ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

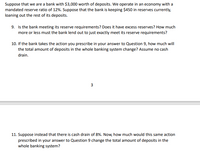

Transcribed Image Text:Suppose that we are a bank with $3,000 worth of deposits. We operate in an economy with a

mandated reserve ratio of 12%. Suppose that the bank is keeping $450 in reserves currently,

loaning out the rest of its deposits.

9. Is the bank meeting its reserve requirements? Does it have excess reserves? How much

more or less must the bank lend out to just exactly meet its reserve requirements?

10. If the bank takes the action you prescribe in your answer to Question 9, how much will

the total amount of deposits in the whole banking system change? Assume no cash

drain.

11. Suppose instead that there is cash drain of 8%. Now, how much would this same action

prescribed in your answer to Question 9 change the total amount of deposits in the

whole banking system?

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which statement about banks and risk is not correct? Select one: a. Banks face liquidity risks from lending activities. This is because the bank's assets are tied up in short- term loans whilst bank liabilities are longer-term b. Banks face credit risks from lending activities. To reduce this risk, banks require that potential borrowers put up some of their own funds or assets to serve as collateral C. Banks create bank money through their lending activities. The amount of bank money in an economy exceeds the amount of base money issued by the central bank creating liquidity risk for the bankarrow_forwardOne effect of the September 11, 2001, terrorist attacks was to temporarily prevent banks from accessing reserves they needed to meet the demands of their customers. (This occurred because the attacks destroyed many records as well as the computers required to access backup records, and it took affected banks several weeks to become fully operational.) In response, the Fed made many billions of dollars of reserves available to banks, gradually withdrawing the new reserves from the banking system as that system returned to normal. Suppose the Fed had not injected reserves in this way. What would likely have happened to interest rates as a result? What would have been the likely impact on the stock market and on spending by consumers and businesses? Would the unemployment rate have gone up or down? Explain your reasoning in each case.arrow_forward9:44 1 D) raise the reserve requirement 35) Suppose a bank has $100,000 in checking account deposits with no excess reserves and the required reserve ratio is 10 percent. If the Federal Reserve raises the required reserve ratio to 12 percent, then the bank will now have excess reserves of A) $12,000. B) $0. C) -$2,000. D) -$12,000.arrow_forward

- If the Bank of Canada performs an Open-Market-Sale with a member of the public, what is the effect on the banking system and the money supply? The banking system has fewer reserves, and the money supply tends to grow. The banking system has more reserves, and the money supply tends to fall. The banking system has more reserves, and the money supply tends to grow. The banking system has fewer reserves, and the money supply tends to fall.arrow_forwardConsider the following scenario for a bank. It has $200 in reserves, $800 in loans, $400 in securities, $1200 in deposits, and $100 in debt. a) Calculate the bank's capital. b) Calculate the bank's leverage ratio. c) Suppose there is a stock market boom, so that the bank's assets increase by 2 percent. What is the percentage change in the bank's capital? What is the change in the bank's capital in dollars? d) Suppose that, instead of stock market boom, some borrowers default on their debt so that the bank's assets decrease by 2 percent. How much is now the bank's capital?arrow_forwardSuppose the bank decides to invest 45 percent of its excess reserves in short-term securities in order to earn interest. The bank issues a cashier's check to a securities dealer to purchase the securities. The securities dealer deposits the check into an account at a different bank. What will ACME Bank's balance sheet look like after the check has been processed? Fill in the values in the table below. Assume a required reserve ratio of 10 percent. The balance sheet for ACME Bank is shown below.arrow_forward

- 11arrow_forward"Banks make a profit by paying depositors a high rate to attract funds and making loans at a low rate to encourage borrowing." Is the previous statement correct or not?arrow_forwardIf a 2-percent increase in the price of corn flakes causes a 10-percent decline in the quantity demanded, what is the elasticity of demand?arrow_forward

- Suppose a bank has a total deposit of $748 million. If the bank’s required reserves equal $253 million, total loans equal $368 million, then the bank has excess reserves of: Group of answer choices $109 million. $115 million. $127 million. $380 million. $495 million.arrow_forwardSuppose the balance sheet of Bigfoot Bank of America is shown below: Assets Liabilities Reserves $100 Deposits $5000 Loans $4900 a) The Reserve Requirement Ratio (RRR) is 0.04 or 4%. What is the Money Multiplier? b) Suppose that Skitch brings in a deposit of $300. What will be the new Deposits, Reserves and Loans amounts immediately after this deposit? Does the bank have any Excess Reserves at this point? How much? Show your work. Deposits = Reserves Loans Excess Reserves = c) What will be the Deposits, Reserves and Loans amounts after the entire money creation process has been completed. Show your work. Deposits = Reserves = Loans =arrow_forwardThe Bank of Key West is not going to have enough reserves at the end of the business day to meet its reserve requirement of 10%. It currently has two options to borrow money overnight in order to meet the requirement. First, it could borrow money from the Federal Reserve at a rate of 1.35%. Second, it could borrow money from other banks at a rate of 0.55%. What is the federal funds rate, and what is the discount rate? 1.35 federal funds rate: Incorrect I 1.55 discount rate: Incorrect What will happen to other short-term interest rates if the Fed increases its federal funds rate target? They will also increase. They will remain unchanged.. They will become irrelevant. They will decrease.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education