ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

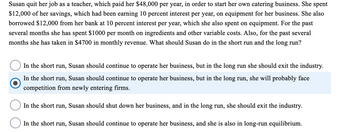

Transcribed Image Text:Susan quit her job as a teacher, which paid her $48,000 per year, in order to start her own catering business. She spent

$12,000 of her savings, which had been earning 10 percent interest per year, on equipment for her business. She also

borrowed $12,000 from her bank at 10 percent interest per year, which she also spent on equipment. For the past

several months she has spent $1000 per month on ingredients and other variable costs. Also, for the past several

months she has taken in $4700 in monthly revenue. What should Susan do in the short run and the long run?

In the short run, Susan should continue to operate her business, but in the long run she should exit the industry.

In the short run, Susan should continue to operate her business, but in the long run, she will probably face

competition from newly entering firms.

In the short run, Susan should shut down her business, and in the long run, she should exit the industry.

In the short run, Susan should continue to operate her business, and she is also in long-run equilibrium.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Average Fixed cost Average Variable Cost Average Total Cost Output 0 1 $ 180.00 $ 135.00 $ 315.00 2 $ 90.00 $ 127.50 $ 217.50 3 $ 60.00 $ 120.00 $ 180.00 4 $ 45.00 $ 112.50 $ 157.50 5 $ 36.00 $ 111.00 $ 147.00 6 $ 30.00 $ 112.50 $ 142.50 7 $ 25.71 $ 115.70 $ 141.41 8 $ 22.50 $ 121.90 $ 144.40 9 $ 20.00 $ 130.00 $ 150.00 10 $ 18.00 $ 139.50 $ 157.50 Table 1-a (continued) Marginal Cost Price Total Revenue Marginal Revenue Output 0 $ 345.00 1 $ 300.00 2 $ 249.00 3 $ 213.00 4 $ 189.00 5 $ 165.00 6 $ 144.00 7 $ 126.00 8 $ 111.00 9 $…arrow_forwardSally Statistics is implementing a system of statistical process control (SPC) charts in her factory in an effort to reduce the overall cost of scrapped product. The current cost of scrap is $X per month. If a 75% learning curve is expected in the use of the SPC charts to reduce the cost of scrap, what would the percentage reduction in monthly scrap cost be after the charts have been used for 6 months? (Hint: Model each month as a unit of production.)arrow_forwardSuppose that the production function takes the form X = min(10L, 5K) and that a competitive firm faces a wage rate of £60 per week and a weekly capital rental of £32. (a) How much must the firm spend to produce 100 units of output, and what is the average cost of production when X = 100? (b) What is the incremental cost of producing the 101st unit of output? (c) What happens to the cost of producing 100 units of output if the wage rate and the rental cost of capital rise by 25 per cent each? What happens to the average and marginal cost? (d) What happens to the cost of producing 100 units of output if the wage rate increases by £1, or if the cost of capital increases by £1?arrow_forward

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education