FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:<

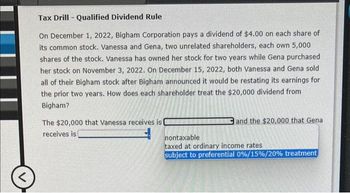

Tax Drill - Qualified Dividend Rule

On December 1, 2022, Bigham Corporation pays a dividend of $4.00 on each share of

its common stock. Vanessa and Gena, two unrelated shareholders, each own 5,000

shares of the stock. Vanessa has owned her stock for two years while Gena purchased

her stock on November 3, 2022. On December 15, 2022, both Vanessa and Gena sold

all of their Bigham stock after Bigham announced it would be restating its earnings for

the prior two years. How does each shareholder treat the $20,000 dividend from

Bigham?

The $20,000 that Vanessa receives is

receives is

and the $20,000 that Gena

nontaxable

taxed at ordinary income rates.

subject to preferential 0%/15 % / 20% treatment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On January 1, 2024, Wallace, Inc. decides to invest in 12,800 shares of Stallion stock when the stock is selling for $11 per share On May 1, 2024, Stallion paid a 50 50 per share cash dividend to stockholders. On December 31, 2024, Stallion reports net income of $120,000 for 2024. Assume Stallion has 32,000 shares of voting stock outstanding during 2024 and Wallace has significant influence over Stallion Read the requirements EXITO Requirement 1. Identify what type of investment the Stallion stock is for Wallace Wallace's investment would be investmentarrow_forwardIn 2020, Mr. Dale paid $40,700 for 3,700 shares of GKL Mutual Fund and elected to reinvest his year-end dividends in additional shares. In 2020 and 2021, he received Form 1099s reporting the following: 2020 2021 Dividends Reinvested $5,365 6,140 Shares Purchased Assume the taxable year is 2022. 393 385 Required A Required B Price per Total Shares Share $13.651 15.948 Required: a. If Mr. Dale sells his 4,478 shares for $15 per share, compute his recognized gain. b. If he sells only 1,250 shares for $15 per share and uses the FIFO method to determine basis, compute his recognized gain. c. If he sells only 1,250 shares for $15 per share and uses the average basis method, compute his recognized gain. Required C Owned Complete this question by entering your answers in the tabs below. 4,093 4,478 < Required B If he sells only 1,250 shares for $15 per share and uses the average basis method, compute his recognized gain. Note: Do not round intermediate calculations. Round your final answer to…arrow_forwardData pertaining to dividends from Jenny Company’s ordinary shares investments for the year 2023 follow: * On October 1, 2023, Jenny received P500,000 liquidating dividend from A Company. Jenny owns a 10% interest in A Company. * Jenny owns a 5% interest in B Company which declared a P5,000,000 cash dividend on November 15, 2023 to stockholders of record on December 15, 2023 payable on January 15, 2024. Jenny does not have ability to exercise significant influence over B Company. * On December 1, 2023, Jenny received from C Company a dividend in kind of one share D Company ordinary shares for every 4 C Company ordinary shares held. Jenny holds 100,000 C Company shares, which have a market price of P50 per share on December 1, 2023. The market price of D Company ordinary is P30 per share. What amount should Jenny report as dividend income in its 2023 income statement?arrow_forward

- Please help mearrow_forwardHaresharrow_forwardDonative Items (LO. 2) Herman inherits stock with a fair market value of $100,000 from his grandfather on March 1. On May 1, Herman sells half the stock at a gain of $10,000 and invests the $60,000 proceeds in Jordan County school bonds. The bonds' annual interest rate is 6%, which is paid on July 31 and January 31. On October 15, Herman receives a $2,200 dividend on the remaining shares of stock. Herman has a gross income of $ from these transactions.arrow_forward

- please quickly thanks!arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Five years ago, Kate purchased a dividend-paying stock for $11,000. For all five years, the stock paid an annual dividend of 2 percent before tax and Kate’s marginal tax rate was 24 percent. Every year Kate reinvested her after-tax dividends in the same stock. For the first two years of her investment, the dividends qualified for the 15 percent capital gains rate; however, for the last three years the 15 percent dividend rate was repealed and dividends were taxed at ordinary rates. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. a. What is the current value (at the beginning of year 6) of Kate's investment assuming the stock has not appreciated in value?arrow_forwardHelp problemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education