Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

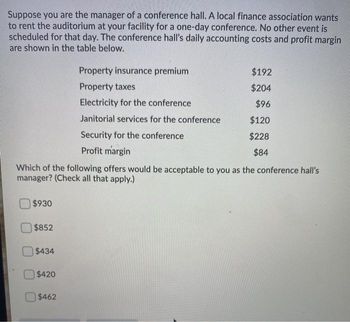

Transcribed Image Text:Suppose you are the manager of a conference hall. A local finance association wants

to rent the auditorium at your facility for a one-day conference. No other event is

scheduled for that day. The conference hall's daily accounting costs and profit margin

are shown in the table below.

$930

Which of the following offers would be acceptable to you as the conference hall's

manager? (Check all that apply.)

$852

$434

$420

Property insurance premium

Property taxes

Electricity for the conference

Janitorial services for the conference

Security for the conference

Profit margin

$462

$192

$204

$96

$120

$228

$84

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- REFLECTING Should Jill consider a payday loan to purchase the refrigerator? Explain. Hint APR means annual percent rate. 2. Jill is buying a new refrigerator. She cannot afford to pay cash. Should she use a credit card or get a personal loan? Justify your answer. 3. Liam, a taxi driver in Revelstoke, wants to buy a new taxi. He was approved for the loans in this chart. a) What should Liam think about when he chooses a loan? should Choose the Lost Fixed APR payments for 4 Apprenticeship and Workplace 11 secured personal 5.5% loan auto loan 7.5% b) Which loan should Liam choose? Explain why. 4 yr 6 yr 4. Hannah says that using payday loans and cash advances on credit cards are bad choices for borrowing money. Do you agree or disagree? Explain. NELarrow_forwardYou want to buy a used car but don't have enough money to purchase it outright. Your parents suggest that you check around at local banks, credit unions, and savings and loans to compare the interest rate on a 36-month $2,000 loan for an older used car. Please Answer the following questions: 1. What is the lowest interest rate that is being charged to borrow money for a used car at a bank, credit union, and savings and loan? Include the interest rate and the name of the institution offering the loan. 2. Of the three options(local banks, credit unions, and savings and loans), which location has the lowest interest rate for a loan?arrow_forwardCould you please solve these questions?arrow_forward

- Many of you will some day own your own business. One rapidly growing opportunity is no-frills workout centers. Such centers attract customers who want to take advantage of state-of-the-art fitness equipment but do not need the other amenities of full-service health clubs. One way to own your own fitness business is to buy a franchise. Snap Fitness is a Minnesota-based business that offers franchise opportunities. For a very low monthly fee ($26, without an annual contract), customers can access a Snap Fitness center 24 hours a day. The Snap Fitness website indicates that start-up costs range from $60,000 to $184,000. This initial investment covers the following pre-opening costs: franchise fee, grand opening marketing, leasehold improvements, utility/rent deposits, and training. Suppose that Snap Fitness estimates that each location incurs $4,000 per month in fixed operating expenses plus $1,460 to lease equipment. A recent newspaper article describing no-frills fitness centers…arrow_forwardOwners of a new restaurant have found numerous costs associated with starting their business (see table). They financed the total of these costs with end-of-month payments through a loan from the bank at {E}compounded {F}, amortized over {G} years. 1. What is the size of the monthly payments required to settle this loan? 2. What is the principal balance outstanding on the loan after one year? 3. What is the size of the final payment? 4. Construct a partial amortization schedule for this loan.arrow_forwardThe company eHarbour is expanding and needs to hire new employees for new software development in other regions, but the company is having a hard time finding good employees to fill positions. In your role as a paralegal or legal assistant working for eHarbour, discuss what type of visa programs exist to allow foreign workers to fill specialty occupations. Discuss what types of positions at eHarbour could qualify for the visa program. Discuss the advantages and disadvantages of sponsoring a visa program for employees. How can bringing in employees born outside the United States add value to the company? What can current employees and the owners of eHarbour do to make foreign employees feel included?arrow_forward

- You run a nail salon. Fixed monthly cost is $5,102.00 for rent and utilities, $5,992.00 is spent in salaries and $1,613.00 in insurance. Also every customer requires approximately $3.00 in supplies. You charge $90.00 on average for each service. You are considering moving the salon to an upscale neighborhood where the rent and utilities will increase to $11,786.00, salaries to $6,735.00 and insurance to $2,228.00 per month. Cost of supplies will increase to $7.00 per service. However you can now charge $167.00 per service. What is the PROFIT or Loss at the crossover point? If a loss include the - Round the quantity to 3 digits when using to calculate the profit Submit Answer format: Number: Round to: 2 decimal places.arrow_forwardScenario: Joe Babbitt, a former executive of T-Mart, just started a term as mayor of Saulk Center. For the past several days, he has been looking for a way to keep his campaign promise to increase services without raising taxes or service charges. While lunching at the country club with the treasurer of T-Mart, the subject of a recent sale and leaseback of one of T-Mart’s stores came up. Following a common practice in retailing, T-Mart had erected a building and sold it to an investor. It then signed a long-term lease on the building. “Bingo! That’s it,” thought Mayor Babbitt. “We can sell several of the city’s buildings—as well as police cars, fire engines, and other vehicles—to investors and lease them back. That will give us the revenues we desperately need. Now I can concentrate on fighting crime.” Question: Do you agree with Mayor Babbitt?arrow_forwardSuppose that a local airport is near a residential neighborhood. To land at this airport, an airliner must pay $119. To soundproof the local homes, so residents do not hear airplanes all hours of the day, residents must pay $33. What is the private cost for a plane to land at this airport? A What is the external cost of a plane landing at the airport? - What is the social cost of a plane landing at the airport? -arrow_forward

- I.M. Aruban has a sandwich shop in a downtown business district. Several ofhis customers have said that they would purchase from his shop more oftenif he offered a delivery service. I.M. is considering establishing a deliveryservice to meet the needs of his market. He believes that he will have to purchasea fax machine, install a new phone line for the fax machine, purchasea delivery van, and hire at least one delivery person. I.M. asks your advice indetermining whether he should take on the delivery service venture.a. What steps would you recommend that I.M. use in reaching a profitabledecision?b. Explain to I.M. what each step involves.arrow_forwardWhat finances do you need to have to achieve getting somewhere with Cosmetology? For instance to build your own salon?arrow_forwardA country club wants to exam the effects of a new marketing campaign that attempts to get more people within the community to become members. In many communities, when people buy a house in the area, they receive a “Welcome Wagon” gift basket containing coupons to local restaurants. The idea of the marketing campaign is to include a free two month membership to the country club in the gift basket with the hope that once “new” residents try the country club then at least a certain proportion will want to become real members. One member of the Club’s Executive Council believes that at least 81% of the people who receive the coupons for the free membership will use the coupon. In a sample of 192 new residents who received the coupon for the two month free membership, there were 138 people who actually took advantage of the free two month membership. When testing the hypothesis that at least 81% of the people that receive the coupon actually use it, what is the test statistic?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education