ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

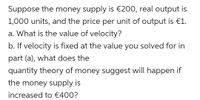

Transcribed Image Text:Suppose the money supply is €200, real output is

1,000 units, and the price per unit of output is €1.

a. What is the value of velocity?

b. If velocity is fixed at the value you solved for in

part (a), what does the

quantity theory of money suggest will happen if

the money supply is

increased to €400?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- QUESTION THREE Assuming a constant velocity of money while the money supply is growing 10% per year, real GDP is growing at 4% per year, and the real interest rate is r = 8%. Assume that actual Inflation is equal to expected inflation. a) Find the value of the nominal interest rate in this economy b) If the central bank increases the money growth rate by 4% per year, find the change in the nominal interest rate Ai C) Suppose the growth rate of Y falls to 2% per year. What will happen to inflation? What must the central bank do if it wishes to keep inflation constant?arrow_forward4 According to the simple Quantity Theory of Money, if velocity is constant and real GDP grows by 2% per year, then money supply growth of 3% per year generates an output gap of 1% an inflation rate of 1% an unemployment rate of 1% an interest rate of 1%arrow_forwardVelocity of Money in the United States. Using the Federal Reserve Bank of St. Louis Web site (www. research.stlouisfed.org/fred2), calculate the velocity of M1 and M2 in 1960 and 2000. How have they changed?arrow_forward

- Consider the following data for the United States: On October 01, 2020, M1 was $17,609 billion, the price level was 1.144, and real GDP was $18,794 billion in base-year dollars. *Real-time data provided by Federal Reserve Economic Data (FRED), Federal Reserve Bank of Saint Louis. Using the information provided above, the income velocity of money was (Enter your response rounded to two decimal places.)arrow_forwardAttempt the following multiple choice questions: 1. The velocity of money represents: (a) Whether individuals are increasing or decreasing the quantity of money spent in an economy (b) The quantity of money available in an economy (c) The level of prices determined by the equation of exchange (d) How often money is used in a specific period of time (e) Whether currency is accepted as a medium of exchange in an economy 2. According to the quantity theory of money, (a) Increases in the money supply will lead to inflation, ceteris paribus (b) The level of inflation is independent of the money supply (c) The money supply times the velocity equals the real GDP (d) When real GDP rises, the money supply must fall by the same proportion (e) The velocity of money is assumed to fluctuate widely over time 3. Monetarists differ from Classical economists in their view of money in that monetarists believe: (a) The velocity of money is relatively constant over time (b) Prices are not influenced by…arrow_forwardSuppose the money supply M has been growing at 19% per year and nominal GDP, PY, has been growing at 77% per year. The data are as follows (in billions of dollars). M PY V 2021 400 4000 2022 476 7080 2023 566.44 12,532 Calculate the velocity V in each year. (Fill in the table above, rounding to one decimal place.) Velocity is growing at an approximate rate of % per year. (Round to the nearest whole number.)arrow_forward

- Suppose that the Price level = 120, Supply of Money = $20 billion, and Real GDP = $4 billion. If the velocity of the money stays the same but Real GDP increases by 5%, what will happen to the price level if the supply of money increases by $5 billion? Select one: a. It will increase to 142.9 b. It will increase to 135.4 c. It will increase to 128.5 d. It will increase to 122.5 e. It will stay 120. These changes are offsettingarrow_forwardIf M 1,000, P = 2, and Y = 4,000, what is velocity? = 1/2 1/4 8arrow_forwardDo not type in dollar signs or round any of your answers. In year one, the money supply (M) is equal to 500, the velocity of money (V) is 5, and the price level is 1.0. According to the equation of exchange, in year 1, nominal and real GDP are both equal to In year 2, the money supply is increased to 530.4 and velocity is unchanged. If the economy grew at the rate of 4 percent, real GDP in year 2 is equal to while nominal GDP in year 2 is equal to As a result of the Fed's decision to increase the money supply from 500 to 530.4, the price level rose from 1.0 to indicating that the inflation rate was percent.arrow_forward

- If a country increases its money supply by 2%, and its nominal GDP increases by 3%, what can you say about what happened to the velocity of money in this country? Group of answer choices A) It decreased. B) None of the other options. C) It did not change. D) We cannot tell which way it changed. E) It increased.arrow_forwardIn Canada during 2020, GDP grew slowly, while M1+ grew by 28%, its highest level since October 1985. a) Using the Quantity Equation, and assuming the velocity of money is stable, show the impact of an increase in the Money Supply. b) List and describe the costs of inflation.arrow_forwardIf real GDP equals 7,000, nominal GDP equals 14,000, and the price level equals 2, then what is velocity if the money stock equals 3,500?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education