Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

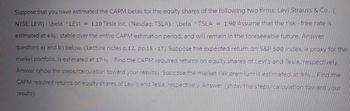

Transcribed Image Text:Suppose that you have estimated the CAPM betas for the equity shares of the following two firms: Levi Strauss & Co. (

NYSE: LEVI): \beta ^ LEVI = 1.10 Tesla Inc. (Nasdaq: TSLA) : \beta ^ TSLA = 1.90 Assume that the risk - free rate is

estimated at 4%, stable over the entire CAPM estimation period, and will remain in the foreseeable future. Answer

questions a) and b) below. (Lecture notes p.12, pp.15-17) Suppose the expected return on S&P 500 index, a proxy for the

market portfolio, is estimated at 17%. Find the CAPM required returns on equity shares of Levi's and Tesla, respectively.

Answer (show the steps/calculation toward your results): Suppose the market risk premium is estimated at 9%. Find the

CAPM required returns on equity shares of Levi's and Tesla, respectively. Answer (show the steps/calculation toward your

results):

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. You estimate the Fama-French 3-factor model for the two stocks, A and B, and find the following coefficients. You also estimate risk premiums for each factor. Calculate the cost of equity capital (i.e., expected rate of return) for each company using the 3-factor APT model. The risk-free rate is 4%. Stock Mkt A B Risk premiums 1.1 1.0 5% SMB -1.2 -2.0 HML -1.0 -1.5 3%arrow_forwardConsider the following table, which gives a security analyst’s expected return on two stocks and the market index in two scenarios: Scenario Probability Market Return Aggressive Stock Defensive Stock 1 0.5 6% 2.0% 5.0% 2 0.5 20 32 15 Required: a. What are the betas of the two stocks? (Round your answers to 2 decimal places.) Beta A : Beta D: b. What is the expected rate of return on each stock? (Round your answers to 2 decimal places.) % Rate of Return on A: % Rate of Return on B:arrow_forwardSuppose the market risk premium is 5% and the risk-free interest rate is 4%. Using the data, calculate the expected return of investing in a. Starbucks’ stock-Equity Beta:0.80b. Hershey’s stock-Equity Beta:0.33c. Autodesk’s stock-Equity Beta:1.72arrow_forward

- 1arrow_forward← You are thinking of buying a stock priced at $109.31 per share. Assume that the risk-free rate is about 4.03% and the market risk premium is 6.48%. If you think the stock will rise to $118.76 per share by the end of the year, at which time it will pay a $3.48 dividend, what beta would it need to have for this expectation to be consistent with the CAPM? The beta is (Round to two decimal places.) ...arrow_forwardYou live in a world where assets are priced by the CAPM. The following information is given to you regarding stock X. The expected payoff from the stock X=£105.00 Expected return of stock X = 18% Risk-free rate =5% Market Risk Premium = 9% Assume there are no other changes, except that the correlation between the returns of Stock X and the market becomes twice what it is currently. How would this change affect the current price of Stock X? Explain why the change of the correlation causes the observed change in the stock price. [hint: Provide a risk-based explanation]arrow_forward

- A financial analyst for the ZZZ Corporation uses the Security Market line to estimate the cost of equity, Re. The analyst observes the current risk-free interest rate, Rf, is 3%. The analyst estimates that ZZ has a beta of 2. If the analyst finds that RE is 13%, what does the analyst use as the value of [E(RM) – R¡]? -arrow_forwardUse the following forecasted financials: (Certain cells were left intentionally blank by asker) You may need to use the CAPM model. Assume beta equals 1.09, the risk-free rate is 1.62%, and the market risk premium is 4.72%. d) Calculate the terminal value and the present value of the terminal value. Assume a long-term growth rate of 3%. e) Calculate Sherwin Williams value per share. The company has 263.3 million shares outstanding.arrow_forwardAssume that if M launches a new e-trading platform, its price will go up to $261. Else, M price will go down to $62. You are aware that M shares are being traded at $162. You also know that the risk-free rate is 5%.What is the probability that M price will go down?***Please round your answer to the nearest three decimals (i.e. 0.512)arrow_forward

- Consider the following table, which gives a security analyst’s expected return on two stocks and the market index in two scenarios: Scenario Probability Market Return Aggressive Stock Defensive Stock 1 0.5 6% 2.0% 5.0% 2 0.5 20 32 15 Required: a. What are the betas of the two stocks? (Round your answers to 2 decimal places.) b. What is the expected rate of return on each stock?arrow_forwardSuppose the common stock of United Industries has a beta of 0.83 and an expected return of 8.7 percent. The risk-free rate of return is 3.4 percent while the inflation rate is 2.8 percent. What is the expected market risk premium? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardAccording to the CAPM, what is the expected return on a security given market risk premium of 13%, a stock beta of 1.77, and a risk free interest rate of 2%? Put the answer in decimal place.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education