FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

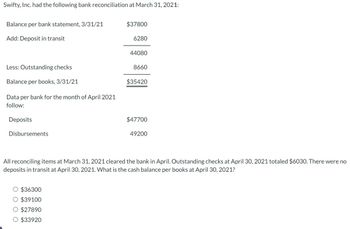

Transcribed Image Text:Swifty, Inc. had the following bank reconciliation at March 31, 2021:

Balance per bank statement, 3/31/21

Add: Deposit in transit

Less: Outstanding checks

Balance per books, 3/31/21

Data per bank for the month of April 2021

follow:

Deposits

Disbursements

$37800

$36300

$39100

$27890

$33920

6280

44080

8660

$35420

$47700

49200

All reconciling items at March 31, 2021 cleared the bank in April. Outstanding checks at April 30, 2021 totaled $6030. There were no

deposits in transit at April 30, 2021. What is the cash balance per books at April 30, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- These data pertain to St. Luke Company as of December 31, 2020: Bank service charge not recorded by St. Luke Bank statement, December 31 Checks outstanding (including certified check of P20,000) Customer note collected by bank for St. Luke Deposit in transit Error made by the bank in recording check issued by St. Lucas Error made by the company in recording check that cleared the bank in December (check was drawn in December for P30,000 but recorded at P80,000) Technically defective checks of customers returned by bank 20,000 4,000,000 500,000 150,000 300,000 40.000 50,000 200,000 What is the cash balance per ledger on December 31, 2020? A. 3,980,000 B. 3,880,000 C. 3,860,000 D. 3,800,000arrow_forwardIn preparing its bank reconciliation for the month of April 2019, Haskins, Inc. has available the following information. Balance per bank statement, 4/30/19 $27,280 NSF check returned with 4/30/19 bank statement 900 Deposits in transit, 4/30/19 7,000 Outstanding checks, 4/30/19 10,400 Bank service charges for April 40 What should be the adjusted cash balance at April 30, 2019? Select one: a. $23,840 b. $23,880 c. $22,980 d. $22,940arrow_forwardAt August 31, Saladino Coffee has the following bank information: cash balance per bank Rp5.200.000, outstanding checks Rp1.462.000, deposits in transit Rp1.211.000, and a bank debit memo Rp110.000. Determine the adjusted cash balance per bank at July 31. Cash balance per bank Rp 5.200.000,00 Add : Deposits in Transit Rp 1.211.000,00 Rp 6.411.000,00 Less Outstanding Checks Rp 1.462.000,00 Adjusted cash balance per bank Rp 4.949.000,00 The information below relates to the Cash account in the ledger of Saladino Coffee Balance Rp 10.094.000 Rp 884.000 Collection of electronic funds transfer Interest earned on checking accounts NSF check: R. Doll Rp 26.000 Rp 245.000 Safety deposit box rent Rp 35.000 Cash balance per books Rp10.094.000 Add: *** ... Less NSF Check Rp245.000 Adjusted cash balance per booksarrow_forward

- Using the following information, prepare the journal entries to reconcile the bank statement. Bank balance: $6,988 • Book balance: $8,866 • Deposits in transit: $1,832 Outstanding checks: $589 and $1,623 • Bank service charges: $50 • Bank incorrectly charged the account $50. The bank will correct the error next month. • Check number 2456 correctly cleared the bank in the amount of $417 but posted in the accounting records as $471. This check was expensed to Utilities Expense. If an amount box does not require an entry, leave it blank.arrow_forward6, 7, A bank reconciliation for October 31 follows. Bank statement balance Add: Deposit in transit Deduct: Outstanding checks Adjusted bank balance View transaction list < 1 2 Note: Enter debits before credits. Date October 31 Bank Reconciliation October 31 Journal entry worksheet Cash $ 6,482 3 291 6,773 79 $ 6,694 Prepare the necessary journal entries based on the bank reconciliation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Book balance Add: 4 Collection of a note Interest earned Deduct: NSF check Bank service charges Adjusted book balance Record the $400 collection of a note receivable by the bank on our behalf. Saved General Journal $ 400 64 Debit 63 61 $ 6,354 Credit 464 6,818 124 $6,694arrow_forwardThe bank reconciliation shows the following adjustments: Outstanding checks: $987 Error by bank recorded customer check twice: $436 Notes receivable collected by bank: $2,500; interest: $145 Deposits in transit: $1,698 Bank charges: $70 PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the adjustments. Using the following accounts: Bank Errors Bank Service Charges Cash Deposits in Transit Interest Expense Interest Income Notes Receivable Outstanding Checks prepare the two correcting journal entries: DR CR and DR CR CR PLEASE NOTE: You must enter the account names exactly as written above and all dollar amounts will be with "$" and commas as needed (i.e. $12,345).arrow_forward

- Given the following information to reconcile GCompany’s cash book balance with its bank statement balance as of July 31, 2021: a. Cheques #296 for $1,334 and #307 for $12,754 were outstanding on the September 30 bank reconciliation. Cheque #307 was returned with the October cancelled cheques, but cheque #296 was not. It was also found that cheque #315 for $893 and cheque #321 for $2,000, both written in July, were not among the cancelled cheques returned with the statement. b. In comparing the cancelled cheques returned by the bank with the entries in the accounting records, it was found that cheque #320 for the July rent was correctly written for $4,090 but was erroneously entered in the accounting records as $4,900. c. Also enclosed with the statement was a $74 debit memo for bank services. It had not been recorded because no previous notification had been received. d. A credit memo enclosed with the bank statement indicated that there was an electronic fund transfer related to a…arrow_forwardPrepare a bank reconciliation from the following information:a. Balance per bank statement as of May 31, $17,755.44b. Balance per books as of May 31, $12,211.94c. Deposits in transit, $2,254.81d. Outstanding checks, $7,819.16e. Bank service charge, $20.85arrow_forwardPlease review the attached files. Thank youarrow_forward

- T. Howard's Cash Book at 2020 September 30 showed debit balance at the bank of $1 024 but the Bank Statement at same date had a credit balance of $262.After comparing the Cash Book with the Bank Statement, the following differences were noted: i. An amount of $142 paid into the bank had not yet appeared on the Statement.ii. Bank interest of $60 in respect of an earlier overdraft had been charged by the bank. iii. Cheques issued for $560 had not been presented for payment.iv. A cheque received for $800 and debited in the Cash Book was returned unpaid by the bank because of lack of funds. v. Funds of $1 120 paid into the bank had been entered in the Cash Book as $1 000.vi. The bank had made a standing order payment for insurance of $480 which had not been recorded in the Cash Book.vii. The bank had received by direct credit transfer a payment of $40 due to Howard from G. Keith. Prepare the following:A. Updated Cash Book of T. Howard.B. Bank Reconciliation Statement as at 2021 September…arrow_forwardNeed answer for this questionarrow_forwardBank Reconciliation and Adjusting Entries (Appendix 6.1) Odum Corporation’s cash account showed a balance of $17,198 on March 31, 2019. The bank statement balance for the same date indicated a balance of $17,924.55. The following additional information is available concerning Odum’s cash balance on March 31: • Undeposited cash on hand on March 31 amounted to $724.50. • A customer’s NSF check for $173.80 was returned with the bank statement. • A note for $2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified Odum of this collection on the bank statement. • The bank service charge for March was $15. • A deposit of $951.75 mailed to the bank on March 31 did not appear on the bank statement. The following checks mailed to creditors had not been processed by the bank on March 31: #429 $57.40 #432 $147.50 #433 $214.80 #434 $191.90 A customer check for $149.50 in payment of his account and listed correctly for that amount on the bank state-ment had…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education