ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

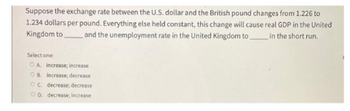

Transcribed Image Text:Suppose the exchange rate between the U.S. dollar and the British pound changes from 1.226 to

1.234 dollars per pound. Everything else held constant, this change will cause real GDP in the United

Kingdom to and the unemployment rate in the United Kingdom to in the short run.

Select one

OA increase; increase

OB. increase; decrease

OC. decrease; decrease

OD. decrease; increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- There is trade between the U.S. (domestic country) and Great Britain (foreign country) and the quantity of pounds supplied is positively related to the exchange rate. The exchange rate is defined as the domestic currency price of the foreign currency, i.e., dollars per pound. Using clearly labeled graphs of demand for and supply of the foreign currency, show and explain what will happen to: (i) the demand for pounds and/or; (ii) the supply of pounds; and (iii) the value of the dollar against the pound as a result of each one of the following changes. (a) a decrease in tariffs in the Great Britain. (b) a decrease in prices of goods produced in China. Both the U.S. and Great Britain trade with China. (c) a decrease in interest rates in the U.Sarrow_forwardSub : EconomicsPls answer very faast.I ll upvote. Thank Youarrow_forward8arrow_forward

- Suppose that the price of the three-month forward pound is $1.97. Will a U.S. investor benefit from covered interest arbitrage? (Hint: The three- 1.5%.) month U.K. interest rate is 10% = 2.5%, and the three-month U.S. interest rate is No, because there will be a loss of 2%. O Yes, the investor will benefit by 4%. O No, because there will be a loss of 3%. O No, because there will be a loss of 4%.arrow_forwardSub : EconomicsPls answer very fast.I ll upvote. Thank You a small open economy is described by the following equations: C = 50 + .75(Y-T) I = 200 - 20r NX = 200 -50e M/P = Y -40r G = 200 T = 200 M = 3000 P = 3 r* = 5 a. Derive and graph the IS* and LM* curves. b. Calculate the equilibrium exchange rate, level of income, and net exports c. Assume a floating exchange rate. Calculate what happens to the exchange rate, the level of income, net exports and the money supply if the government increases spending by 50. Use graph to illustrate what you find. d. Now assume fixed exchange rate. Calculate what happens to the exchange rate, the level of income, net exports and the money supply if the government increases spending by 50. Use graph to illustrate what you find.arrow_forwardExplain the effects of a fall in the value of the UK pound and lower spending by businesses and households on U.K. aggregate demand and aggregate supply The fall in the value of the U.K. pound OA. decreases U.K exports and increases U.K. imports, decreases OB. increases UK exports and decreases UK imports, increases C. increases UK exports and decreases U.K. imports, does not change D. has no influence on U.K. exports or UK imports, does not change which aggregate demand. USarrow_forward

- A 144.arrow_forwardWhich of the following increases the price of the dollar relative to the Mexican peso? Select oneE a. an increase in the supply of dollars b. an increase in the demand for dollars C. a decrease in the supply of pesos d. an increase in the demnand for pesosarrow_forwardMacroarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education