Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

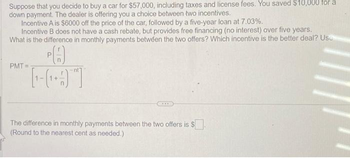

Transcribed Image Text:Suppose that you decide to buy a car for $57,000, including taxes and license fees. You saved $10,000 for a

down payment. The dealer is offering you a choice between two incentives.

Incentive A is $6000 off the price of the car, followed by a five-year loan at 7.03%.

Incentive B does not have a cash rebate, but provides free financing (no interest) over five years.

What is the difference in monthly payments between the two offers? Which incentive is the better deal? Use

PO

L-GOT

PMT=

***

The difference in monthly payments between the two offers is $.

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are shopping for a car and read the following advertisement in the newspaper: "Own a new Spitfire! No money down. Four annual payments of just $18,000." You have shopped around and know that you can buy a Spitfire for cash for $64,800. What is the interest rate the dealer is advertising (what is the rate that equates the PV of the payments to today's cash price of the car)? Assume that you must make the annual payments at the end of each year. C The rate that equates the PV of the payments to today's cash price of the car is %. (Enter your response as a percent rounded to two decimal places.)arrow_forwardA. If i buy a car from a dealership for $27000 with 2.5% paying monthly for a total of 3 years how much will i owe? B. If i buy a car from the dealership with 2% APR for 60 months with sticker price of $30,000 how much will i owe? C. If i buy the car for 10,000 with 10% interest for 6 years how much would it cost. Which option is better?arrow_forwardSuppose that you decide to buy a car for $63,000, including taxes and license fees. You saved $12,000 for a down payment. The dealer is offering you a choice between two incentives. Incentive A is $6000 off the price of the car, followed by a five-year loan at 7.72%. Incentive B does not have a cash rebate, but provides free financing (no interest) over five years. What is the difference in monthly payments between the two offers? Which incentive is the better deal? Use PMT= The difference in monthly payments between the two offers is $ (Round to the nearest cent as needed.) Which incentive is the better deal? Choose the correct answer below. A. Incentive A is the better deal. B. Incentive B is the better deal. PA n nt 1 - ( 1₁ + -/-) - ² narrow_forward

- Problem: Yuseff was able to sell a car whose suggested retail price is $1,2000.000. The vehicle will be financed through a bank. The required down payment was $120,000.00 and the monthly amortization for 6 years will be 22,000.00. The car dealer gave 4% commission rate. Questions: 1. What percent of retail price is the down payment? 2. How much was the gross balance or the amount to be financed by the bank?arrow_forwardSuppose that you are thinking about buying a car and have narrowed down your choices to two options. The new-car option: The new car costs $26,000 and can be financed with a four-year loan at 7.75%. The used-car option: A three-year old model of the same car costs $16,000 and can be financed with a four-year loan at 5.28%. What is the difference in monthly payments between financing the new car and financing the used car? (Round to the nearest cent as needed.)arrow_forwardAfter deciding to acquire a new car, you realize you can either lease the car or purchase it with a two-year loan. The car you want costs $34,000. The dealer has a leasing arrangement where you pay $97 today and $497 per month for the next two years. If you purchase the car, you will pay it off in monthly payments over the next two years at an APR of 6 percent. You believe that you will be able to sell the car for $22,000 in two years. What is the present value of purchasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of lease $ What is the present value of leasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of purchase $ What break-even resale price in two years would make you indifferent between buying and leasing? (Do not round intermediate calculations and round your answer to 2…arrow_forward

- You have been given a choice of paying $20,000 for a new GM car with a $3,000 cash rebate (net cost of $17,000 which you finance separately), or zero percent financing for 48 months with no cash rebate. What is the implicit rate of interest in this deal?arrow_forwardSuppose you would like to purchase a new mustang GT. The sticker price of the mustang you want is $40000. The dealer is able to give you an APR of 4% for 5 years. How much will your monthly payments be?How much will you have paid in interest once the loan is paid off?arrow_forwardYou went to the car dealer to lease a car. The car is valued at $30,000 and you can drive away without putting any money down. The dealer offers you a 5 year lease with a $5,000 residual payment at the end if you want to buy the car. Assuming monthly payments of $508.32, what is the implied APR? Your answer should be close to a round number. Use a % symbol and round to the nearest 1 decimal point.....3.0% would be the form of a correct answer.arrow_forward

- You are looking to buy a car. You can afford $600 in monthly payments for five years. In addition to the loan, you can make a $700 down payment. If interest rates are 9.25 percent APR, what price of car can you afford (loan plus down payment)? Note: Do not round intermediate calculations and round your final answer to 2 decimal places.arrow_forward← You need a loan of $150,000 to buy a home. Calculate your monthly payments and total closing costs for each choice below. Briefly discuss how you would decide between the two choices. Choice 1: 20-year fixed rate at 6% with closing costs of $2900 and no points. Choice 2: 20-year fixed rate at 5.5% with closing costs of $2900 and 4 points. What is the monthly payment for choice 1? A (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardSuppose that a car that you want costs $9000. You make a down payment of $1000 and finance the rest for 4 years at 1.9% interest, compounded monthly. If you make monthly payments for 4 years, what is the total amount of interest that you'll end up paying? Round your answer to two decimal places if rounding is necessary. The $ sign is already written next to the answer box, so do not type a $ sign in your answer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education