FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

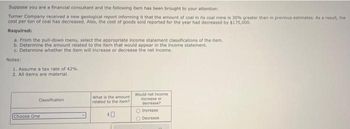

Transcribed Image Text:Suppose you are a financial consultant and the following item has been brought to your attention:

Turner Company received a new geological report informing it that the amount of coal in its coal mine is 30% greater than in previous estimates. As a result, the

cost per ton of coal has decreased. Also, the cost of goods sold reported for the year had decreased by $175,000.

Required:

a. From the pull-down menu, select the appropriate income statement classifications of the item.

b. Determine the amount related to the item that would appear in the income statement.

c. Determine whether the item will increase or decrease the net income.

Notes:

1. Assume a tax rate of 42%

2. All items are material.

Classification

What is the amount

related to the item?

Would net income

increase or

decrease?

O Increase i

Choose One

$0

O Decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help to determine the following; 3. For P & B Manufacturing to asses their asset management I need help to calculate the average collection period (assuming all sales are on account) AND the average sale period (use 365 days in a year). Include calculations and round answers to 2 decimal places.arrow_forwardA family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector Industry. Supply the missing data in the table below: (Loss amounts should be Indicated by a minus sign. Do not round your Intermediate calculations.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ Company A 390,000 168,000 16 % 17 % Company B $ 800,000 $ 54,000 $ 20 % 46,000 % S S S Company C 550,000 148,000 % 11 % 7,000arrow_forwardA family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Do not round your intermediate calculations.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ Company A 480,000 156,000 21 % 18 % Company B $ 740,000 GA GA $ 53,000 $ 69 18 % 54.000 % $ $ $ Company C 520,000 155,000 % 12 % 5,000arrow_forward

- In its income statement for the year ended December 31, 2020, Cheyenne Corp. reported the following condensed data. Operating expenses Cost of goods sold Interest expense (a) $753,390 1,293,700 72,600 V V > M Interest revenue eTextbook and Media Loss on disposal of plant assets Net sales Other comprehensive income Prepare a multiple-step income statement. (List other revenues before other expenses. If there is a net loss then enter the amount using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Cheyenne Corp. Income Statement For the Year Ended December 31, 2020 $ 30,920 $ 16,420 2.404.800 6.970 $arrow_forwardI want the Correct answer in text Formatarrow_forwardA family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Round your percentage answers to nearest whole percent and other amounts to whole dollars.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ A 470,000 160,000 15 % 16 % $ $ $ Company B 680,000 43,000 19 % 57,000 % C $ 560,000 $ 145,000 $ % 10 % 5,000arrow_forward

- The following information is available for Reynolds Corporation: Retained Earnings, December 31, 2020 $1,500,000 Profit for the year ended December 31, 2021 250,000 The company accountant, in preparing financial statements for the year ending December 31, 2021, has discovered the following information:The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2019 and 2020 using the double diminishing-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effect of the error on prior years was $9,000. Depreciation was calculated by the straight-line method in 2021. Reynolds' average tax rate is 22%. During 2021, Reynolds declared and paid cash dividends of $80,000.Instructions a)Calculate the impact on retained earnings. b)Prepare the statement of retained earnings for 2021. Please don't provide solution in an image format thank youarrow_forwardSaharrow_forwardIn its income statement for the year ended December 31, 2025, Cullumber Company reported the following condensed data Salaries and wages expenses $492,900 Cost of goods sold 808,930 Interest expense Interest revenue Depreciation expense (a) - 75,260 68,900 334,800 Your answer is partially correct. Loss on disposal of plant assets Sales revenue Income tax expense Sales discounts Utilities expense $68,900 2,142,600 Prepare a multiple-step income statement. (List other revenues before other expenses.) 26,250 169,600 116,600arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education