Microeconomic Theory

12th Edition

ISBN: 9781337517942

Author: NICHOLSON

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

the answer IS NOT A)

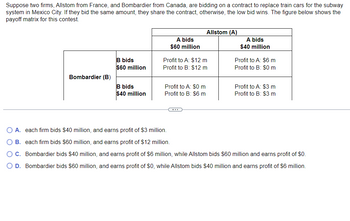

Transcribed Image Text:Suppose two firms, Allstom from France, and Bombardier from Canada, are bidding on a contract to replace train cars for the subway

system in Mexico City. If they bid the same amount, they share the contract, otherwise, the low bid wins. The figure below shows the

payoff matrix for this contest.

Bombardier (B)

B bids

$60 million

B bids

$40 million

A bids

$60 million

Profit to A: $12 m

Profit to B: $12 m

Profit to A: $0 m

Profit to B: $6 m

Allstom (A)

C

A bids

$40 million

Profit to A: $6 m

Profit to B: $0 m

Profit to A: $3 m

Profit to B: $3 m

O A. each firm bids $40 million, and earns profit of $3 million.

B. each firm bids $60 million, and earns profit of $12 million.

O C. Bombardier bids $40 million, and earns profit of $6 million, while Allstom bids $60 million and earns profit of $0.

O D. Bombardier bids $60 million, and earns profit of $0, while Allstom bids $40 million and earns profit of $6 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Does each individual in a prisoners dilemma benefit more from cooperation or from pursuing self-interest? Explain briefly.arrow_forwardJane and Bill are apprehended for a bank robbery. They are taken into separate rooms and questioned by the police about their involvement in the crime. The police tell them each that if they confess and turn the other person in, they will receive a fighter sentence. If they both confess, they will be each be sentenced to 30 years. If neither confesses, they will each receive a 20-year sentence. If only one confesses, the they will receive 15 years and the one who stayed silent will receive 35 years. Table 10.7 below represents the choices available to Jane and Bill. If Jane trusts Bill to stay silent, what should she do? If Jane thinks that Bill will confess, what should she do? Does Jane have a dominant strategy? Does Bill have a dominant strategy? A = Confess; B = Stay Silent. (Each results entry lists Janes sentence first (in years), and Bills sentence second.)arrow_forward

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:Cengage Learning

Principles of Microeconomics

Economics

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:Cengage Learning