ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

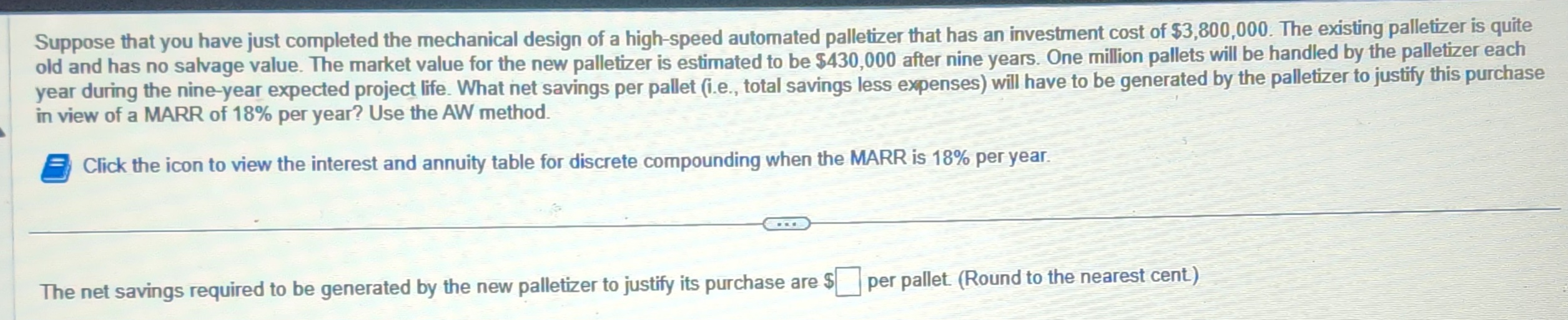

Transcribed Image Text:Suppose that you have just completed the mechanical design of a high-speed automated palletizer that has an investment cost of $3,800,000. The existing palletizer is quite

old and has no salvage value. The market value for the new palletizer is estimated to be $430,000 after nine years. One million pallets will be handled by the palletizer each

year during the nine-year expected project life. What net savings per pallet (i.e., total savings less expenses) will have to be generated by the palletizer to justify this purchase

in view of a MARR of 18% per year? Use the AW method.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 18% per year.

The net savings required to be generated by the new palletizer to justify its purchase are $

per pallet (Round to the nearest cent)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A new office building is expected to produce the initial net operating income (NOI) of $10 at time 1. The NOI is expected to grow 5% per year, and the investor expects an annual IRR of 15%. If the construction cost is $90, what is the land value at time 0?arrow_forwardPlease solve the problem and draw a diagram for the problem, Make sure you post pictures of your work instead of writing it. Please! Thank you for your help.arrow_forwardPlease answer as quickly as possible and zoom in for better viewarrow_forward

- Please answer as quickly as possible and zoom in for clear viewarrow_forward3) Find the rate of return (IRR-Ch16.3) on a project that will cost $100,000 today and $400,000 in 3 years from today, BUT will return $50,000 at the end of every year for 11 years (4)arrow_forwardYour firm is thinking about investing $300,000 in the overhaul of a manufacturing cell in a lean environment. Revenues are expected to be $39,000 in year one and then increasing by $13,000 more each year thereafter, Relevant expenses will be $20,000 in year one and will increase by $10,000 per year until the end of the cell's nine-year life. Salvage recovery at the end of year nine is estimated to be $10,000. What is the annual equivalent worth of the manufacturing cell if the MARR is 10% per year? How sensitive is the annual worth to ± 10% changes in the MARR? Are changes in the MARR really a significant consideration in this problem? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 9% per year. E Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year. Find Annual Equivalent…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education