Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

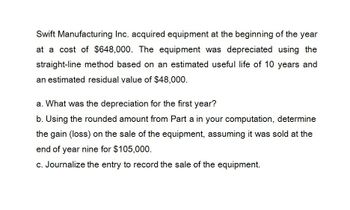

Transcribed Image Text:Swift Manufacturing Inc. acquired equipment at the beginning of the year

at a cost of $648,000. The equipment was depreciated using the

straight-line method based on an estimated useful life of 10 years and

an estimated residual value of $48,000.

a. What was the depreciation for the first year?

b. Using the rounded amount from Part a in your computation, determine

the gain (loss) on the sale of the equipment, assuming it was sold at the

end of year nine for $105,000.

c. Journalize the entry to record the sale of the equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.arrow_forwardAlbany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.arrow_forwardLoban Company purchased four cars for 9,000 each and expects that they will be sold in 3 years for 1,500 each. The company uses group depreciation on a straight-line basis. Required: 1. Prepare journal entries to record the acquisition and the first years depreciation expense. 2. If one of the cars is sold at the beginning of the second year for 7,000, what journal entry is required?arrow_forward

- Assume the same information as in RE11-3, except that Albany Corporation purchased the asset on April 1, Year 1. Calculate the depreciation for Year 1 and Year 2 using the double-declining-balance method. Round to the nearest dollar.arrow_forwardBliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.arrow_forwardA fixed asset with a 5-year estimated useful life is sold during the second year. How would the use of the straight-line method of depreciation instead of the double-declining-balance method of depreciation affect the amount of gain or loss on the sale of the fixed asset?arrow_forward

- When depreciation is recorded each period, what account is debited? a. Depreciation Expense b. Cash c. Accumulated Depreciation d. The fixed asset account involved Use the following information for Multiple-Choice Questions 7-4 through 7-6: Cox Inc. acquired a machine for on January 1, 2019. The machine has a salvage value of $20,000 and a 5-year useful life. Cox expects the machine to run for 15,000 machine hours. The machine was actually used for 4,200 hours in 2019 and 3,450 hours in 2020.arrow_forwardIMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE CALCULATION OF DEPRECIATION On January 1, 20-1, Dans Demolition purchased two jackhammers for 2,500 each with a salvage value of 100 each and estimated useful lives of four years. On January 1, 20-2, a stronger blade to improve performance was installed in Jackhammer A for 800 cash and the compressor was replaced in Jackhammer B for 200 cash. The compressor is expected to extend the life of Jackhammer B one year beyond the original estimate. REQUIRED 1. Using the straight-line method, prepare general journal entries for depreciation on December 31, 20-1, for Jackhammers A and B. 2. Enter the transactions for January 20-2 in a general journal. 3. Assuming no other additions, improvements, or replacements, calculate the depreciation expense for each jackhammer for 20-2 through 20-4.arrow_forwardEquipment was acquired at the beginning of the year at a cost of $612,500. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $44,360. a. What was the depreciation for the first year? Round your answer to the nearest cent. 63,127 b. Using the rounded amount from Part a in your computation, determine the gain(loss) on the sale of the equipment, assuming it was sold at the end of year eight for $102,987. Round your answer to the nearest cent and enter as a positive amount. $4,517 Loss c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent.arrow_forward

- Equipment was acquired at the beginning of the year at a cost of $79,140. The equipment was depreciated using the straight-line method based on an estimated useful life of six years and an estimated residual value of $7,920. a. What was the depreciation expense for the first year?$ b. Assuming the equipment was sold at the end of the second year for $59,800, determine the gain or loss on sale of the equipment.$ c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank.arrow_forwardEquipment was acquired at the beginning of the year at a cost of $79,200. The equipment was depreciated using the straight-line method based on an estimated useful life of six years and an estimated residual value of $7,860. a. What was the depreciation expense for the first year? $ b. Assuming the equipment was sold at the end of the second year for $59,900, determine the gain or loss on sale of the equipment. c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Accounts Payable Accumulated Depreciation Cash Gain on Sale of Equipment Loss on Sale of Equipmentarrow_forwardEquipment was acquired at the beginning of the year at a cost of $75,720. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,920. Required: a. What was the depreciation expense for the first year? b. Assuming the equipment was sold at the end of the second year for $57,370, determine the gain or loss on sale of the equipment. c. Journalize the entry to record the sale. Refer to the Chart of Accounts for exact wording of account titles. Chart of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Inventory 117 Supplies 119 Prepaid Insurance 120 Land 121 Equipment 122 Accumulated Depreciation 132 Goodwill 133 Patents LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,