FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A1 please help.....

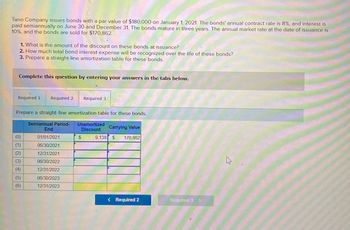

Transcribed Image Text:Tano Company issues bonds with a par value of $180,000 on January 1, 2021. The bonds' annual contract rate is 8%, and interest is

paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is

10%, and the bonds are sold for $170,862.

1. What is the amount of the discount on these bonds at issuance?

2. How much total bond interest expense will be recognized over the life of these bonds?

3. Prepare a straight-line amortization table for these bonds.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required 3

Prepare a straight-line amortization table for these bonds.

Semiannual Period-

End

(0)

01/01/2021

(1)

06/30/2021

(2)

12/31/2021

(3)

06/30/2022

(4)

12/31/2022

(5)

06/30/2023

(6)

12/31/2023

Unamortized

Discount

Carrying Value

$

9,138

$ 170,862

< Required 2

Required 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- M You x O File: xLA File x + Ass X Q App x Q Rev x O Que X 202 X C [Th X O ISB X E Can x to.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%25 DuTube A Maps f Login - Rowan Uni. A My Drive - Google. ID ID.me | Simple, Se. A Division of Unemp.. plied C Class Principles of.. omework- Assignment 1 Saved Help On June 30, Sharper Corporation's stockholders' equity section of its balance sheet appears as follows before any stock dividend or split. Sharper declares and immediately distributes a 50% stock dividend. Common stock-$10 par value, 60,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings $ 600,000 250,000 685,000 Total stockholders' equity $ 1,535,000 (1) Prepare the updated stockholders' equity section after the distribution is made. (2) Compute the number of shares outstanding after the distribution is made. Complete this question by entering your answers in…arrow_forwardcan you answer darrow_forwardAssistarrow_forward

- 5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardD nctions Question 10 Use the diagram below to find each of the following: sine of point a • cose of point b • tane of point c d earrow_forwardⒸ O D O H < UB Unblockit - Proxies to acce X C Solved P11-1A Gão Limited X b Home | bartleby C (4) How to study fo... Dropbox- 1st B.tec... (10) Lil Jaico - Toma Dropbox - 1st B.tec... (10) Lil Would you like to make Opera GX your everyday browser? How do I do that? www.chegg.com/homework-help/questions-and-answers/journalize-transactions-b-post-equity-accounts-use-j5-posting-refrence-c-prepare-share-cap-q90903484 Jaico-Toma (17) Liverpool reacti... (1) How To Study fo... (6) HABITS of SUCC... AMARIA BB - Slow... Type here to search MARM O x + Chegg Books Jan. 10 Mar. 1 Apr. 1 May 1 Aug. 1 Sept. 1 Nov. 1 Study Career Find solutions for your homework business/accounting / accounting questions and answers/p11-1a gão limited was organized on january 1, 2017, it is... Question: P11-1A Gão Limited Was Organized On January 1, 2017. It Is Authorized To Issue 10,000 8%, HK$1,000 Par Value Preference Share... P11-1A Gão Limited was organized on January 1, 2017. It is authorized to issue 10,000…arrow_forward

- J 7 Choose from list of answer choices and show/explain work.arrow_forward合日 Document1 Q. Search in Document Home Insert Draw Design Layout References Mailings Review View + Share a A. A- E -E - E , E E Times New R... - AaBbCcDc AaBbCcDdEe AaBb( AabbCcDdEe AaBbCcDdEe AaBbCcDdEe AgBbCcDdEe AgBbCcDdEe Paste в I U - abe X, x2 Normal Heading 1 Subtle Emph.. Emphasis Styles Pane No Spacing Heading 2 Title Subtitle You are considering opening your own restaurant. To do so, you will have to quit your current job, which pays $46k per year, and cash in your life savings of $200k, which have been in a certificate of deposit paying 6% per year. You will need this $200k to purchase equipment for your restaurant operations. You estimate that you will have to spend $4k during the year to maintain the equipment so as to preserve its market value at $200k. Fortunately, you own a building suitable for the restaurant. You currently rent out this building on a month-by-month basis for $2,500 per month. You anticipate that you will spend $50k for food, $40k for extra help, and…arrow_forwardmyedio.com Question 12 Listen Use the function f(x)=2x-5 • Find the inverse of f(x). . . Graph f(x) and f(x) and state the domain of each function. Prove that f(x) and f¹(x) are inverses, both graphically and algebraically. ATTACHMENTS W Algebra2 U9 UnitTest_Q17 docx 146.32 KBarrow_forward

- need help with question 6arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardTopic: Uni X U2_AS i Topic: Uni X M Question X M Question x M Question √x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% 253A%252F%252Flms.mheducation.com%252Fmghmiddle Complete this question by entering your answers in the tabs below. Required 1 Required 2 F2 Moab Incorporated manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year. a. Moab Incorporated sold a machine that it used to make computerized gadgets for $30,600 cash. It originally bought the machine for $21,400 three years ago and has taken $8,000 in depreciation. b. Moab Incorporated held stock in ABC Corporation, which had a value of $23,000 at the beginning of the year. That same stock had a value of $26,230 at the end of the year. c. Moab Incorporated sold some of its inventory for $9,200…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education