ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

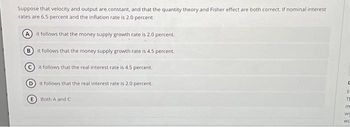

Transcribed Image Text:Suppose that velocity and output are constant, and that the quantity theory and Fisher effect are both correct. If nominal interest

rates are 6.5 percent and the inflation rate is 2.0 percent

it follows that the money supply growth rate is 2.0 percent.

(В

it follows that the money supply growth rate is 4.5 percent.

it follows that the real interest rate is 4.5 percent.

Dit follows that the real interest rate is 2.0 percent.

Both A and C

UEFE

m

Wo

WC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that inflation is 2 percent, the federal funds rate is 4 percent, and real GDP is 5 percent above potential GDP. According to the Taylor rule, in what direction and by how much should the Fed change the real federal funds rate? SEE PICTURE!!arrow_forwardIf the money supply is $60 and nominal GDP is $360, then Group of answer choices A) the velocity of money must be 300. B) the velocity of money must be 4.2. C) the velocity of money must be 3. D) the velocity of money must be 60. E) the velocity of money must be 6.arrow_forward21.According to the quantity theory of money, ultimate control over the rate of inflation in the United States is exercised by: A)the Organization of Petroleum Exporting Countries (OPEC). B)the U.S. Treasury. C)the Federal Reserve. D)private citizens. 22.According to the quantity theory of money, if money is growing at a 10 percent rate and real output is growing at a 3 percent rate, but velocity is growing at increasingly faster rates over time as a result of financial innovation, the rate of inflation must be: A)increasing. B)decreasing. C)7 percent. D)constant. 23.If the money supply increases 12 percent, velocity decreases 4 percent, and the price level increases 5 percent, then the change in real GDP must be ______ percent. A)3 B)4 C)9 D)11 24.Percentage change in P is approximately equal to the percentage change in: A)M. B)M minus percentage change in Y. C)M minus percentage change in Y plus percentage change in velocity. D)M minus…arrow_forward

- Assume an economy’s annual money velocity in circulation is 10. Please answer the following two question: In the view of monetarists (i.e. neoclassical view), if the annual economic growth rate is 6%, what should be the money supply increasing rate to maintain a low inflation rate as 3%? Please show equation.arrow_forwardAssume the money supply is $1,000, the velocity of money is 12, and the price level is $4. Using the quantity theory of money: (a) Determine the level of real output. (b) Determine the level of nominal output. (c) Assuming velocity remains constant and that the economy is at full-employment equilibrium, what will happen if the money supply rises by 10%?arrow_forwardWhich of the following statements are true about the velocity of money? Choose one or more: A. Velocity is part of the equation of exchange. B. Velocity is the number of times a unit of currency exchanges hands in a given year. C. An increase in velocity, all else being equal, increases real GDP. D. An increase in velocity, all else being equal, increases nominal GDP.arrow_forward

- What is the expected impact of a decline in the money supply to the US economy? A. Higher aggregate prices (inflation) B. Lower aggregate prices (deflation) C. There is no general relationship between the money supply and inflatonarrow_forwardSuppose velocity increases by 2 percent and potential GDP grows by 4 percent. The trend inflation rate will equal zero if the quantity of money grows by -2 percent. 4 percent. 0 percent. 2 percent.arrow_forwardthe money supply of Freedonia this year is $150 billion nominal GDP is $750 billion .assuming that velocity of money is stable. real GDP gross 2%this year. and money supply does not change what are the velocity, price level, and inflation ratearrow_forward

- According to the long-run relationship between money growth, income growth, and the change in the price level, if European inflation is higher than U.S. inflation but money growth is the same, it must be that: a) real income growth in Europe and the United States is the same. b) real income growth in Europe is larger than real income growth in the United States. c) real income growth in the United States is higher than in Europe. d) the level of nominal income is higher in Europe than in the United States.arrow_forwardIn 2019, an economy produces wheat only and has enough labor, capital, and land to produce 500bushels of wheat (Y or real GDP). Price of wheat and money supply are $2 per bushel and $1,000respectively. In 2020, the central bank increases money supply by $ 1040. Suppose both the velocity ofmoney (V) and the amount of wheat produced remain unchanged. a. Compute the velocity of money and nominal GDP in 2019. b. Calculate inflation rate in year 2020. c. Use a well-labelled money supply-demand diagram to illustrate and explain what happen to the pricelevel and the value of money after such money injection?arrow_forward"Considering the Taylor Rule for monetary policy, which action would a central bank most likely take if the actual inflation rate is below the target inflation rate and the real GDP is above the potential GDP? A) Increase the interest rate to reduce inflation. B) Decrease the interest rate to stimulate inflation. C) Keep the interest rate unchanged, as the effects on inflation and GDP are offsetting. D) Increase the money supply to reduce the real GDP to its potential level.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education