ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

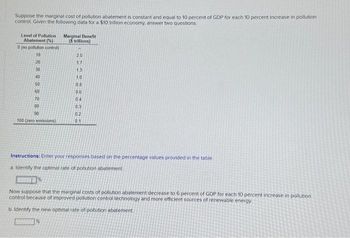

Transcribed Image Text:Suppose the marginal cost of pollution abatement is constant and equal to 10 percent of GDP for each 10 percent increase in pollution

control Given the following data for a $10 trillion economy, answer two questions,

Level of Pollution

Abatement (%)

0 (no pollution control)

10

20

30

40

50

60

70

80

90

100 (zero emissions)

Marginal Benefit

($ trillions)

2.0

1.7

1.3

1.0

08

06

04

03

02

0.1

Instructions: Enter your responses based on the percentage values provided in the table

a. Identify the optimal rate of pollution abatement

Now suppose that the marginal costs of pollution abatement decrease to 6 percent of GDP for each 10 percent increase in pollution

control because of improved pollution control technology and more efficient sources of renewable energy

b. Identify the new optimal rate of pollution abatement

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Provide a reason why the marginal damages from some emissions may be increasing with the level of emissions (like in the figure above). Suppose the unregulated level of emissions is E3. What area(s) represent the total damages from unregulated emissions? Suppose emissions levels drop from E3 to E1. What area(s) represent the total benefits from the emissions reduction from E3 to E1? What point denotes the marginal damage from emissions at E2?arrow_forwardFor the following statement given below, indicate whether you tend to agree, disagree, or are uncertain about the truth of the statement, and explain your reasoning. Graphical analysis is encouraged. "A free market will product too much output when negative externalities exist and to0 little output if positive externalities exist."arrow_forwardNo hand written solution Afirm has an industrial plant that emits pollutants into a town’s lake. The plant’s marginal abatement function is MAC= 200 – 0.5E and damages caused by its emissions are given by MD = 2E where emissions are in kg. per day. What is the socially efficient level of emissions from this plant? Illustrate this in a graph. As an incentive to reduce emissions to the socially efficient level, government offers to pay the firm for each kg. of emissions it abates per day from this plant. What subsidy per kg. should the government offer? If the plant abates to the socially efficient level of emissions, what total subsidy payment would the firm receive? Identify the area in your graph. How much better or worse off would the firm be compared to if it did no abating? Identify the area in your graph. What would be the net benefit to society if we pay the firm to reduce the plant’s emissions to the socially efficient level? Identify this area in your graph.arrow_forward

- Consider two firms with the following marginal abatement costs (MAC) as a function of emissions (E): MAC_1 = 12-.5E_1 MAC_2 = 12-E_2, and assume marginal external damages (MED) from the aggregate emissions of both firms (E_Agg = E_1 + E_2) is: MED = (1/3)E_Agg. To achieve the socially efficient level of aggregate emissions (E*_Agg), the government institutes a per unit tax on emissions. The per- unit tax on emissions is $ Answer:arrow_forwardQUESTION 3 Fill in the blanks: pollutants are pollutants for which the environment has little or no absorptive capacity. pollutants are pollutants for which the environment has some absorptive capacity.arrow_forwardTo model the effects of a carbon tax on CO2 emissions, policymakers study the marginal cost of abatement B(x), defined as the cost of increas- ing CO2 reduction from x to x +1 tons (in units of ten thousand tons- Figure 4). Which quantity is represented by the area under the curve over [0, 3] in Figure 4? B(x) ($/ton) 100 75 50+ 25- 1 3 Tons reduced (ten thousands) FIGURE 4 Marginal cost of abatement B(x).arrow_forward

- I Price and cost (thousands of dollars per student) 20 16 12 8 0 200 A) 0 students; 400 students B) 600 students; 600 students C) 400 students; 600 students D) 600 students; 400 students E) 400 students; 400 students S = MC MSB MB 400 600 800 1,000 Quantity (students per year) 35) 35) The figure above shows the market for private elementary school education in Chicago. There is no external cost of private elementary education. If the government does not intervene in this market, the equilibrium number of students being privately educated is and the efficient quantity isarrow_forward1arrow_forwardImagine a firm's marginal abatement cost function with existing technologies is: MAC = 200 - 10E. If the firm adopts new pollution abatement technologies, its marginal abatement cost function will be: MAC = 100 - SE. With a tax on emissions of $20, the benefits of adopting the new technologies equal: Select one: a. $30. b. $20. c. $25. d. $50.arrow_forward

- Oregon legislative committee passes cap-and-trade bill Lawmakers are moving Oregon a step closer to adopting what would be the nation's second economywide carbon pricing scheme. after California. Price and cost (cents per mile) Q 40- S=MC a G Source: Portland Business Journal, May 17, 2019 35 The transportation sector is Oregon's largest contributor to carbon emissions. Under what conditions would Oregon's carbon pricing scheme reduce carbon emissions to the efficient quantity? Use a graph to illustrate your explanation. Show the effects of setting the price of carbon too low and too high. 30- 25 20 15 and permits traded at a The efficient quantity of transportation would be produced if the quantity of permits was set such that, price OA. marginal private cost of transportation equals marginal benefit, above marginal external cost B. marginal social cost of transportation equals marginal benefit, equal to marginal external cost OC. marginal social cost of transportation equals marginal…arrow_forwardThe marginal private cost of fertilizer production is MPC = 40 + Q, where Q is the amount of fertilizer produced. The marginal benefit (both private and social) of fertilizer is MB = 340 – 4Q. In addition to the private costs faced by producers of fertilizer, people who walk or drive past the area where the fertilizer is produced also face costs because of the horrible smell of the fertilizer; the marginal external cost generated by the fertilizer is MEC = 20 + 3Q. How much fertilizer will be produced by the free market? What is the efficient quantity of fertilizer? Calculate the amount of deadweight loss in this market, and explain what this number means. Suppose that the government realizes that the current amount of fertilizer produced by the free market is inefficient and decides to correct this inefficiency by taxing the production of fertilizer. How large should the tax per unit of fertilizer be to induce the market to produce the efficient amount, and why would such a tax…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education