ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

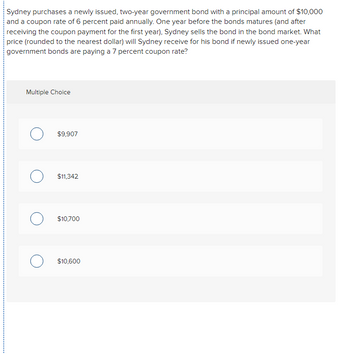

Transcribed Image Text:Sydney purchases a newly issued, two-year government bond with a principal amount of $10,000

and a coupon rate of 6 percent paid annually. One year before the bonds matures (and after

receiving the coupon payment for the first year), Sydney sells the bond in the bond market. What

price (rounded to the nearest dollar) will Sydney receive for his bond if newly issued one-year

government bonds are paying a 7 percent coupon rate?

Multiple Choice

$9,907

$11,342

$10,700

$10,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A corporate bond returns 12 percent of its cost (in present value terms) in the first year, 11 percent in the second year, 10 percent in the third year, and the remainder in the fourth year. What is the bond's duration in years? Please show all the steps including the equation.arrow_forwardRework part (f), assuming that Annie holds the bond for 10 years and sells it when the required return is 7.0%. Compare your finding to that in part (f), and comment on the bond's maturity risk. PV= 1,000 N=10 I/Y= 7% Assume that Annie buys the bond at its current price of $983.80 and holds it until maturity. What will her current yield and yield to maturity (YTM) be, assuming annual interest? After evaluating all of the issues raised above, what recommendation would you give Annie with regard to her proposed investment in the Atilier Industries bonds?arrow_forwardConsider a U.S. Treasury Bill with 270 days to maturity. The face value is $100. If the annual yield is 4.7 percent, what is the price? (Note: Treat 270 days as 9 months, or 9/12 of a year using a 360-day year.)arrow_forward

- How can we determine the real (inflation-free) rate of return for a bond?arrow_forwardIf the current price of a bond is greater than its face value: A) There is no right answer. B) the yield to maturity must be larger than the current yield. C) the coupon rate must be equal to the current yield.arrow_forwardIndicate which one of following statements is true for a coupon bond: A) When the price of a bond is above its par value, the yield to maturity is greater than the coupon rate. B) The yield to maturity and the price of a coupon bond are positively related. C) When the price of a coupon bond equals its face value, the yield to maturity equals the coupon rate. D) When the price of a bond is below its par value, the yield to maturity is less than the coupon rate Support your answer with the use of a formula and explain in detail all the assumptions you make and all the components you use. (You may also want to use a yield calculator to verify you answer).arrow_forward

- You own a 10-acre blueberry farm. You could farm the land yourself or rent it out for $7,000 per year. Another option is to sell the land this year at its current market price of $80,000. The price of the land next year will be $78,000. If you sell it, your group has an investment opportunity from which you expect to make a return of 6 percent per year. What is the opportunity cost to you of using the land to grow blueberries for a year? O a. $2,000 O b. $4,800 OC. $5,000 d. $9,800arrow_forwardConsider a bond with a face value of $2,000 that pays a coupon of $50 for 1 year (that is, you will receive both the face value and one coupon payment next year). Suppose the bond is purchased at $2,000. What is the yield to maturity of the bond? 2.5% 25% 1.025% 1.25%arrow_forwardQuestion 6 Suppose you are interested in buying a one-year 1,000 dirham bond. You have two options available in the bond market: Option 1 - Emirates Airline bond that pays a coupon rate of 4.75% per year paid annually. Option 2 - Emaar bond that pays a coupon rate of 6.0% per year paid annually. If you decide to buy the Emirates Airline bond, which of the prices below will give you a return approximately equal to the Emaar bond? O a. 956.9 dirhams Ob.973.2 dirhams O. 995.2 dirhams Od. 988.2 dirhamsarrow_forward

- Andover Bank and Lowell Bank each sell one-year certificates of deposit (CDs). The interest rates on these CDs are given in the table below for a three-year period. Bank Andover Bank Lowell Bank 2020 2% 5% Suppose you deposit $2,000 in a CD in each bank at the beginning of 2020. At the end of 2020, you take your $2,000 and any interest earned and invest it in a CD for the following year. You do this again at the end of 2021. At the end of 2022, the interest over this three-year period at Andover Bank is $ 2021 2% 5% 2022 11% 5% (Enter your response rounded to the nearest penny.)arrow_forwardEconomics Annual premiums are paid into a 3 year unit linked endowment policy where 98% of each premium is allocated to units in a fund that carries a 3% bid- offer spread and charges management fees of 0.75% of assets at the end of each policy year. The policy has a death benefit of the bid value of units payable at the end of the year of death subject to a minimum of £12,500. The survival benefit is the bid value of units at the end of the term. The life assurance company estimates that expenses are £95 per policy per year. (a) Produce projected revenue accounts for each year of a policy with an annual premium of £5,000 assuming the annual rate of mortality is 0.00498, an investment return of 6.9% per annum and an interest rate on cash balances of 3% per annum. (b) Does the life assurance company meet its internal profit margin objective of 5% on this policy if its risk discount rate is 5.5% per annum?arrow_forwarddo fastarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education