ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Math 3

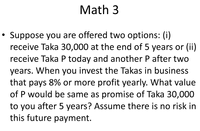

Suppose you are offered two options: (i)

receive Taka 30,000 at the end of 5 years or (ii)

receive Taka P today and another P after two

years. When you invest the Takas in business

that pays 8% or more profit yearly. What value

of P would be same as promise of Taka 30,000

to you after 5 years? Assume there is no risk in

this future payment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 2 1. You need $30,000 to buy a new Air-Con for your house in 4 years. What value you must have now if the compounded annually return is 10%. 2. Your father placed $50,000 in a trust fund for you. In 12 years what will be the worth of the savings. If the estimated rate of return on the trust fund is 7%?arrow_forwardEngineering economicsarrow_forwardBond Valuation with Annual Payments Jackson Corporation's bonds have 5 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 8.5%. The bonds have a yield to maturity of 11%. What is the current market price of these bonds? Round your answer to the nearest cent.?arrow_forward

- Q1. How much will a $65,000 investment today be worth in 8 years if it earns 6% annual compound interest?arrow_forward2.5 To purchase a new truck, you borrow $42,000. The bank offers an interest rate of 7.5% compounded monthly. If you take a 5-year loan and you will be making monthly payments, what is the total amount that must be paid back? a. What is the number of time periods (n) you should use in solving this problem? b. What rate of interest (i), per period of time, should be used in solving this problem?arrow_forwardDown payment Annual payments Years Discount rate plan A 1.297.19 5.342.38 20 12% What is the present value of plan B? plan 8 2.869.46 7.761.18 20 12% $278.29 9.449.95 20 12%arrow_forward

- ECONOMICS UPVOTE WILL BE GIVEN. PLEASE WRITE THE SOLUTIONS LEGIBLY. NO LONG EXPLANATION NEEDED. Shala Co. is making a decision about investing in new technology. It currently expects to earn Php 100,000,000 in its lifetime. If it invests in brand-new equipment today, its expected earnings will permanently increase by 5% per day. What is the expected value of investing in the new equipment?arrow_forwardKevin invested part of his $5000 bonus in a certificate of deposit (CD) that paid 2% annual simple interest, and the remainder in a mutual fund that paid 4% annual simple interest. If his total interest for that year was $140.00, how much did Kevin invest in the mutual fund? Group of answer choices Kevin invested $4986.00 in the mutal fund. Kevin invested $4846.00 in the mutal fund. Kevin invested $2000.00 in the mutal fund. Kevin invested $2140.00 in the mutal fund.arrow_forwardA $1000 face-value coupon bond has a current yield of 5.75% and a market price of $1060. What is the bond’s coupon rate?arrow_forward

- 1. Engr. Dela Cruz, the buyer of a certain equipment may pay either in 4,000.00 cash down paymentand 2,000.00 annually for the next 6 years, or pay 5,000.00 cash down payment and 2,000.00 annuallyfor the next 5 years. A.) What type of annuity are the options of Engr. Dela Cruz?B.) If money is worth 12% compounded annually, which method of payment is better for Engr.Dela Cruz and how much?arrow_forwardQ3arrow_forwardOrdinary annuity payment. Fill in the missing annuity in the following table for an ordinary annuity stream: Number of Payments or Years 6 21 33 15 Annual Interest Rate 9% 4% 6% 10% Future Value $0.00 $24,000.00 $0.00 $98,433.34 Annuity (Round to the nearest cent.) $ (Round to the nearest cent.) $(Round to the nearest cent.) (Round to the nearest cent.) Present Value $24,000.00 $0.00 $150,000.00 $0.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education