ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Suppose the government establishes a ceiling on price of rental accomodation. In this case,

Select one:

O a. The market for rental housing is unaffected

O b. Construction of new rental units will be encouraged

O. Those people who obtain rental units will benefit

O d. A surplus of rental units will develop

O e. The current stock of rental housing will be better maintained as there is a shortage of housing

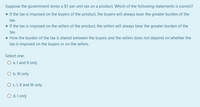

Transcribed Image Text:Suppose the government levies a $1 per unit tax on a product. Which of the following statements is correct?

• lí the tax is imposed on the buyers of the product, the buyers will always bear the greater burden of the

tax.

• lí the tax is imposed on the sellers of the product, the sellers will always bear the greater burden of the

tax.

• How the burden of the tax is shared between the buyers and the sellers does not depend on whether the

tax is imposed on the buyers or on the sellers.

Select one:

O a. I and Il only

O b. I only

O.I, Il and III only

O d. I only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A relative price is the O slope of the supply curve. difference between one money price and another. O ratio of one money price to another, O slope of the demand curve. none of the answers given is true.arrow_forwardFigure 4-15 so rice 45 40 35 30 25 20 15 10+ 5- 100 200 300 400 500 600 700 800 quantity Refer to Figure 4-15. At the equilibrium price, O a. 600 units would be supplied, but only 200 would be demanded. b. 400 units would be supplied and demanded. O c. 200 units would be supplied and demanded. d. 600 units would be supplied and demanded.arrow_forwardWhat is the consumer surplus when the price is $20? Price 40 35 + 30 25 + 20 15 10 D 10 20 30 40 s0 60 70 00 Duantity Select one: O a. $20 O b. $1000 O. $500 O d. $50arrow_forward

- I need answer typing clear urjent no chatgptarrow_forwardles of Microeconomics Spring20 fall20 Consumer surplus is the Select one: O A. price of a good expressed in dollars. O B. value of a good expressed in dollars. on O C. value of a good plus the price paid for it summed over the quantity bought. O D. value of a good minus the price paid for it summed over the quantity bought.arrow_forwardPrice $20- 18- 16- 14 12 10 8 6- 4 2- 0 10 20 30 40 50 90 100 Quantity Refer to the Figure 4-3. If the price in this market is currently $14, what would happen? O a. There would be a shortage of 20 units so producers would increase production. O b. There would be a surplus of 20 units and the price would tend to fall. O c. There would be a shortage of 40 units so producers would increase production. O d. There would be a surplus of 40 units and the price would tend to fall.arrow_forward

- Suppose that video game discs are a normal good.. If the income of video game players increases, you predict that in the market for video games, O both equilibrium price and quantity will fal. O equilibrium price will increase, and quantity will decrease. o both equilibrium price and quantity will increase. O equilibrium price will fall, but quantity will increase.arrow_forwardAnswer the following questionsarrow_forwardQUESTION 13 New cars are normal goods. What will happen to the equilibrium price of new cars if public transportation becomes more expensive and less comfortable and auto-workers receive higher wages? O Quantity will rise, and the effect on price is ambiguous. O Price will rise, and the effect on quantity is ambiguous. O Quantity will fall, and the effect on price is ambiguous. O Price will fall, and the effect on quantity is ambiguous.arrow_forward

- If goods A and B are substitutes, an increase in the price of A will result in Select one: a. no difference in the quantity sold of either good O b. None of the answers are correct O c. increases the demand for O d. reduces the demand for Barrow_forwardO FIGURE ⒸOURE 31 FIGURE 2 FIGURE 3 FIGURE 4 02 DI FIGURE 2 02 DI N FORES 51 Pe 32 01 FIGURE 4 32 31 01 Use FIGURE 1 to FIGURE 4 above Assume that the relevant market is for sour cream. If sour cream and baking potatoes are complements, an increase in the price of baking potatoes would tend to match which Figure for the sour cream.market above? Ganyarrow_forwardBy definition: a substitute is a good that: Select one: O a. has same likeness as another good O b. that is not used in place of another good O c. of lower quality than another good O d. of higher quality than another goodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education