Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Ff.54.

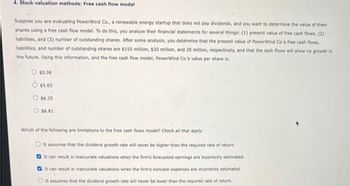

Transcribed Image Text:4. Stock valuation methods: Free cash flow model

Suppose you are evaluating PowerWind Co., a renewable energy startup that does not pay dividends, and you want to determine the value of their

shares using a free cash flow model. To do this, you analyze their financial statements for several things: (1) present value of free cash flows, (2)

liabilities, and (3) number of outstanding shares. After some analysis, you determine that the present value of Power Wind Co.'s free cash flows,

liabilities, and number of outstanding shares are $155 million, $30 million, and 20 million, respectively, and that the cash flows will show no growth in

the future. Using this information, and the free cash flow model, PowerWind Co.'s value per share is:

$5.06

$5.63

$6.25

$6.81

Which of the following are limitations to the free cash flows model? Check all that apply.

It assumes that the dividend growth rate will never be higher than the required rate of return.

It can result in inaccurate valuations when the firm's forecasted earnings are incorrectly estimated.

It can result in inaccurate valuations when the firm's noncash expenses are incorrectly estimated.

It assumes that the dividend growth rate will never be lower than the required rate of return.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Determine the range of the following set of values. 48 42 55 28 112 79 95 27 36 14 96 193 191arrow_forwardOther than 1040, what other forms need to be completed?arrow_forwardSean and Jenny own a home in Boulder City, Nevada, near Lake Mead. During the year, they rented the house for 40 days for $3,200 and used it for personal use for 18 days. The house remained vacant for the remainder of the year. The expenses for the house included $14,150 in mortgage interest, $3,560 in property taxes, $1,200 in utilities, $1,340 in maintenance, and $11,000 in depreciation. What is the deductible net loss for the rental of their home (without considering the passive loss limitation)? Use the Tax Court method for allocation of expenses.arrow_forward

- FV(Quar.) = $100(1.03)20 = $arrow_forward9. What is the capital balance of Tak at December 31, 20x2? 28 A a. P180,000 b. P170,000 c. P165,000 d. Not given SIXOS mot and 100 to stile si 10. What is the capital balance of Gu at December 31, 20x2? a. P220,000 b. P215,000 c. P200,000 d. Not given 007 0902 3 nevig Vo ordub juongoro att mi to side odd ei four we 17 000.08 I s 000.079 000/03/1 8arrow_forwarder 31, 2020 al analysis encil only, ennies blank aper properly. lines asarrow_forward

- Hansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forwardThe answer is 1,130.55arrow_forwardNow, assume that the state of the limit order book is as follows just before the call of CBA's opening call auction: Buy Quantity Price $8.08 $8.01 $7.99 $7.96 $7.91 $7.87 $7.84 $7.82 0 0 0 a. $7.96 O b. $8.01 O c. Other O d. $7.99 e. $7.91 1800 800 1100 1900 800 Sell Quantity 1600 1800 1200 0 0 0 0 If no more orders are entered, the call price would be:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education