FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

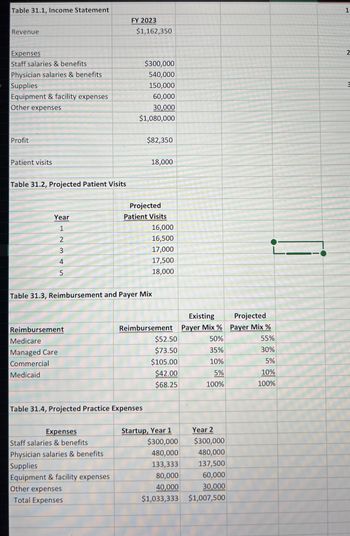

Calculate year 2 net income assuming patient visits increase to 16,500, staff and physician salaries are unchanged, equipment and facility expense decreases by $20,000 , and other expenses decreases by $10,000.

Transcribed Image Text:Table 31.1, Income Statement

Revenue

Expenses

FY 2023

$1,162,350

1

2

Staff salaries & benefits

$300,000

Physician salaries & benefits

540,000

Supplies

150,000

3

Equipment & facility expenses

60,000

Other expenses

30,000

$1,080,000

Profit

$82,350

Patient visits

18,000

Table 31.2, Projected Patient Visits

Year

12345

Projected

Patient Visits

16,000

16,500

17,000

17,500

18,000

Table 31.3, Reimbursement and Payer Mix

Reimbursement

Medicare

Managed Care

Commercial

Medicaid

Existing

Projected

Reimbursement Payer Mix %

Payer Mix %

$52.50

50%

55%

$73.50

35%

30%

$105.00

10%

5%

$42.00

5%

10%

$68.25

100%

100%

Table 31.4, Projected Practice Expenses

Expenses

Startup, Year 1

Year 2

Staff salaries & benefits

$300,000

$300,000

Physician salaries & benefits

480,000

480,000

Supplies

133,333

137,500

Equipment & facility expenses

80,000

60,000

Other expenses

40,000

30,000

Total Expenses

$1,033,333

$1,007,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Projected revenue for year 20X1 is as follows: $823,155 in January, $685,546 in February, $454,050 in March, and $811,904 in April. Historical net revenues categorized by payer: Payer Revenue Percent Medicare 8,931,228 Medicaid 11,906,868 Blue Cross 10,159,306 Private 5,082,192 Total ? Collection patterns by payer: Payer Within 1 Month Within 2 Months Within 3 Months Within 4 Months Total Medicare 18% 26% 28% ? 100% Medicaid 6% 20% 49% ? 100% Blue Cross 11% 43% 26% ? 100% Private 59% 28% 6% ? 100% How much revenue do we expect to collect in total in March? (Do not round intermediate calculations. Round your final answer to 2 decimal places. Omit the "$" sign and commas in your response. For example, $12.3456 should be entered as 12.35.)arrow_forwardMultiple statements. The following are account balances (in thousands) for Lima Health Plan. Prepare (a) a balance sheet and (b) an income statement for the year ended December 31, 20 X0. Givens (in '000s) Income tax benefit of operating loss $ 12,000 Net property and equipment Physician services expense $244,000 Premium revenue $225,000 Marketing expense $21,000 Compensation expense, $15,000 Interest income and other revenue, $9,000 Outside referral expense, $7,000 Medicare revenue, $160,000 Occupancy and depreciation expense $1,000 Medical claims payable, $57,000 Accounts receivable, $1,500 Emergency room expense, $24,000 Inpatient services expense $191, 000 Interest expense $1,000 Medicaid revenue $55,000 Stockholders' equity $71, 700 Cash and cash equivalents $127,000 Long-term debt $2,800 Other administrative expense $1,400arrow_forwardProjected revenue for year 20X1 is as follows: $845,622 in January, $517,629 in February, $528,674 in March, and $847,032 in April. Historical net revenues categorized by payer: Payer Medicare Medicaid Blue Cross Private Payer Revenue Percent Medicare 8,331,224 Medicaid 12,723,238 Blue Cross 10,763,087 Collection patterns by payer: Private Total Within 1 Month 21% 9% 5% 54% 5,527,687 Within 2 Months 33% 17% 40% 30% ? Within 3 Months 35% 48% 36% 5% Within 4 Months Total ? 100% ? 100% ? 100% ? 100% How much revenue do we expect to collect in total in March? (Doarrow_forward

- Using the following information, determine the net operating income NOI. Subject Property Number of apartments 15 Market rent per month. 1000 Vacancy and collection losses 10% of PGI Operating expenses 5% of EGI Capital expenditures 10% of EGIarrow_forwardPenslon data for the Ben Franklin Company Include the following for the current calendar year: Discount rate, 10% Expected return on plan assets, 12% Actual return on plan assets, 11% Service cost, $300,000 January 1: PBO ABO Plan assets Amortization of prior service cost Amortization of net gain December 31: Cash contributions to pension fund Benefit payments to retirees $1,500,000 1,100,000 1,600,000 30,000 5,000 230,000 250,000 Required: 1. Determine pension expense for the year. 2. Prepare the journal entries to record pension expense and funding for the year.arrow_forwardPension plan assets were $340 million at the beginning of the year. The return on plan assets was 5%. At the end of the year, retiree benefits paid by the trustee were $15 million and cash invested in the pension fund was $19 million. What was the amount of the pension plan assets at year-end?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education