ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

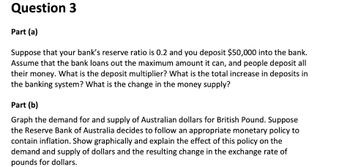

Transcribed Image Text:Question 3

Part (a)

Suppose that your bank's reserve ratio is 0.2 and you deposit $50,000 into the bank.

Assume that the bank loans out the maximum amount it can, and people deposit all

their money. What is the deposit multiplier? What is the total increase in deposits in

the banking system? What is the change in the money supply?

Part (b)

Graph the demand for and supply of Australian dollars for British Pound. Suppose

the Reserve Bank of Australia decides to follow an appropriate monetary policy to

contain inflation. Show graphically and explain the effect of this policy on the

demand and supply of dollars and the resulting change in the exchange rate of

pounds for dollars.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the Bank of Canada performs an Open-Market-Sale with a member of the public, what is the effect on the banking system and the money supply? The banking system has fewer reserves, and the money supply tends to grow. The banking system has more reserves, and the money supply tends to fall. The banking system has more reserves, and the money supply tends to grow. The banking system has fewer reserves, and the money supply tends to fall.arrow_forwardFind the amount of money that would be created in the banking system because of the money multiplier if the required reserve ratio is 14%, and a bank that had been holding $1,000 as excess reserves decides to loan all this money out.arrow_forwardFor a financial system, the reserve ratio is 10% and the Fed decides to buy $5 million worth of bonds from the public. If the public deposits this amount into transactions accounts, what happens to the money supply initially and directly? What is the potential change in lending capacity (money creation) for the banking system?arrow_forward

- Our banking system is called Fractional Reserve Banking because: a) banks are required to hold only a fraction of money deposited in them as reserves b) the banks excess reserves are always a faction of their total reserves c) banks hold money in many denominations d) the money in the banks can disappear in a fraction of a secondarrow_forwardWhat are bank reserves? a.Deposits that are held in the form of gold reserves b.The fraction of deposits kept as currency that are not used for lending purposes c.The value of the owner’s equity in the bank d.The value of investments a bank keeps in excess of the value of deposits e.The sum of all loans a bank makes to borrowersarrow_forwardI'd like help on b,c,darrow_forward

- banks do not have enough reserves to satisfy the reserve requirement, they can borrow additional reserves in True or False True Falsearrow_forwardBanks acquire $50 billion in new reserves, and the reserve requirement ratio is 6%. What will be the impact on the total deposits in the system, assuming all excess reserves are loaned to borrowers and the public redeposits all the borrowed funds in the banking system?arrow_forwardImagine you saved $2,500 at Bank of Prosperity. There, they maintain a reserve requirement of 9%. Create a T-account to show how Bank of Prosperity will allocate your deposit so that debits = credits. Then, using the money multiplier, show how your deposit affects the economy by providing dollars in the market for loanable funds.arrow_forward

- suppose the required reserve ratio is 11%. How much additional money can BBB lend out at a maximum? suppose the required reserve ratio is lowered to 8%. What is the Maximum amount of additional money that BBB can lend out? Is this different than the maximum amount of new money BBB can create by itself? 3. suppose the required reserve ratio is raised to 15%. What is the maximum amount of additional money BBB can lend out?arrow_forwardYou deposit a $1,000 scholarship check in the bank. If the required reserve ratio is 10 percent, explain how the banking system will create new money and how much money can potentially be created.arrow_forwardFind the amount of money that would be created in the banking system because of the money multiplier if the required reserve ratio is 6%, and a bank that had been holding $550 as excess reserves decides to loan all this money out.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education