handling equipment is removed just after the tax year, again using MACRS-GDS allowances.arrow_forwardA concrete and rock crusher for demolition work has been purchased for $50,000, and it has an estimated SV of $12,000 at the end of its five year life Engineers have estimated that the following units of production (in m³ of crushed material) will be contracted over the next five years. Using the units of production depreciation method, what is the depreciation allowance in year three, and what is the BV at the end of year two? The depreciation allowance in year three is $ The BV at the end of year two is $. (Round to the nearest dollar) (Round to the nearest dollar) EOY m³ 1 14,000 2 26,000 3 35,000 4 17,000 5 8,000arrow_forward

- Estimate the approximate after-tax rate of return for a project that has a before-tax ROR of 18.6%. Assume the company's effective tax rate is 26% and it uses MACRS depreciation for an asset that has a $40,000 salvage value. The approximate after-tax rate of return is %.arrow_forwardAn industrial organization has established an automated assembly line (for $360,000) that will reduce labor costs by $56,000 each year for 10 years. The Internal Revenue Service has ruled that you must depreciate the assembly line on a Straight Line (SL) basis with a depreciable life of 10 years. After-tax MARR is 10% per year. The effective income tax rate is 25%. After 10 years, the machine will have zero salvage value. a) Draw a table showing Before Tax Cash Flow (BTCF) and After-Tax Cash Flow (ATCF). b) Calculate the after-tax PW and IRR. (Use interpolation method to find IRR). Is it feasible?arrow_forwardCalculate GNPFC if the value of depreciation is $300 million and the value of NNPFC is $650 millionarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education