Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:JC..

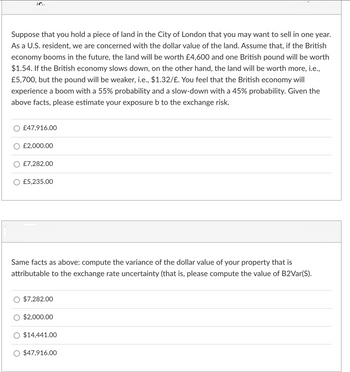

Suppose that you hold a piece of land in the City of London that you may want to sell in one year.

As a U.S. resident, we are concerned with the dollar value of the land. Assume that, if the British

economy booms in the future, the land will be worth £4,600 and one British pound will be worth

$1.54. If the British economy slows down, on the other hand, the land will be worth more, i.e.,

£5,700, but the pound will be weaker, i.e., $1.32/£. You feel that the British economy will

experience a boom with a 55% probability and a slow-down with a 45% probability. Given the

above facts, please estimate your exposure b to the exchange risk.

£47,916.00

£2,000.00

£7,282.00

£5,235.00

Same facts as above: compute the variance of the dollar value of your property that is

attributable to the exchange rate uncertainty (that is, please compute the value of B2Var(S).

$7,282.00

$2,000.00

$14,441.00

$47,916.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Prblmarrow_forwardCarambola de Honduras. Slinger Wayne, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Carambola. Slinger Wayne estimates that Carambola will generate a free cash flow of 12 million Honduran lempiras (Lp) next year, and that this free cash flow will continue to grow at a constant rate of 7.0% per annum indefinitely. A private equity firm like Slinger Wayne, however, is not interested in owning a company for long, and plans to sell Carambola at the end of three years for approximately 10 times Carambola's free cash flow in that year. The current spot exchange rate is Lp15.8194/$, but the Honduran inflation rate is expected to remain at a relatively high rate of 15.0% per annum compared to the U.S. dollar inflation rate of only 2.5% per annum. Slinger Wayne expects to earn at least a 21% annual rate of return on international investments like Carambola. a. What is Carambola worth if the Honduran lempira were to…arrow_forwardVijayarrow_forward

- Suppose you have been hired by President Emmanuel Macron of France as an economic policy consultant. In order to finance an increase in unemployment benefits, the French government needs to raise €10 billion in additional tax revenue. President Macron is considering two policies to achieve this goal: a new tax on gasoline or a new tax on bequests (money left to your children or other heirs). Which of these two policies would be the most economically efficient? Why? Explain why the policy you recommended in a.) might be politically unpopular. Dismayed by your assessment, President Macron proposes a third alternative: a broad decrease in current taxes. Explain why this could increase tax revenue for the French government, but it is unlikely to work in practice.arrow_forwardThanks stepsssarrow_forwardYou are International Business Manager at a UK based company. Considering high demand your company plans a full-scale expansion. Your company has identified USA and Europe as potential markets. You are requested to analyse both projects and advise. In considering such large project, you must work out the risk of each project, cost of capital and NPV. Allocate discount rate for each project accordingly and justify why you allocated this rate in your discussion. Discuss how international risks can be managed. Projected cash flows in respective currencies: Year Net Cash Flow – USD USA Net Cash Flow - EUR Europe0 -20 million -20 million 1 2 million 2 million2 4 million 3 million3 5 million 4 million4 6 million 8 million5 8 million 8 million Instructions:a. Discuss viability of both projects in today’s global business context and allocate discount rate. b. How much investment is needed for each project and what is the NPV of each project? c.…arrow_forward

- Carambola de Honduras. Slinger Wayne, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Carambola. Slinger Wayne estimates that Carambola will generate a free cash flow of 10 million Honduran lempiras (Lp) next year, and that this free cash flow will continue to grow at a constant rate of 8.5% per annum indefinitely. A private equity firm like Slinger Wayne, however, is not interested in owning a company for long, and plans to sell Carambola at the end of three years for approximately 10 times Carambola's free cash flow in that year. The current spot exchange rate is Lp14.3439/$, but the Honduran inflation rate is expected to remain at a relatively high rate of 15.0% per annum compared to the U.S. dollar inflation rate of only 3.0% per annum. Slinger Wayne expects to earn at least a 22.5% annual rate of return on international investments like Carambola. a. What is Carambola worth if the Honduran lempira were to…arrow_forwardYou want to invest in a riskless project in Australia. The project has an initial cost of AUD3.86 million and is expected to produce cash inflows of AUD 2 million a year for four years. The project will be worthless after four years. The expected inflation rate in Australia is 3.2 percent while it is 2.8 percent in the U.S. A risk-free security is paying 4.1 percent in the U.S. The current spot rate is AUD7.7274. What is the net present value of this project in Australian Dollar if the international Fisher effect applies?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education