Concept explainers

Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Tamarisk Company. The following information relates to this agreement.

| 1. | The term of the non-cancelable lease is 3 years with no renewal option. The equipment has an estimated economic life of 5 years. | |

| 2. | The fair value of the asset at January 1, 2020, is $85,000. | |

| 3. | The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $5,000, none of which is guaranteed. | |

| 4. | The agreement requires equal annual rental payments of $27,911 to the lessor, beginning on January 1, 2020. | |

| 5. | The lessee’s incremental borrowing rate is 5%. The lessor’s implicit rate is 4% and is unknown to the lessee. | |

| 6. | Tamarisk uses the straight-line |

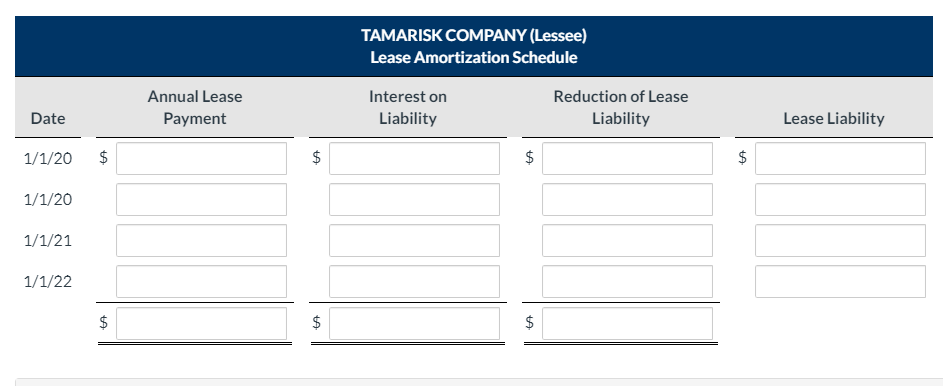

Prepare an amortization schedule that would be suitable for the lessee for the lease term. (Round answers to 0 decimal places, e.g. 5,265.)

|

TAMARISK COMPANY (Lessee)

Lease Amortization Schedule |

||||||||

|---|---|---|---|---|---|---|---|---|

|

Date

|

Annual Lease

Payment |

Interest on

Liability |

Reduction of Lease

Liability |

Lease Liability

|

||||

|

1/1/20

|

$enter a dollar amount

|

$enter a dollar amount

|

$enter a dollar amount

|

$enter a dollar amount

|

||||

|

1/1/20

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

||||

|

1/1/21

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

||||

|

1/1/22

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

||||

|

|

$enter a total amount for this column

|

$enter a total amount for this column

|

$enter a total amount for this column

|

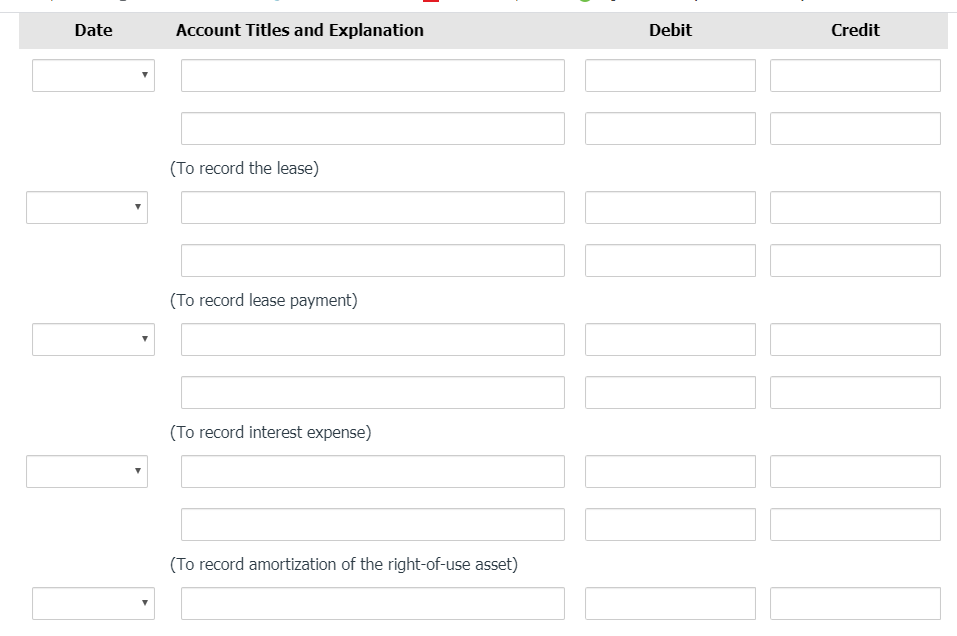

Prepare all of the

|

Date

|

Account Titles and Explanation

|

Debit

|

Credit

|

|

|---|---|---|---|---|

| Enter transaction date | ||||

|

(To record the lease)

|

||||

|

Enter a transaction date

|

||||

|

(To record lease payment)

|

||||

|

Enter transaction date

|

||||

|

(To record interest expense)

|

||||

|

Enter transaction date

|

||||

|

(To record amortization of the right-of-use asset)

|

||||

|

Enter transaction date

|

||||

|

(To reverse interest expense)

|

||||

|

||||

|

(To record lease payment)

|

||||

|

Enter transaction date

|

||||

|

(To record interest expense)

|

||||

|

Enter transaction date

|

||||

|

(To record amortization of the right-of-use asset)

|

- This is a list of the accounts that can be used:

- Accounts Payable

Accumulated Depreciation -Buildings- Accumulated Depreciation-Leased Buildings

- Accumulated Depreciation-Capital Leases

- Accumulated Depreciation-Equipment

- Accumulated Depreciation-Leased Equipment

- Accumulated Depreciation-Leased Machinery

- Accumulated Depreciation-Machinery

- Accumulated Depreciation-Right-of-Use Asset

- Advertising Expense

- Amortization Expense

- Airplanes

- Buildings

- Cash

- Cost of Goods Sold

- Deferred Gross Profit

- Deposit Liability

- Depreciation Expense

- Equipment

- Executory Costs

- Executory Costs Payable

- Gain on Disposal of Equipment

- Gain on Disposal of Plant Assets

- Gain on Lease

- Gain on Sale of Buildings

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Leased Asset

- Leased Buildings

- Leased Equipment

- Lease Expense

- Leased Land

- Lease Liability

- Lease Receivable

- Lease Revenue

- Legal Expense

- Loss on Capital Lease

- Machinery

- Maintenance and Repairs Expense

- Notes Payable

- Prepaid Lease Executory Costs

- Prepaid Legal Fees

- Property Tax Expense

- Property Tax Payable

- Rent Expense

- Rent Payable

- Rent Receivable

- Rent Revenue

- Revenue from Sale-Leaseback

- Right-of-Use Asset

- Salaries and Wages Expense

- Sales Revenue

- Selling Expenses

- Trucks

- Unearned Profit on Sale-Leaseback

- Unearned Lease Revenue

- Unearned Service Revenue

(The second attached image with the account journalization is missing some of the titles but there are a total of 17 account titles. the text above is probably more accurate in that regard.)

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

- Dineshbhaiarrow_forwardGlaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $525,000, and the fair value of the asset on January 1, 2020, is $700,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $50,000. Jensen estimates that the expected residual value at the end of the lease term will be $50,000. Jensen amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Glaus desires a 5% rate of return on its investments. Jensen's incremental borrowing rate is 6%, and the lessor's implicit rate is unknown. Instructions (Assume the accounting period ends on…arrow_forwardWells Leasing Company signs an agreement on January 1. 2020, to lease equipment to Manchester Company. The following information relates to this agreement. The term of the non-cancellable lease is 6 years with no renewal option. 1. The equipment has an estimated economic life of 6 years. The cost of the asset to the lessor is S250,000. The fair value of the asset at January 1, 2020, is $250,000. The asset will revert to the lessor at the end of the lease term, at which 3. time the asset is expected to have a residual value of $25000, none of which is guaranteed. The agreement requires equal annual rental payments, beginning on 4. January 1, 2020. 5. Collectability of the lease payments by Windsor is probable. A. Assuming the lessor desires a 6o rate of return on its investment, calculate the amount of the annual rental payment required.arrow_forward

- Accounting Questionarrow_forwardSheffield Corporation leases equipment from Falls Company on January 1, 2020. The lease agreement does not transfer ownership, contain a bargain purchase option, and is not a specialized asset. It covers 3 years of the equipment’s 8-year useful life, and the present value of the lease payments is less than 90% of the fair value of the asset leased.Prepare Sheffield’s journal entries on January 1, 2020, and December 31, 2020. Assume the annual lease payment is $44,000 at the beginning of each year, and Sheffield’s incremental borrowing rate is 9%, which is the same as the lessor’s implicit rate. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 0 decimal places, e.g. 5,265. Record journal entries in the order presented in the problem.)Click here to view factor tables. Date Account Titles and Explanation Debit…arrow_forwardplease help me to solve this problemarrow_forward

- Skysong enters into an agreement with Traveler Inc. to lease a car on December 31, 2019. The following information relates to this agreement. 1. The term of the non-cancelable lease is 3 years with no renewal or bargain purchase option. The remaining economic life of the car is 3 years, and it is expected to have no residual value at the end of the lease term. 2. The fair value of the car was $14,100 at commencement of the lease. 3. Annual payments are required to be made on December 31 at the end of each year of the lease, beginning December 31, 2020. The first payment is to be of an amount of $5,148.50, with each payment increasing by a constant rate of 5% from the previous payment (i.e., the second payment will be $5,519.36 and the third and final payment will be $5,795.30). 4. Skysong’ incremental borrowing rate is 8%. The rate implicit in the lease is unknown. 5. Skysong uses straight-line depreciation for all similar cars. (a)Prepare Skysong’ journal…arrow_forwardOn December 31, 2019, Windsor Corporation signed a 5-year, non-cancelable lease for a machine. The terms of the lease called for Windsor to make annual payments of $8.092 at the l an estimated useful life of d and a $4,900 unguar feach year of the lease, starting December 31, 2019. The machine has residual value. The machine reverts back to the lessor at the end of the lease term. Windsor uses the straight-line method of depreciation for all of its plant assets. Windhor's Incremental borrowing rate 15% and the lessor's implicit rate is unknownarrow_forwardBlossom, Inc. leases a piece of equipment to Wildhorse Company on January 1, 2025. The contract stipulates a lease term of 5 years, with equal annual rental payments of $8,880 at the end of each year. Ownership does not transfer at the end of the lease term, there is no bargain purchase option, and the asset is not of a specialized nature. The asset has a fair value of $48,000, a book value of $43,000, and a useful life of 8 years. At the end of the lease term, Blossom expects the residual value of the asset to be $12,000, and this amount is guaranteed by a third party. Assuming Blossom wants to earn a 5% return on the lease and collectibility of the lease payments is probable, record its journal entry at the commencement of the lease on January 1, 2025. (List all debit entries before credit entries. Credit account titles are automaticallyarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education